Torsten Asmus

Investment Approach

- Fidelity® Limited Term Bond Fund is a shorter-duration investment-grade bond strategy, which is focused primarily on U.S. corporate credit.

- The fund’s primary benchmark is the Bloomberg U.S. 1-5 Year Government/Credit Bond Index. However, given the fund’s focus on credit, it also has a secondary, composite benchmark, which consists of 70% Bloomberg U.S. 1-5 Year Credit Bond Index, 20% Bloomberg U.S. 1-5 Year Government Bond Index and 10% ICE BofA 1-5 Year BB-B U.S. Cash Pay High Yield Constrained Index. The composition differed in periods prior to February 28, 2024.

- Utilizing a team-based investment process, the fund relies on experienced portfolio managers, research analysts and traders. We concentrate on areas where we believe we can repeatedly add value, including asset allocation, sector and security selection, yield-curve positioning and opportunistic trading.

- Robust governance and risk management, consisting of extensive quantitative modeling, formal and informal portfolio reviews, and proprietary tools, support the identification of both opportunities and risks.

Performance Summary

|

Cumulative |

Annualized |

|||||

|

3 Month |

YTD |

1 Year |

3 Year |

5 Year |

10 Year/ LOF1 |

|

|

Fidelity Limited Term Bond Fund Gross Expense Ratio: 0.30%2 |

1.12% |

1.76% |

6.14% |

0.34% |

1.45% |

1.74% |

|

Bloomberg US 1-5 Year Government/Credit Bond Index |

0.83% |

0.97% |

4.66% |

-0.20% |

1.02% |

1.42% |

|

Fidelity Limited Term Composite Index |

0.95% |

1.38% |

5.49% |

0.18% |

1.45% |

1.82% |

|

Lipper Short-Intermediate Investment Grade Debt Funds Classification |

0.91% |

1.51% |

5.48% |

-0.09% |

1.22% |

1.45% |

|

Morningstar Fund Short-Term Bond |

1.06% |

1.95% |

5.96% |

0.67% |

1.59% |

1.64% |

|

1Life of Fund (LOF) if performance is less than 10 years. Fund inception date: 02/02/1984. 2This expense ratio is from the most recent prospectus and generally is based on amounts incurred during the most recent fiscal year, or estimated amounts for the current fiscal year in the case of a newly launched fund. It does not include any fee waivers or reimbursements, which would be reflected in the fund’s net expense ratio. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares. Current performance may be higher or lower than the performance stated. Performance shown is that of the fund’s Retail Class shares (if multiclass). You may own another share class of the fund with a different expense structure and, thus, have different returns. To learn more or to obtain the most recent month-end or other share-class performance, visit Fidelity Funds | Mutual Funds from Fidelity Investments, Financial Professionals | Fidelity Institutional, or Fidelity NetBenefits | Employee Benefits. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative total returns are reported as of the period indicated. For definitions and other important information, please see the Definitions and Important Information section of this Fund Review. |

Taxable Bond Market Review

U.S. taxable investment-grade bonds, as measured by the Bloomberg U.S. Aggregate Bond Index, posted a very modest gain (+0.07%) in the second quarter of 2024 amid mixed economic data and an ongoing holding pattern on benchmark interest rates by the U.S. Federal Reserve.

After raising policy interest rates 11 times beginning in March 2022, the Fed has held rates steady in a range of 5.25% to 5.5% since July 2023. The bond market began 2024 with investors anticipating six to seven quarter-point cuts to the federal funds rate over the course of the year, with the first taking place in March. But during the first quarter, stronger-than-expected employment and consumer spending data, coupled with consumer price index reports that showed U.S. inflation metrics either moving sideways or ticking up, kept the Fed on pause and led investors to push back their expectations for the timing and magnitude of rate cuts this year. The Aggregate index returned -0.78% for the first three months of 2024.

The downbeat sentiment persisted into the start of Q2, with the index returning -2.53% in April. During the month, hotter-than-expected inflation and the Fed’s “higher for longer” message on rates sent bond yields rising and prices down; the yield on the 10 year U.S. Treasury (US10Y), which started the year at 3.88%, stood at 4.70% on April 25. May, however, brought encouraging news, when that month’s CPI update (through April 30) indicated year-over-year headline inflation slowing from the previous month’s mark for the first time in 2024. Combined with separate monthly reports showing weaker U.S. retail sales and softer job growth, the cooler inflation reading reignited market hopes that the central bank would begin cutting rates sooner rather than later.

