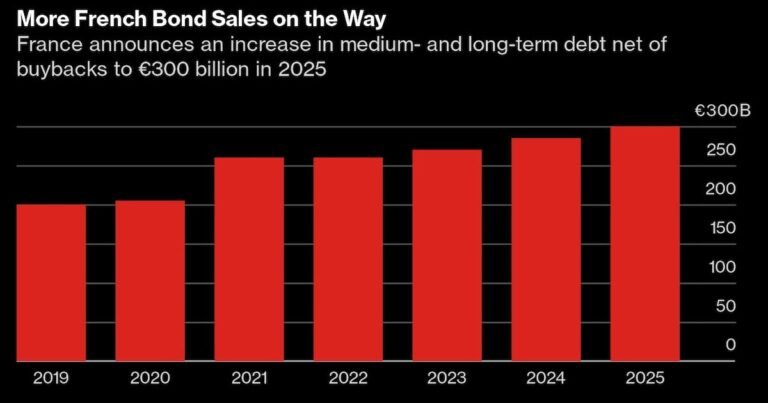

(Bloomberg) — France has announced plans to sell €300 billion ($328 billion) in government bonds next year to finance its budget, following months of political turmoil.

The target compares to sales of €285 billion this year and is in line with analyst estimates. Part of the money will go toward funding an estimated €136 billion deficit, which is €31 billion lower than this year’s.

France’s government is under acute pressure to shore up the nation’s crumbling fiscal accounts and regain the confidence of investors who’ve ditched the nation’s bonds in past months. The budget announcement is a milestone in the current political crisis, and any slippages could trigger another market selloff.

Despite the political turmoil that roiled markets this year, France has been able to sell bonds without major setbacks. Demand for recent auctions was broadly in line with the average seen before President Emmanuel Macron called for snap elections in June.

There will be about €175 billion of existing bonds maturing in 2025, from €155 billion this year, according to a Treasury statement. Total financing requirements will reach €307 billion in 2025, from a revised €319 billion this year, and the debt service cost will rise to about €55 billion.

While analysts from banks including Societe Generale SA, Danske Bank A/S and Citigroup Inc expected France to sell more bonds next year given the higher volume of notes maturing, the figure confirms an upward trend in borrowing. The target, which includes medium- and long-term notes net of buybacks, is about €100 billion larger than before the pandemic.

Other European countries, in the meantime, are seen reducing issuance next year. Societe Generale estimates euro-area gross bond sales will fall to about €1.2 trillion from €1.3 trillion this year.

France’s deficit as a percentage of the gross domestic product is set to rise to 6.1% this year before falling to 5% next year. The country plans to bring the shortfall back within the European Union’s limit of 3% by 2029, two years later than the initial plan.

The widening hole in France’s public finances has put markets on edge in recent months, driving up borrowing costs compared with other European countries. Its debt yields are now aligned with lower-rated Spain and about 77 basis points higher than safer German peers.

Reinout De Bock, head of European rates strategy at UBS Group AG, said higher debt issuance targets were unlikely to weigh on French bonds given that was expected. Also the larger volume of redemptions means the net supply won’t be as heavy, he added.

“The numbers would have to be a lot higher to get the spread widening substantially,” he said before the release of the data. “We expect the France-Germany 10-year yield spread to settle at 75 basis points by year-end.”

Europe’s second largest economy will soon face the verdict of the world’s three biggest credit rating firms. Fitch Ratings, which downgraded France last year, may issue a new assessment on Friday, followed by Moody’s Ratings on Oct. 25 and S&P Global Ratings a month later.

©2024 Bloomberg L.P.