What if you could double or even triple the market’s return? Is it worth the risk?

There are always investors who want to get rich as quickly as possible. That’s why Wall Street has happily created exchange-traded funds (ETFs) that deliver double or even triple the market’s returns.

But before you let your dreams of easy wealth take over, you need to consider the risks that go along with the potential rewards.

What do leveraged ETFs do?

You can buy leveraged ETFs from sponsors like Leverage Shares, Direxion, and ProShares, among others. Historically, these products have been tied to broad indexes like the S&P 500 (^GSPC +0.69%) via an ETF such as Direxion Daily S&P 500 Bull 3X Shares (SPXL +2.06%). However, you can also focus on sectors via ETFs such as ProShares Ultra Financials (UYG +1.41%).

Image source: Getty Images.

That said, in typical Wall Street fashion, the leveraged ETF trend has been pushed to extremes by financial companies. There are now products tied to individual stocks, such as Leverage Shares 2X Long OPEN Daily ETF (OPEG +14.52%), which tracks Opendoor Technologies. You can even buy leveraged ETFs tied to other things, like the VIX, which tracks market volatility, via 2x Long VIX Futures ETF (UVIX 4.53%).

There are many options, but they all do the same basic thing. These exchange-traded funds use complex investment approaches that allow for performance that is some multiple of whatever they are tracking. That sounds exciting, and it can be when things are going well.

Don’t forget that things go up and down

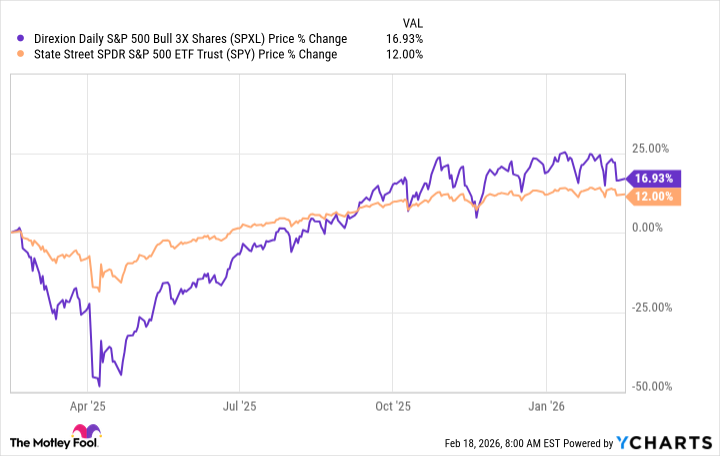

The problem with leveraged ETFs is that they multiply performance both ways. If the S&P 500 rises 10%, Direxion Daily S&P 500 Bull 3X Shares will rise around 30%. But if the S&P 500 falls 10%, well, Direxion Daily S&P 500 Bull 3X Shares will fall around 30%.

Generally speaking, these ETFs reset their performance daily, so the outperformance you expect may not actually work out the way you think over time, as the chart highlights. It’s simple math: If an investment goes down by 50%, it needs to go up by 100% just to get back to breakeven.

Data by YCharts.

You need to ask yourself two big questions. First, are you starting to view investing as gambling instead of a way to build long-term wealth? If you are trying to time the market’s moves with a leveraged ETF, you have probably drifted dangerously close to gambling. That’s a particular risk if you shift between leveraged ETFs and inverse ETFs, which move in the opposite direction of the index.

Second, if you are still thinking long term, can you actually hold a leveraged ETF through the normal ups and downs of the market? If you are like most investors, suffering through giant price swings won’t let you sleep at night. If you can’t hold through the down days, you won’t be around to benefit from the up days.

Given the downside risk of these products, most investors are likely better off avoiding them.