Frisco ISD board members placed the bond package and tax rate election on the ballot for the Nov. 5 general election during an Aug. 19 meeting. Approving the tax rate and calling the tax rate election was approved by trustees in 5-2 votes, with Stephanie Elad and Marvin Lowe casting dissenting votes.

Calling a bond election was approved in a 6-1 vote, with Elad voting against approval. Elad cited concerns for how the bond propositions were packaged. She would have rather seen the campus refresh and Staley Middle School construction be separated from the rest of Proposition A.

“Regardless of where we are Nov. 5, it is my hope this district continues to look at measures to reduce spending, get to a balanced budget and lower the tax burden on our community,” she said.

If voters approve all the bond propositions, the district’s interest and sinking tax rate—which is used for bonds and debt services—would not increase from its existing rate of $0.27.

Sorting out details

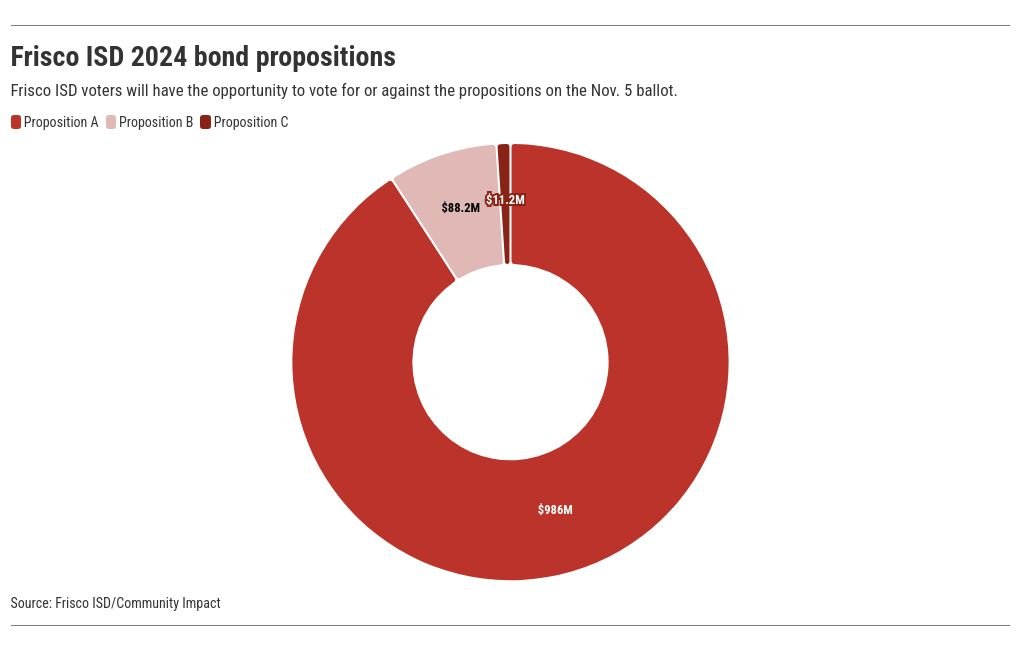

The bond totaling $1.08 billion is broken down by three propositions that touch on maintenance, technology and sports facilities.

Proposition A includes $986 million for refreshing campuses, replacing furniture and equipment, among other costs. The proposition includes:

- Refreshing 20 campuses that are reaching 25 years old

- Constructing a new Staley Middle School

- Refreshing furniture and equipment for schools not included in the 25-year refresh

- Repairing landscaping and paving districtwide

- Purchasing new school buses, work trucks, a fueling station and truck wash

- Upgrading safety and security

The construction of the new Staley Middle School, which opened in 1996, could start in 2025 and be completed in 2026, if approved. Staley students were dismissed early Aug. 19 due to a malfunction in the campus’s cooling system, according to a social media post from the school.

The new building will be located next to the existing campus. During construction, students can stay at the existing Staley campus, which will be used for special education students ages 18-21 once it is vacated by its middle school students.

Proposition B is $88.2 million and includes a technology update to replace outdated devices to maintain the district’s one-to-one student-to-device ratio from kindergarten through 12th grade.

Proposition C comes in at $11.2 million to construct a tennis center of 16 outdoor courts for tournaments.

Diving in deeper

Along with the bond, voters will consider raising the maintenance and operation tax rate by $0.0294 per $100 valuation in a tax rate election, also known as a VATRE. A VATRE is used when a district needs to increase its tax rate above a certain threshold, which voters must then consider in an election.

Maintenance and operations, also known as M&O, funds payroll and other operational costs.

The district’s total tax rate would be $1.0569 per $100 valuation, if approved by voters. This is broken down between $0.7869 for maintenance and operations and $0.27 for interest and sinking, which covers debt payments.

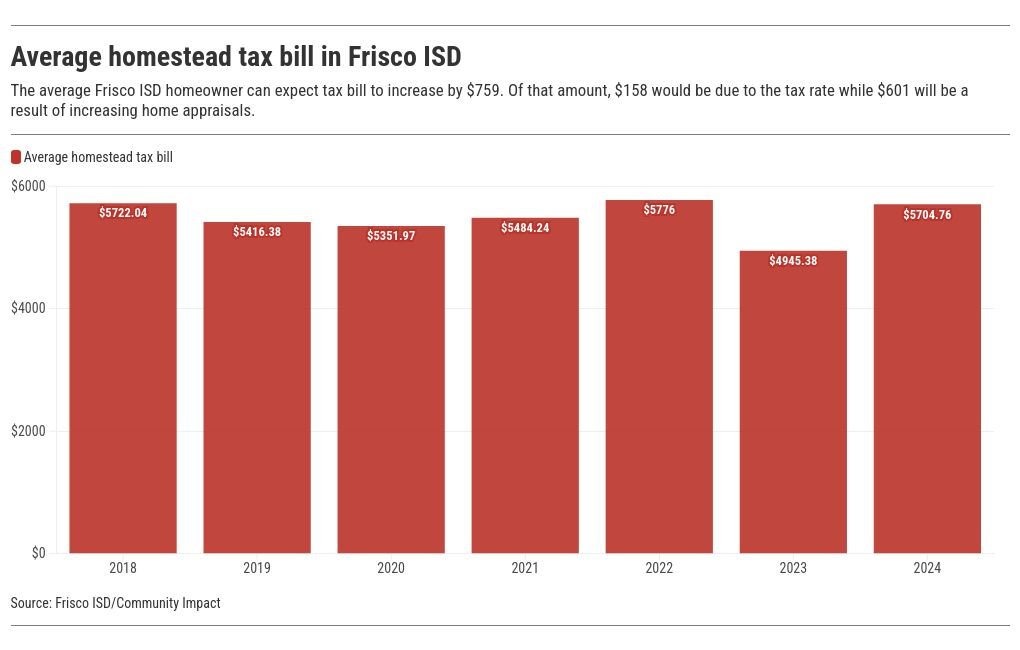

The average homeowner in Frisco ISD could see a $158 increase on their tax bill if the new rate is approved. This is based on an average home valuation of $727,914 and a taxable value of $539,763, according to a board workshop presentation.

The new tax rate would generate an additional $11.5 million in revenue for the district. In total, the increase would generate $19.5 million in revenue, but $8 million would go to the state in recapture, according to the meeting presentation.

FISD voters last approved raising the M&O portion of the tax rate by $0.13 per $100 valuation in 2018.