June’s CPI report (through May 31) further raised those hopes. Headline inflation, at 3.3%, ticked down from 3.4% the previous month, and closely-watched core inflation – which excludes volatile energy and food prices – was lower than expected. Following the Fed’s committee meeting on June 12, Chair Jerome Powell noted the progress but said the central bank needed further evidence that inflation was slowing to start cutting interest rates. By quarter end, the 10-year U.S. Treasury yield had fallen more than 30 basis points from its April high mark. The Aggregate index gained 1.70% in May and 0.95% in June.

For the full three months, returns were muted across major segments of the bond market. By quality rating, top-tier, AAA-rated investment-grade securities (+0.53%) fared best by a notable margin. Meanwhile, short-term maturities (1-3 Years) gained 0.95% and outpaced all longer-term issues.

Results were mixed among yield-advantaged, credit-sensitive sectors on both a total- and excess-return basis (see exhibit below). U.S. investment-grade corporate bonds (-0.09%) and agency mortgage-backed securities (+0.07%) trailed U.S. Treasurys (+0.10%) and government-related securities (+0.30%); conversely, asset backed securities (+0.98%) and commercial mortgage-backed securities (+0.68%) solidly outperformed.

Outside the Aggregate index, U.S. Treasury Inflation-Protected Securities advanced 0.79%, per Bloomberg, while below investment-grade segments such as U.S. high-yield corporate bonds (+1.09%) and emerging-markets high-income securities (+1.17%) showed relative strength.

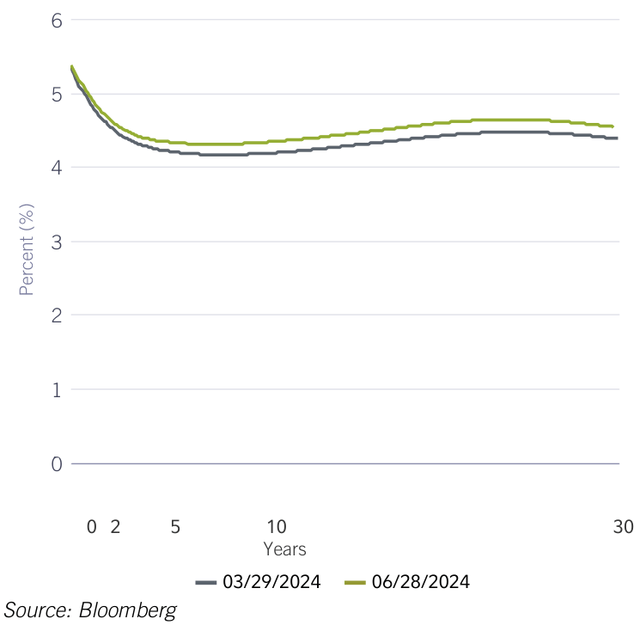

U.S. Treasury Yield Curve

Three-Month Fixed-Income Sector Returns

|

Sector |

Total Return |

Excess Return* |

|

Government-Related |

0.30% |

0.03% |

|

U.S. Mortgage-Backed Securities |

0.07% |

-0.09% |

|

Asset-Backed Securities |

0.98% |

0.17% |

|

Commercial Mortgage-Backed Securities |

0.68% |

0.24% |

|

U.S. Corporate Investment Grade |

-0.09% |

-0.04% |

|

U.S. Corporate High Yield |

1.09% |

0.36% |

|

Emerging Markets: Investment Grade |

0.40% |

0.37% |

|

Emerging Markets: High Yield |

1.17% |

0.84% |

|

U.S. Treasury |

0.10% |

0.00% |

|

Source: Bloomberg *Over similar-duration Treasuries |

Outlook and Positioning

At quarter end, the U.S. economic expansion demonstrates evidence of both mid- and late-cycle dynamics. Disinflation trends and the move to monetary easing progressed globally in Q2, but persistent core inflation in the U.S. is making the “last mile” of disinflation toward the Fed’s 2% target more difficult.

After declining significantly from 2022’s highs, both headline and core inflation have remained above 3% in 2024. Nominal 10-year Treasury bond yields ticked modestly higher during the quarter, rising sharply in April then moderating in May and June. As is typical during a late-cycle expansion, the yield curve remains inverted.

Current market projections signal an expectation of one or possibly two rate cuts from the U.S. Federal Reserve in 2024, with the first most likely taking place in September. This represents a more optimistic view than was held early in the quarter, but the timing and pace of easing is significantly diminished compared with expectations entering this year.

