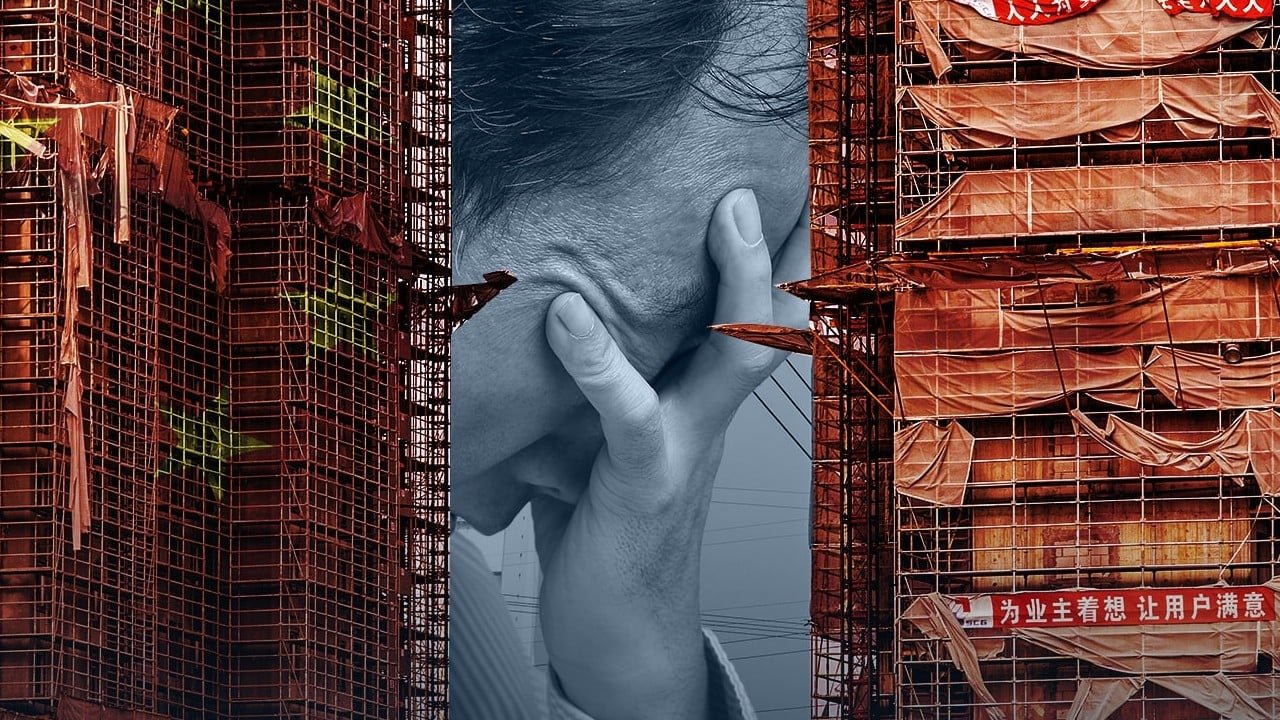

Chinese developer R&F Properties missed interest payments on three offshore notes in another sign of escalating troubles for the country’s home builders amid a gruelling property market downturn.

The developer failed to pay interest on three dollar-denominated notes issued by its subsidiary Easy Tactic, which was due on July 11, it said in a filing to the Hong Kong stock exchange on Sunday. The three bonds have US$4.53 billion in total face amount outstanding.

The US$147.1 million semi-annual interests on the bonds were due on July 11 and the developer has not paid bondholders even after a 30-day grace period. This non-payment may prompt the note holders to demand accelerated repayment, according to the filing.

The company, based in Guangzhou in southern Guangdong province, is talking bondholders for a solution and will consider all possible actions regarding its offshore debts. The firm has engaged Alvarez & Marsal as its financial adviser and Sidley Austin as its legal adviser for the process.

R&F shares fell 2.5 per cent to HK$0.77 on Monday.

Despite measures issued by China’s central and local authorities to support property developers and shore up sentiment, the nation’s slumping property market is seeing little sign of recovery. Home prices fell for a 13th consecutive month in July, while land purchases by the biggest developers slumped 38 per cent from a year earlier.

R&F said it sold One Nine Elms, a mixed-use skyscraper in London, three months ago to relieve debt pressure, and will aim to sell its equity interest in certain project development companies to generate additional cash inflows”.

“Since the second half of 2021, the mainland property market has slowed down and real estate developers have been confronted with unprecedented difficulties with regard to liquidity and financing,” R&F said. Progress in properties sales among real estate developers is slow, it added.

R&F said its business operations remain normal and that it will “work relentlessly to ensure the delivery of properties, accelerate the sales of properties and stabilise its business operations”.

“Despite the strained market environment, the group remains hopeful that the real estate market in mainland China will gradually recover with the central government’s introduction of policies promoting healthy recovery of the real estate industry,” the company said.