(Bloomberg) — Bankers and borrowers are getting ready for bond sales to pick up this week, looking to secure deals while markets are calm.

Nearly 40% of market participants surveyed by Bloomberg News expect issuance to reach between €15 billion ($16.5 billion) and €20 billion this week. That compares to just €3.5 billion of new bonds sold in Europe over the past two weeks combined, according to data compiled by Bloomberg.

“The market is in a good position for the post-summer wave of issuance,” said Marc Lewell, head of EMEA and APAC syndicate at JPMorgan Chase & Co. “The recent bout of volatility has highlighted a fear factor for issuers and reminded them to take advantage of issuance windows when they come.”

A gauge of investment-grade credit risk widened at the start of August to the highest level this year after weak US jobs data triggered a market selloff, reminding investors there is still room for negative surprises.

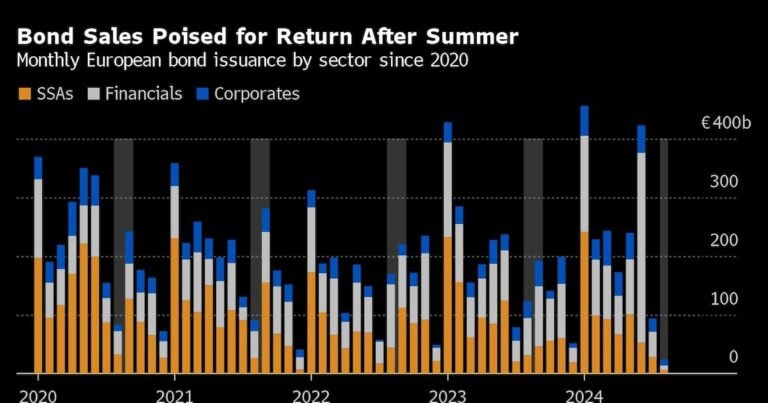

Bond issuance tends to pick up substantially in the last week of August, with more than €30 billion of bond sales both in 2022 and 2023, the data shows.

Overall European bond issuance is up 28% year-on-year and running at a record pace, according to league table data compiled by Bloomberg, fueled by some front-loading of issuance ahead of interest rate cuts and borrowers’ concerns about volatility.

While last week saw outflows from investment-grade funds mainly in the mid-term and long-term segments, that followed six weeks of inflows, according to a Bank of America Corp. report using EPFR data.

Investors will be clamoring for deals to put the cash accumulated over previous weeks to work and lock in higher yields before further possible central bank rate cuts.

A hypothetical investor who parked cash in money-market funds wouldn’t have missed out on a lot of returns so far this year, according to Lewell. “But fear of missing out is a driver and many have wanted to get on the credit train before it is gone,” he said.

©2024 Bloomberg L.P.