For the three months, on average, about 72% of the fund’s assets were invested in corporate bonds. Within corporates, the debt of industrial companies was our largest sector allocation, at roughly 34% of total average assets, edging out financials. The portfolio also owned about 8% U.S. Treasurys, on average, and a roughly 10% non-benchmark allocation to asset-backed securities, such as collateralized loan obligations and securitized car loan debt. Consistent with our strategy, the fund was notably underweight Treasurys, which represented about 19% of the Composite index and about 67% of the fund’s Bloomberg benchmark, on average.

To learn more about how the fund was positioned versus the Fidelity Limited Term Composite Index, see the tables below.

In a dynamic market environment, our goal remains to work with our investment teams to try to find attractively priced bonds for the portfolio while maintaining a disciplined approach to risk management. It is important to reiterate that the portfolio is constructed with a careful emphasis on security selection, especially with consideration to liquidity and financial resiliency. Investing is a long-term endeavor, and we’re focused on generating strong risk- adjusted performance over a full market cycle.

Market-Segment Diversification

Change Relative From Prior Quarter

|

Market Segment |

Portfolio Weight |

Index Weight |

Relative Weight |

Change Relative From Prior Quarter |

|

U.S. Treasury |

7.58% |

19.46% |

-11.88% |

-0.92% |

|

U.S. Agency |

0.03% |

0.65% |

-0.62% |

0.05% |

|

Other Government Related (U.S. & Non-U.S.) |

1.10% |

12.07% |

-10.97% |

-0.42% |

|

Corporate |

71.05% |

67.82% |

3.23% |

-0.39% |

|

MBS Pass-Through |

0.20% |

0.00% |

0.20% |

0.00% |

|

ABS |

9.23% |

0.00% |

9.23% |

-0.17% |

|

CMBS |

5.80% |

0.00% |

5.80% |

0.19% |

|

CMOs |

2.82% |

0.00% |

2.82% |

-0.23% |

|

Cash |

2.69% |

0.00% |

2.69% |

1.07% |

|

Net Other Assets |

-0.50% |

0.00% |

-0.50% |

0.82% |

|

Futures, Options & Swaps |

15.65% |

0.00% |

15.65% |

0.27% |

| Net Other Assets can include fund receivables, fund payables, and offsets to other derivative positions, as well as certain assets that do not fall into any of the portfolio composition categories. Depending on the extent to which the fund invests in derivatives and the number of positions that are held for future settlement, Net Other Assets can be a negative number. |

Characteristics

|

Portfolio |

Index |

|

|

Duration |

2.61 years |

2.54 years |

|

30-Day SEC Yield |

5.17% |

— |

|

30-Day SEC Restated Yield |

— |

— |

|

Net Asset Value |

$11.22 |

— |

Credit-Quality Diversification

|

Credit Quality |

Portfolio Weight |

Index Weight |

Relative Weight |

Relative Change From Prior Quarter |

|

U.S. Government |

8.50% |

20.01% |

-11.51% |

-0.91% |

|

AAA |

11.63% |

8.99% |

2.64% |

0.89% |

|

AA |

5.55% |

11.73% |

-6.18% |

-0.99% |

|

A |

26.95% |

26.11% |

0.84% |

-1.22% |

|

BBB |

33.33% |

23.69% |

9.64% |

1.02% |

|

BB |

5.99% |

6.59% |

-0.60% |

-0.02% |

|

B |

3.24% |

2.85% |

0.39% |

0.08% |

|

CCC & Below |

0.31% |

0.00% |

0.31% |

0.11% |

|

Short-Term Rated |

0.00% |

0.00% |

0.00% |

0.00% |

|

Not Rated/Not Available |

2.26% |

0.03% |

2.23% |

-0.87% |

|

Cash & Net Other Assets |

2.24% |

0.00% |

2.24% |

1.91% |

|

Net Other Assets can include fund receivables, fund payables, and offsets to other derivative positions, as well as certain assets that do not fall into any of the portfolio composition categories. Depending on the extent to which the fund invests in derivatives and the number of positions that are held for future settlement, Net Other Assets can be a negative number. Credit ratings for a rated issuer or security are categorized using the highest credit rating among the following three Nationally Recognized Statistical Rating Organizations (“NRSRO”): Moody’s Investors Service (Moody’s); Standard & Poor’s Rating Services (S&P); or Fitch, Inc. Securities that are not rated by any of these three NRSRO’s (e.g. equity securities) are categorized as Not Rated. All U.S. government securities are included in the U.S. Government category. The table information is based on the combined investments of the fund and its pro-rata share of any investments in other Fidelity funds. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.