Stay informed with free updates

Simply sign up to the Chinese economy myFT Digest — delivered directly to your inbox.

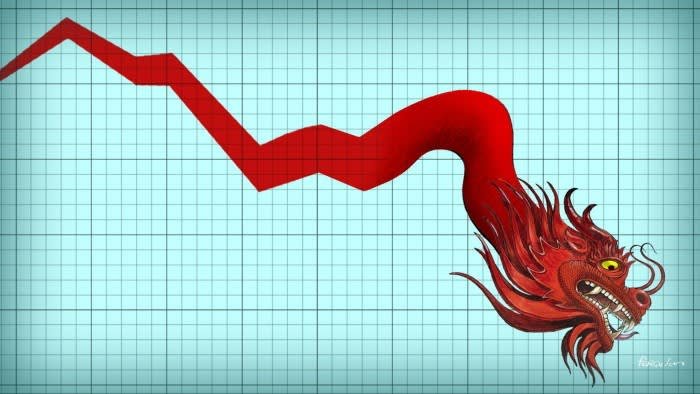

There is a bubble in the Chinese government bond market — or so, at least, the People’s Bank of China would fervently like to believe. A bubble would be a worrying risk to financial stability. The existence of such a risk, however, is far more palatable than the plausible alternative: that bond markets are sending out an increasingly dire signal of concern about the prospects for China’s economy, the danger of deflation and the need for a change of course.

Over the past few weeks, the PBoC has been engaged in a strange mirror image of the quantitative easing campaigns conducted by many global central banks. Where others tried to push down long-term bond yields to stimulate their economies, the PBoC is battling to hold them up.

China’s 10-year yield dipped briefly below 2.1 per cent last week, after sliding all year, before PBoC action pushed it back up again. The authorities have gone so far as to name and shame a group of rural banks for buying government bonds — a most unusual sin, like punishing a child for tidying their bedroom.

The PBoC’s stated concern is for financial stability. In particular, it worries about leveraged investment funds that promise high returns, and the risk of failures similar to Silicon Valley Bank in the US, if banks load up on duration risk by buying bonds with long maturities and then interest rates move in the other direction. There is also a deeper risk to financial stability if the yield curve flattens out too much, because China’s huge state banks will find it harder to make money.

Fretting about bond yields, however, is a strange way to tackle financial stability. If investment funds are abusing leverage, then regulate them; if banks are gambling on duration risk, then examiners have ample powers to stop them. To demand a particular level of bond yields points to a different scenario: that the market is behaving rationally, and Chinese government bonds are not overpriced, but the PBoC cannot stomach what that implies.

Does the rush for bonds make sense? Prices in China are falling and that increases the real yield on bonds, after inflation. While the consumer price index remains slightly positive, the deflator for GDP has now been negative for five consecutive quarters, down by 0.7 per cent compared with a year earlier, according to the most recent figures. Given investment is such a huge share of China’s economy, the deflator is a better indicator than the CPI of overall prices.

The attraction of bonds also depends on the alternatives: equities, property, credit and deposits. With no end in sight to China’s housing market downturn, households have little appetite for property, while domestic companies are suffering from weak consumption and the aftermath of Beijing’s crackdown on the technology industry. Deposits, meanwhile, are only attractive if you expect interest rates to rise in the future. With the outlook so gloomy, it seems wholly rational for Chinese investors to flock into bonds and gold.

Perhaps the true concern of the PBoC, and a well justified concern at that, is the downbeat and potentially self-fulfilling signal sent by falling bond yields. They amount to a vote of no confidence in government policy, a forecast that economic conditions will not improve and a warning that deflation will take root if nothing is done to stop it. The next stage in 1990s Japan, note economists at Morgan Stanley, was for companies to respond to the low-price environment by limiting wage growth. That is how a deflationary spiral can take hold.

The PBoC recognises the fundamental problem, referring in its most recent policy report to “insufficient effective [domestic] demand”. Constrained by its need to stabilise the exchange rate, however, the central bank cannot do much. It made one small rate cut in July. It may be able to do more as and when the US Federal Reserve eases policy, narrowing the interest rate gap with China. The PBoC is also equipping itself with the tools for more active intervention in bond markets, which is perfectly reasonable, but will not hold back the macroeconomic tide that is pushing yields down.

The real need is still for more effective reflationary action by China’s government. Beijing continues to shovel money towards the manufacturing sector, which generates activity in the short term, and keeps GDP growth on track. But adding more and more supply, while doing little to encourage demand, will not bring the economy back into balance any time soon. The priorities should be to clear up the overhang of unsold property; to support local government and household budgets; and to cease heavy-handed state interventions, so private companies have the confidence to invest. But Beijing’s policies in all these areas remain halfhearted, reactive and incremental.

This is not a doomist prediction. China’s economic strengths are formidable, and it has ample space to grow, so it can run unbalanced policies for a while and still get back on track. Growth is a cure for most economic problems, as China has demonstrated in the past. Nonetheless, the cure will only get harder the longer the illness is left to fester. China’s bond market is now flashing urgent deflationary warning signs. Policymakers would do well to take heed.