Synopsis

Dim Sum bonds are offshore renminbi (RMB) bonds, mainly issued in Hong Kong, that allow global borrowers to raise RMB outside China’s capital controls. First popularised in 2010, the market has since grown into a mainstream funding channel for sovereigns, corporates, and financial institutions. Lower Chinese interest rates, stronger RMB liquidity pools, and better hedging tools have taken issuance to record levels and made the market more stable and strategic. Is this the start of a trade where Chinese currency gets accepted more as a medium of exchange? And should they be a bigger worry of President Trump than anything else?

Dim Sum bonds – sometimes misspelt as “dimsim”, but named after the familiar delicacy – are offshore renminbi (RMB) bonds born in Hong Kong and designed to let global borrowers and investors deal in the Chinese currency outside the mainland’s capital controls.They have evolved from a niche experiment in the late 2000s into a mainstream funding market that now sits at the crossroads of trade, finance, and geopolitics. To understand why they

- FONT SIZE

AbcSmall

AbcMedium

AbcLarge

Uh-oh! This is an exclusive story available for selected readers only.

Worry not. You’re just a step away.

What’s Included with

![]() ETPrime Membership

ETPrime Membership

1Invest Wisely With Smart Market Tools & Investment Ideas

Investment Ideas

Grow your wealth with stock ideas & sectoral trends.

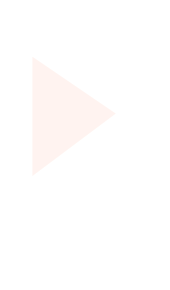

Stock Reports Plus

Buy low & sell high with access to Stock Score, Upside potential & more.

BigBull Portfolio

Get to know where the market bulls are investing to identify the right stocks.

