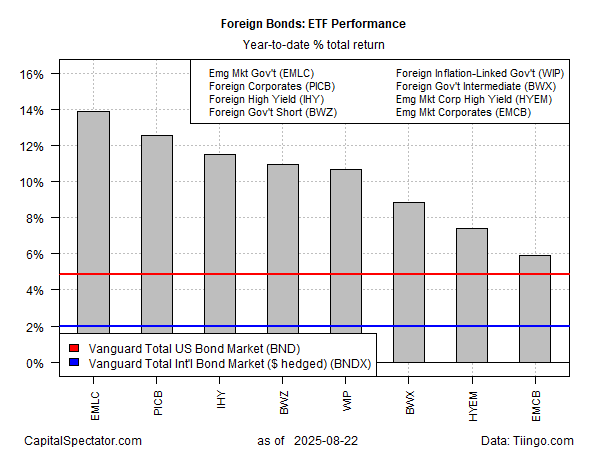

Tilting toward foreign bonds remains a winning strategy for US investors this year, based on a set of ETFs through Friday’s close (Aug. 22). The modest gain for a benchmark of US government and investment-grade securities has been no match for offshore bond markets in US-dollar terms.

The top performer year to date: , which is up 13.9%. The rally is far ahead of the , which clocks in with a moderate 4.9% total return so far in 2025.

Even the weakest foreign bond performer – corporates in emerging markets (EMCB) — is outperforming with a 5.9% rally.

A key factor for the offshore rally is the weak US dollar. The is down 9.9% year to date. All else equal, a lower greenback translates into higher offshore prices after translating into US dollar terms. Hedging foreign currency risk, in short, has been a hefty headwind this year for US investors investing overseas.

The technical profile for the US Dollar Index still looks bearish, and so the forex tailwind for non-dollar assets remains intact.

Federal Reserve Chairman Powell’s dovish comments last week add another factor for expecting that the greenback will stay relatively weak. The prospect for lower implies a weaker dollar as the competitive allure declines on the margins for US yields.

Another dimension is the potential that US inflation could heat up due to tariffs. “We see a risk that the Fed could make a policy error by cutting just as activity rebounds, with headed to 3%,” analysts at Bank of America wrote in a research note.

Misguided or not, Fed funds futures are pricing in a high probability (85%) that the Fed will reduce its target rate at next month’s FOMC meeting (Sep. 17). In turn, the odds still look low that US bonds will start to outperform their foreign counterparts in the near term.