Boss Bond investors can expect a gift from Santa on Christmas Eve.

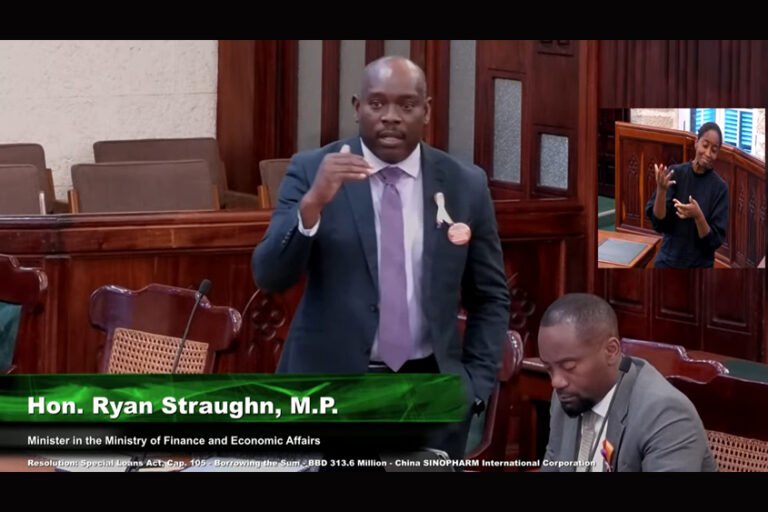

Yesterday Minister in the Ministry of Finance Ryan Straughn said that was when the last payment of the BOSS Bonds is expected to be sent out.

In 2020 the Government introduced bonds to generate economic activity geared toward public servants within Central Government and later the initiative was extended to include members of the public with BOSS Plus.

Straughn explained that the initiative arose out of the COVID-19 pandemic and then every Member of Parliament, including the Leader of the Opposition Ralph Thorne as well as public servants – for whom it was not mandatory – gave up a portion of their salaries from July 2020 to December 2021 to help finance a series of intervention projects by the Ministry of Housing. About $83.815 million was raised for the projects in a situation where a large part of the economy was without income.

“We asked the public service to sacrifice a little bit in order to help with the public finances of the country,” Straughn stated.

“We did not sacrifice public servants. We asked public servants to contribute to the recovery,” he stated, adding that the original BOSS bonds deductions was for a four-year period.

As of July last year until December of this year, every month public servants were receiving the amount that was deducted from their salaries each month. Over the four years, each person was getting the interest payments.

The Minister said that over the period $16.63 million total interest was paid out and the total number of people who participated was 3 374 public servants as well as Members of Parliament in the original BOSS programme.

“The last payment will be December 24 this year. I want to thank all of the public servants who assisted with the Government being able to finance ourselves through COVID, because they didn’t have to do it but I believe that they did it, because they were in a position to do so, because not every public servant necessarily had the capability,” Straughn stated.

In addition, said the Minister, not a lot of people were able as they had to take on additional responsibilities of supporting their families.

“So not every public servant was in a position to participate in giving up part of your salary during COVID, but I thank them nevertheless, because they helped their families to see their way through what was a very extraordinary set of circumstances.

“But for those 3 374 persons, of which 30 of us here are a subset of that, I want to thank all of you for allowing the Government the opportunity to be creative. You’ve now received all of your money back, except for the one that will come in on Christmas Eve,” he said.

The House of Assembly was debating simultaneously resolutions related to the borrowing of $313.6 million from China SINOPHARM International Corporation (SINOPHARMINTL) to finance, 80 per cent of the cost of the design and construction of an outpatient clinic, a patient ward, a burn unit and a laboratory centre known as Queen Elizabeth Hospital Enmore Site Extension Lot 1 Project; the construction of an oncology centre, an administration office known as Queen Elizabeth Hospital Enmore Site Extension Lot 2 Project and the borrowing of $100 million by way of two loans from the OPEC Fund for International Development to strengthen social services.