Stock Analyzer

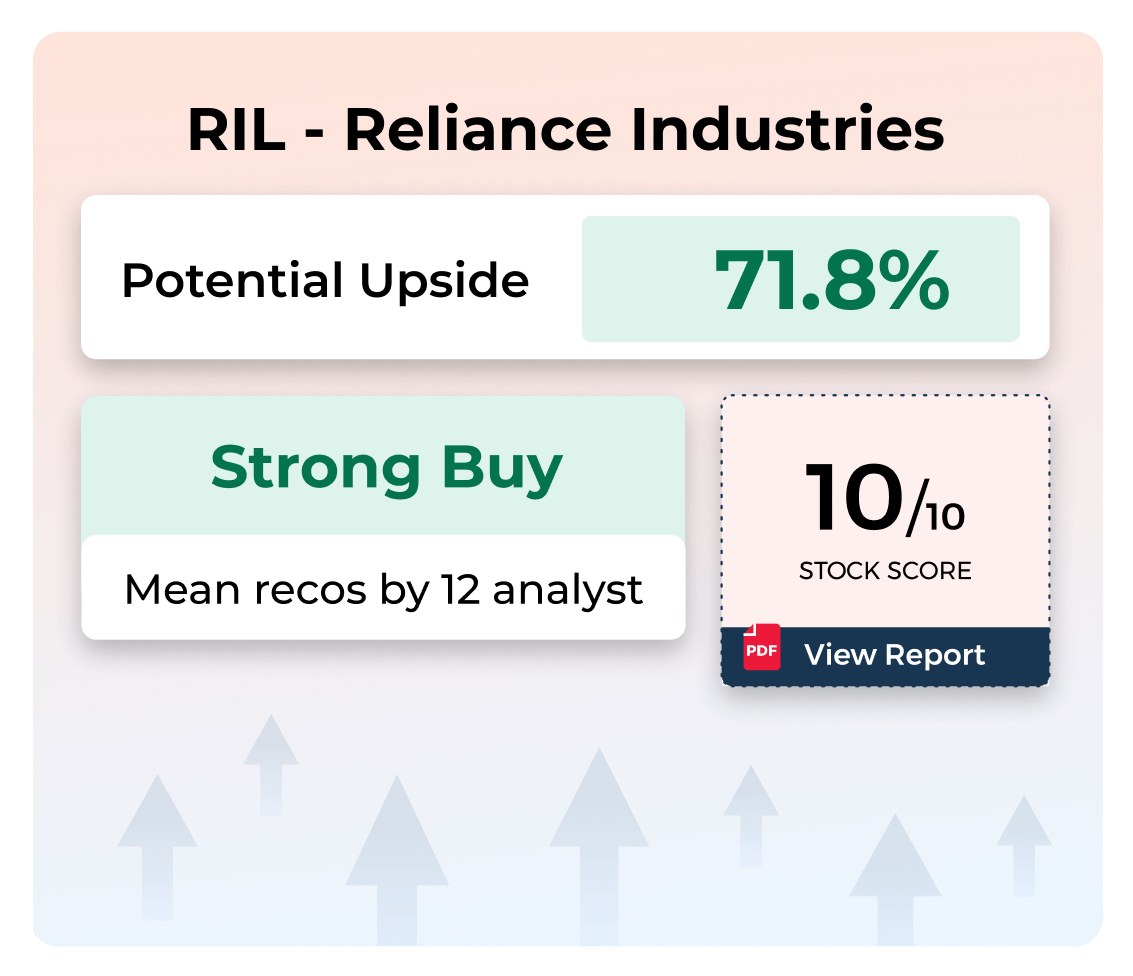

Check the score based on the company’s fundamentals, solvency, growth, risk & ownership to decide the right stocks.

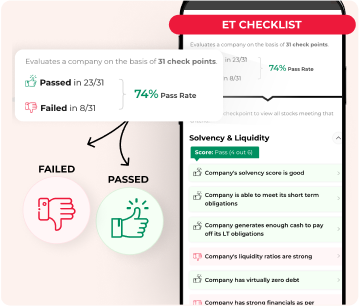

Market Mood

Analyze the market sentiments & identify the trend reversal for strategic decisions.

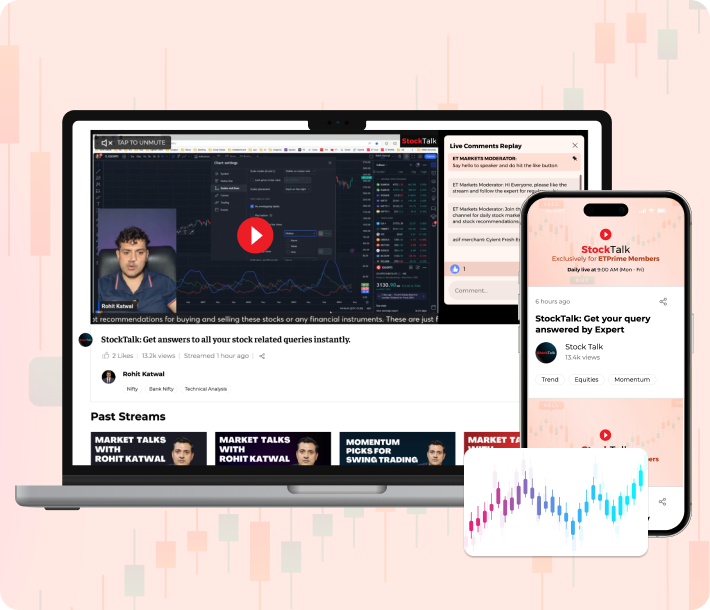

Stock Talk Live at 9 AM Daily

Ask your stock queries & get assured replies by ET appointed, SEBI registered experts.

2Stay informed anytime, anywhere with ET ePaper

ePaper – Print View

Read the PDF version of ET newspaper. Download & access it offline anytime.

ePaper – Digital View

Read your daily newspaper in Digital View & get it delivered to your inbox everyday.

Wealth Edition

Manage your money efficiently with this weekly money management guide.

3Exclusive Insights That Matter

4Times Of India Subscription (1 Year)

TOI ePaper

Read the PDF version of TOI newspaper. Download & access it offline anytime.

Deep Explainers

Explore the In-depth explanation of complex topics for everyday life decisions.

Health+ Stories

Get fitter with daily health insights committed to your well-being.

Personal Finance+ Stories

Manage your wealth better with in-depth insights & updates on finance.

New York Times Exclusives

Stay globally informed with exclusive story from New York Times.

5Enjoy Complimentary Subscriptions From Top Brands

TimesPrime Subscription

Access 20+ premium subscriptions like Spotify, Uber One & more.

Docubay Subscription

Stream new documentaries from all across the world every day.