Chattanooga, Tennessee, plans to price $80 million of bonds for a minor league baseball stadium that is pitched as the key to reviving a bedraggled part of the city.

The Sports Authority of the County of Hamilton and City of Chattanooga, Tennessee will price $64.5 million in tax-exempt and $15.3 million in taxable bonds Oct. 16, said Javaid Majid, Chattanooga’s chief financial officer.

The bonds will provide most of the money for a $115 million stadium anchored by the minor league Chattanooga Lookouts baseball team.

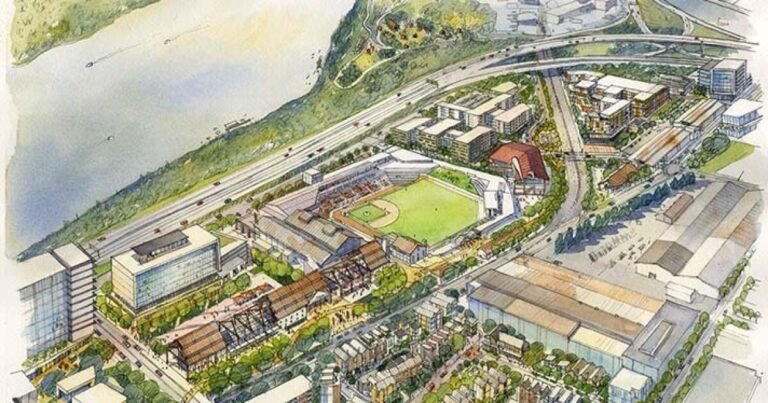

Courtesy city of Chattanooga

The new stadium, replacing the 24-year-old AT&T Field two miles away, will revitalize the depressed South Broad neighborhood, Majid said.

The Lookouts will provide $3 million from their own accounts and another $16 million by buying a tax increment financing note issued by the city’s industrial development board, according to an online investor presentation promoting the deal. The team promises to pay $1 million per year in rent to the Sports Authority in a 30-year lease agreement.

Another $5 million will be raised through a privately placed Series 2024C, the investor presentation said.

The team also promises to pay for any stadium cost overruns. And the landowner is donating nine acres of land for the stadium,

The bonds are payable from sales tax revenues, tax increment financing and term lease payments derived from the project. The taxable bonds are payable also from the team’s term lease payments.

If all goes as planned, debt service will be fully covered with such project related revenues.

If they don’t go as planned, taxpayers will make up the difference; the city of Chattanooga and Hamilton County have pledged non-ad valorem property tax revenues to make up for any shortfalls in project-related revenue.

Freelance journalist Neil deMause, author of the book “Field of Schemes,” said the Lookouts’ contribution seemed “pretty chintzy.”

“After 40 years of economic research, there is no evidence that any professional team stadiums can bring measurable economic activity to cities,” deMause said. “They can shift a small amount of spending from one place to another sometimes but not in any significant way. And Minor League venues aren’t even a ripple.”

But city officials see the Lookouts stadium as a cornerstone to turn around a declining part of the city.

“The rusted old Wheland Foundry site where the new stadium itself will go is the first thing many visitors to Chattanooga see when they come into the city on Interstate 24, giving the false impression of our city that has been the bane of Chattanoogans, economic development officials, and the Chamber of Commerce for years,” said Eric Holl, senior advisor to Mayor Tim Kelly.

Holl said the city also needed a new venue to retain the Lookouts because AT&T Field no longer meets Major League Baseball standards.

MLB increased facility standards after it took direct control of Minor League Baseball before the 2021 season and

Earlier this month, the Washington, D.C. based Tax Foundation published

Since usually some of the bonds are tax-exempt, the federal government also subsidizes the stadium construction, the foundation said.

“The academic research tells us that city-wide economic development (job growth, wage growth, sales tax growth, etc.) is unlikely to occur,” said Adam Hoffer, director of excise tax policy at the Tax Foundation, in an email. “Neighborhood-specific development can occur in areas surrounding the stadium, but that growth often comes at the expense of growth elsewhere in the city.”

Spending at a new ballpark, arena or stadium often comes at the expense of spending on other activities and leisure, like movies and going to restaurants, he said.

“The question for whether or not a city should build or subsidize a stadium construction is this: does that stadium create a city amenity worth more than the amount the city will spend on it,” Hoffer said.

“Stadium construction is an expensive and poorly targeted economic development tool,” Hoffer said.

The details of the sports stadium deals determine the projects’ worth, said Joseph Krist, publisher of Muni Credit News.

“The municipalities often are at a disadvantage in those negotiations especially given the political nature of the whole process …. There will also be more of these situations as Major League Baseball continues to pressure Minor League franchise operators to modernize and/or replace stadia to maintain their working agreements with Major League Baseball franchises,” he said.

“The model of pairing stadium and commercial development is extending to other sports like soccer and hockey,” Krist said. “Chattanooga is taking a cue from Nashville. Nashville has been very upfront about its belief that pro sports teams are a key to achieving their economic goals.”

JP Morgan will underwrite the Sports Authority deal. PFM Financial Advisors is the municipal advisor and Bass, Berry & Sims is the bond counsel.

The stadium will have 5,000 seats. Along with baseball games, the stadium and facilities built with it will be used for concerts, festivals, business meetings, conferences, receptions, holiday parties, and “other year-round events,” according to the preliminary official statement.

The Lookouts date to at least 1908 and are a feeder team for the Cincinnati Reds.

JPMorgan and PFM suggested moving the bonds pricing to Oct. 16 from Oct. 10, Majid said, because of what they saw as volatility in the week of Oct. 10.

“We’re excited about the ballpark and keeping the Lookouts in Chattanooga,” Holl said. “They’ve been an iconic fixture of our community for 115 years.”

The deal commits the team to staying in Chattanooga for 30 years.

“But the mayor has said repeatedly that he’s even more excited about all the other new development that will be brought to the South Broad district by this project,” Holl said.

The CEO of the company that owns the Lookouts, Jason Freier of Hardball Capital, pointed the project-support website, which said private sector investment in the project of reviving the South Broad neighborhood is expected to exceed $1 billion, providing more than $2.3 billion in economic impact for residents in the region. The Lookouts will pay all operating and maintenance cost on the stadium for 30 years.

Adobe Stock

The sales tax revenues directly supporting the bonds would come from transactions that occur at the stadium and parking lot. The TIF revenues would come from incremental property tax revenues generated from certain properties located in the South Broad District, near the stadium, and certain other property tax collections.

S&P Global Ratings rates the deal AAA, based on the support of the city and county governments.

Chattanooga’s

“Chattanooga’s credit quality is supported by its growing regional economy, strong and stable financial position — propelled by significant revenue growth in recent year, supportive financial management practices and policies and comparatively low debt burden,” said S&P analyst Matthew Martin in explaining the Sports Authority bonds rating.

“The city is central to the region’s status as an expanding manufacturing hub, anchored by Volkswagen and auto manufacturing, with a diverse presence across an array of other industries,” Martin said.