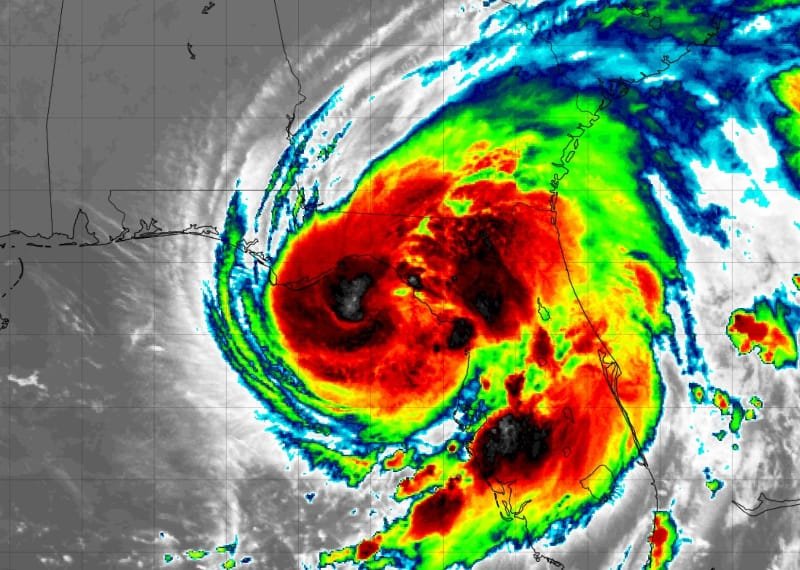

As hurricane Debby approaches landfall, given the relatively sparsely populated landfall region the insurance and reinsurance industry exposure will be more limited, which has led investment manager Icosa Investments AG to say it does not expect any substantial impacts to catastrophe bonds from the storm. As we have been reporting, hurricane Debby formed over the weekend and is expected to make a category 1 strength landfall in the Florida Big Bend region.

As we have been reporting, hurricane Debby formed over the weekend and is expected to make a category 1 strength landfall in the Florida Big Bend region.

With sustained winds around 80 mph and stronger gusts, Debby is not an especially intense hurricane and the limited time it had over the very warm Gulf of Mexico waters has saved the region of Florida from a stronger impact.

But, rainfall remains a key focus, with hurricane Debby expected to soak Florida first but then drop as much as 15 to 30 inches of rainfall in parts of Georgia and the Carolinas, creating a severe flooding threat and a chance of more significant economic losses than insured.

Swiss catastrophe bond fund manager Icosa Investments AG noted that because the landfall region is less populated and insured value concentration lower there, catastrophe bonds are expected to remain safe from hurricane Debby.

Icosa Investments explained, “Hurricane Debby is anticipated to make landfall in Florida within the next few hours as a Category 1 hurricane. Fortunately, the expected landfall area is sparsely populated, which limits insurance exposure. This location is similar to where Hurricane Idalia made landfall in 2023 as a much stronger Category 4 hurricane. Despite its strength, Hurricane Idalia proved manageable for the cat bond market.

“Given that Hurricane Debby is significantly weaker, we do not foresee any substantial impact on the cat bond market at this time.”

The investment manager added, “The only remaining uncertainty pertains to potential flood exposure in the coming days. There is a minimal residual risk for investors in the junior layers of the FEMA cat bond program. We will continue to monitor the situation closely and provide updates if necessary.”

It would take a particularly significant flood event for the FloodSmart Re catastrophe bond program to attach and face any losses, but Icosa Investments is right to highlight this minimal tail risk.