UK borrowing costs spiked yesterday as traders bet that the Bank of England will keep interest rates on hold for the rest of the year in a blow to households and Rachel Reeves.

The yield on benchmark ten-year bonds – which rise as prices fall – climbed to more than 4.76 per cent, the highest level since late May.

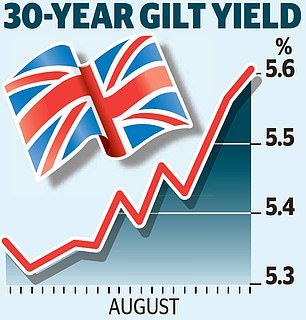

Traders also sold 30-year UK bonds, sending yields above 5.62 per cent and close to levels last seen in April when they soared to their highest since 1998.

Rising yields translate into higher borrowing costs for the Government and will pile further pressure on the Chancellor ahead of the Budget.

Already facing an estimated £50billion financial black hole, a downturn in the market for UK bonds – known as gilts – make the prospect of tax increases even more certain.

U-turns on winter fuel payments and welfare reform have tied Reeves’ hands as she tries to repair the public finances.

On hold: Traders are betting that the Bank of England (pictured) will keep interest rates on hold for the rest of the year

And Simon French, chief economist at broker Panmure Liberum, even suggested yesterday that she ‘should resign in dignified protest’ if Keir Starmer does not back her efforts in the face of resistance from Labour backbenchers.

Markets bet that the Bank of England will not cut interest rates any further this year.

Traders yesterday saw a 56 per cent chance that rates would remain at 4 per cent in December.

Interest rates have been coming down steadily since last summer, easing pressure on borrowers. But that progress could be halted if – as is increasingly feared – inflation worsens.

A report yesterday from financial firm S&P Global showed the latest rate cut boosted consumer sentiment – implying that a pause in cuts will have a damaging impact.

It gave a reading of 47 for August, up from 45.1 in July and the highest level since October’s Budget. A reading below 50 shows deterioration and above 50 shows improvement.

That suggests that while household sentiment remains negative – after Reeves’ tax-raising Budget and Trump’s trade war – the tide has at least briefly been halted.

S&P said the poll of 1,500 households came ‘hot on the heels’ of the Bank’s decision to cut rates to 4 per cent earlier this month.

Maryam Baluch, an economist at S&P, said the reading was ‘a telling sign that the easing of monetary policy has been received positively by households across the country’.

Figures tomorrow are expected to show inflation climbing to 3.7 per cent from 3.6 per cent the month before. The Bank of England predicts it will hit 4 per cent later this year.

That will add to cost of living pressures on households as well as making it harder for the Bank to cut rates further.

Recent official figures showed economic growth slowing sharply and debt ballooning while unemployment has risen by more than 200,000 since Labour came to power.

The dismal picture has underlined serious worries about Reeves’ handling of the economy.

Bond markets have turned volatile on a number of occasions over the past year as traders question her ability to bring public finances under control.

Global events have also had an impact, with US inflation fears last week sending bond yields higher across the world.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

InvestEngine

InvestEngine

Account and trading fee-free ETF investing

Trading 212

Trading 212

Free share dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.