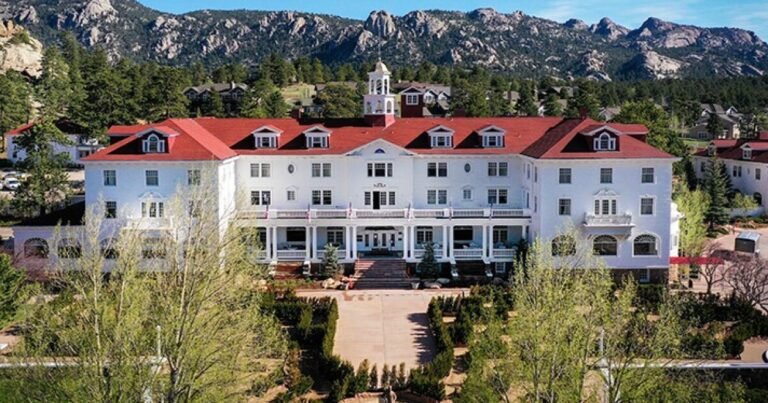

Adobe Stock

The Colorado Educational and Cultural Facilities Authority will issue up to $475 million of revenue bonds to finance the purchase of a historic hotel that inspired Stephen King’s The Shining, under resolutions passed by its board on Wednesday.

The deal, which participants labeled “unique,”

In June, the authority

A

A financing plan presented at Wednesday’s meeting called for nearly $247 million of tax-exempt and $40.87 million of taxable Series A senior lien bonds, $79.43 million of tax-exempt Series B subordinate lien bonds, and $33 million of tax-exempt and $14 million of taxable Series C junior lien bonds.

Sources for debt payment include net revenue from the hotel and a new event center, as well as incremental increases in state sales taxes generated by the project under Colorado’s

All of the bonds will be unrated with the Series 2024 A and B bonds targeted for a public sale to qualified institutional investors and the Series 2024 C bonds privately placed with John Cullen, president and CEO of Grand Heritage Hotel Group, the Stanley Hotel’s current owner. The final maturity is capped at 40 years. RBC Capital Markets is the bond underwriter and placement agent.

“Once the bonds are retired, CECFA/SPACE will own the Stanley Hotel campus and have access to the projected net revenue of $50,000,000 per year to support its mission, which will be the most significant public benefit flowing from this project,” the authority said in a statement.

Plans for the 193-room hotel include an additional 64 guest rooms, a restaurant, and an event center with an approximately 864-seat outdoor amphitheater and a film museum.

Timberline Lodge in Oregon stood in for the exterior of The Shining’s Overlook Hotel in Stanley Kubrick’s 1980 movie version, which was mostly filmed in England. A 1997 television mini-series based on The Shining used the Stanley Hotel, which is located just outside Rocky Mountain National Park, as a filming location.