IDB Invest announced a partnership with Banco Nacional de Costa Rica (BNCR) to launch Costa Rica’s first blue bond. IDB Invest committed $25 million to the $50 million bond issuance while mobilizing an additional $20 million from FinDev Canada and $5 million from LAGreen.

The proceeds will help increase financing for companies in Costa Rica for blue economy projects supporting marine-coastal areas, sustainable water and sewage management, plastic waste management, and the circular economy. This initiative will also strengthen BNCR’s capital base and the development of a blue portfolio.

“This collaboration highlights a shared commitment to supporting climate change mitigation and adaptation, conserving natural resources and biodiversity, and promoting sustainable development,” said IDB Invest.

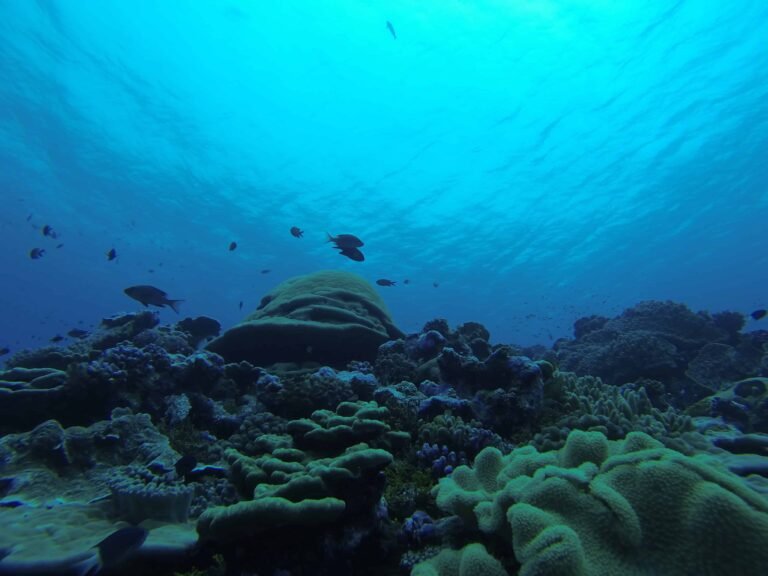

Oceans and coastal zones are essential to the planet’s natural infrastructure, providing crucial ecosystem services. Costa Rica, with over 51,000 square kilometers of marine territory and 1,200 kilometers of coastline, represents about 4% of the world’s biodiversity. These areas support local livelihoods and significantly contribute to the economy through fishing, tourism, and coastal infrastructure.

Blue bonds are an emerging financial instrument aimed at mobilizing capital to solve social and environmental challenges, create sustainable ocean and water-related business opportunities, and signal responsible ocean stewardship in line with the Sustainable Development Goals (SDGs) and the Paris Agreement.

“As the first blue bond in Costa Rica, this project is also expected to have a catalytic effect in financial markets, opening new alternatives for companies and investors interested in blue economy projects,” IDB invest added.

IDB Invest also supported BNCR with advisory services, including blue investment analysis, developing a Sustainable Financing Framework with blue taxonomy, co-financing the second-party opinion, and conducting a training program to enhance sustainable finance capabilities, and will collaborate to identify further thematic investment categories, focusing on climate and social areas such as Afro-descendant communities, the silver economy, and indigenous peoples.

This project will contribute to the following United Nations Sustainable Development Goals (SDGs): Zero Hunger (SDG 2), Clean Water and Sanitation (SDG 6), Decent Work and Economic Growth (SDG 8), Industry, Innovation and Infrastructure (SDG 9), Responsible Consumption and Production (SDG 12), and Life Below Water (SDG 14).