designer491

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the first week of July.

Market Action

BDCs had a strong week with a 1.5% total return, outperforming the broader income market. High-valuation BDCs like MAIN, CSWC and HTGC were in the lead – a common pattern during rallies as valuation in the sector diverges.

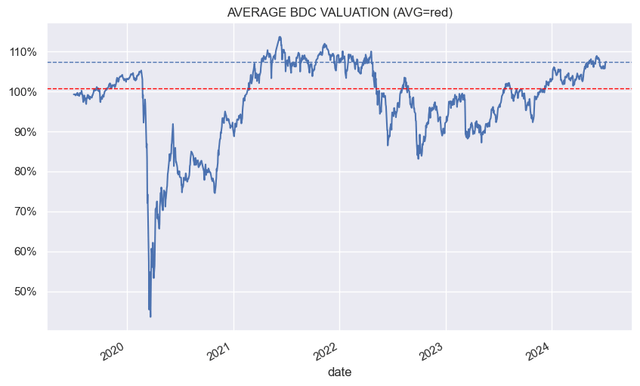

Sector valuation has mostly reversed the recent drop and is trading near the 5-year peak.

Market Themes

Trinity Capital (TRIN) updated the conversion rate of its 2025 convertible bonds. This happens whenever the common dividend exceeds the initial dividend threshold of $0.30 set in the indenture (as well as the company paying a supplemental dividend). The conversion price is now set at $12.62. A holder of $1,000 principal amount is entitled to 79.2226 shares of the stock. This ratio will increase further as the company is likely to continue to pay a significantly higher dividend than $0.30. Net income has been around $0.55-0.6 so, if anything, the dividend could rise further.

Convertible bonds have some benefits for management. The coupons they have to pay on the bonds are lower than for standard unsecured bonds. This is because convertible bonds carry an embedded option for bondholders which may allow them to convert the bond to shares at a favorable rate. For example, at this point $1,000 of bond principal is worth $1,113 in TRIN common shares because of the premium at which the stock is trading.

The second benefit to management is that they can issue additional common shares. These can be further leveraged, resulting in a growth of total assets and, hence, fees. For existing common shareholders, the impact is mixed. There will be some EPS dilution as new shares are issued but net income remains the same, however, this should be temporary since EPS will grow as the new equity capital is leveraged and put to work. The NAV will drop a bit as new shares are issued at a price below the NAV. This will result in a slight headwind for existing shareholders.

Stance And Takeaways

The two pillars of BDC sector valuations remain expensive. The average BDC in our coverage is trading at a 9% premium – not far off the peak over the last 5 years. And two, underlying loan spreads are on the tight side – a similar dynamic can be seen in the public loan market with 60% of loans trading above par.

Although the BDC sector is not cheap in absolute terms, there are pockets of value with individual BDCs trading at attractive levels. These include a few of the stocks we recently added to our Income Portfolios such as the Blue Owl Capital Corp III (OBDE), the Golub Capital BDC (GBDC) and the Barings BDC (BBDC), among others.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!