Jacobs Stock Photography Ltd/DigitalVision via Getty Images

On Monday 12th, August 2024, B. Riley Financial (NASDAQ:RILY) would update the market that it intends to suspend its quarterly cash dividend to its common shareholders. This distribution at $0.50 per share had already dipped from $1 per share a year ago and would have been pushed through to see RILY save $64 million per year in dividend payments. The stock would collapse following the dividend suspension and a fiscal 2024 second-quarter net loss estimate of $433 million to $475 million from losses related to RILY’s investment in Franchise Retail Group (“FRG”). There is a non-cash aspect of between $330 million to $370 million included in the net loss estimate for the second quarter. RILY’s Vintage Capital loan receivable, collateralized by equity in FRG, is set to see significant losses with weaker consumer spending driving a decline in trading across FRG’s businesses.

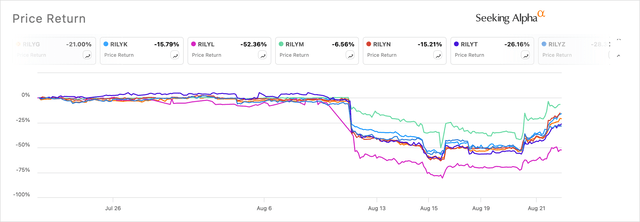

The public trading baby bonds have also subsequently been heavily sold off, with the 6.375% Senior Notes Due 2/28/2025 (NASDAQ:RILYM) dropping to as low as $13.50 per share, a fall of 44% from before the Monday announcement. I own a position in the 5.25% Senior Notes Due 08/31/2028 (NASDAQ:RILYZ) and these fell to roughly $7 per share, roughly 28 cents on the dollar as the stock market rapidly and heavily priced in the prospect of bankruptcy following the Monday announcement. The fall was compounded by a report to the Securities and Exchange Commission looking into whether RILY fully disclosed the risks associated with some of its assets and dealing with former FRG CEO Brian Kahn. Whether the SEC reaches a different conclusion to the investigation by two separate law firms that RILY did not know about any alleged misconduct of Brian Kahn or his affiliates will be known shortly. However, there could be a fine, for comparison Carl Icahn and Icahn Enterprises (IEP) were recently fined $2 million by the SEC over disclosure failures.

Bonds Rally From Lows, Is RILY Going Bankrupt?

Right now, nothing else matters except the solvency of RILY and their ability to continue servicing the baby bonds. The company needs to call 80% of its baby bonds 90 days early, hence, RILYM will have to be majority repaid in a few months on November 30th. These were issued just before the outbreak of the pandemic on the 10th of February 2020 with the sale of 4,600,000 million notes at $25 per note for $115 million. RILY has to pay back $92 million of this in November. The market realization of this led RILYM to stage a significant rally from lows after the Monday selloff, with the prospect of bankruptcy 3 months out essentially written to zero by the rally from bonds that had dropped to trade for 54 cents on the dollar. The later bonds have also staged rallies from the post-selloff lows, but have yet to fully recover from the post-Monday drop or my last coverage. If you don’t think RILY will remain solvent, get out now.

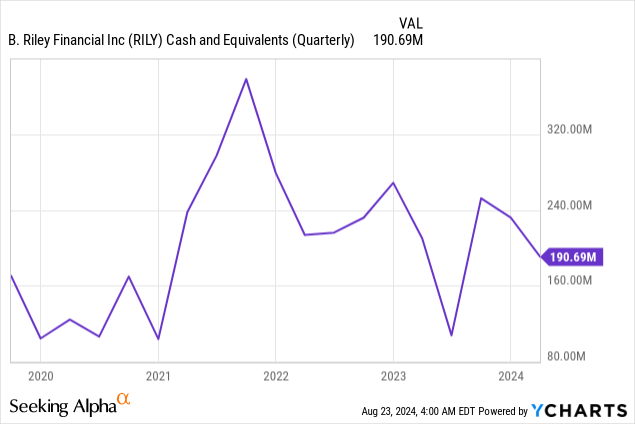

However, I intend to continue to hold RILYZ, but I have not added to my position in light of the risk, I’m also still waiting on the form 10-Q to be filed. RILY has several positive catalysts to remain a going concern. Firstly, the company held cash and equivalents at the end of $191 million at the end of its first quarter. This is more than enough funds to cover its upcoming bond payment. Further, there are rumors that RILY is set to announce a deal with Oaktree Capital to sell a majority stake in its appraisal and valuation services business and its retail, wholesale, and industrial solutions business for a combined $380 million. The floated stake would be between 51% to 55%. RILY also expects to recognize operating adjusted EBITDA in the range of $50 million to $55 million for its second quarter.

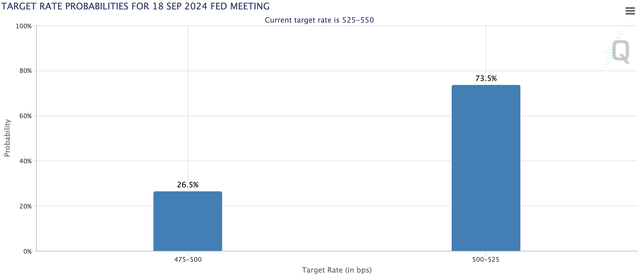

This comes as the Fed is set to cut the Fed funds rate for the first time since 2020 at is September 18th FOMC meeting. While RILY won’t receive a reprieve from near-term rate cuts with its risk rating and deteriorated creditworthiness set to see its cost of issuing new debt prohibitively more expensive, the company holds investments in multiple companies with varying rates of floating rate debt on their balance sheet. There might also be a boost for the bonds from yield compression, but this would be more likely against 75 to 100 basis points of cuts in aggregate rather than the sole 25 basis point cut expected in September with a 73.5% certainty by the CME FedWatch Tool. The dividend cut savings should be immediately recycled to buyback bonds on the open market, especially the most near-term maturities. The take-private offer from RILY CEO also seems opportunistic, with the success of the offer hinged on near-term liquidity transactions which place the market cap of the company above the $7 per share offer price.