MUMBAI, Oct 11 (Reuters) – India’s benchmark bond yield may drop to levels last in November 2021 by the end of this financial year, on strong foreign inflows and central bank rate cuts, a fixed income official from TT International Asset Management said.

“While foreigners have been highly active in local markets, we expect strong flows to continue,” said Jean Charles Sambor, head of emerging markets debt at the firm, which managed assets worth $5.5 billion as of September.

“We anticipate increased regional participation, along with potential crossover money,” said Sambor, who expects the 10-year benchmark bond yield to drop around 50 basis points to 6.30% by the end of March from the current 6.77%.

A Reuters poll of economists showed the 10-year bond yield will fall to 6.60% in the same period.

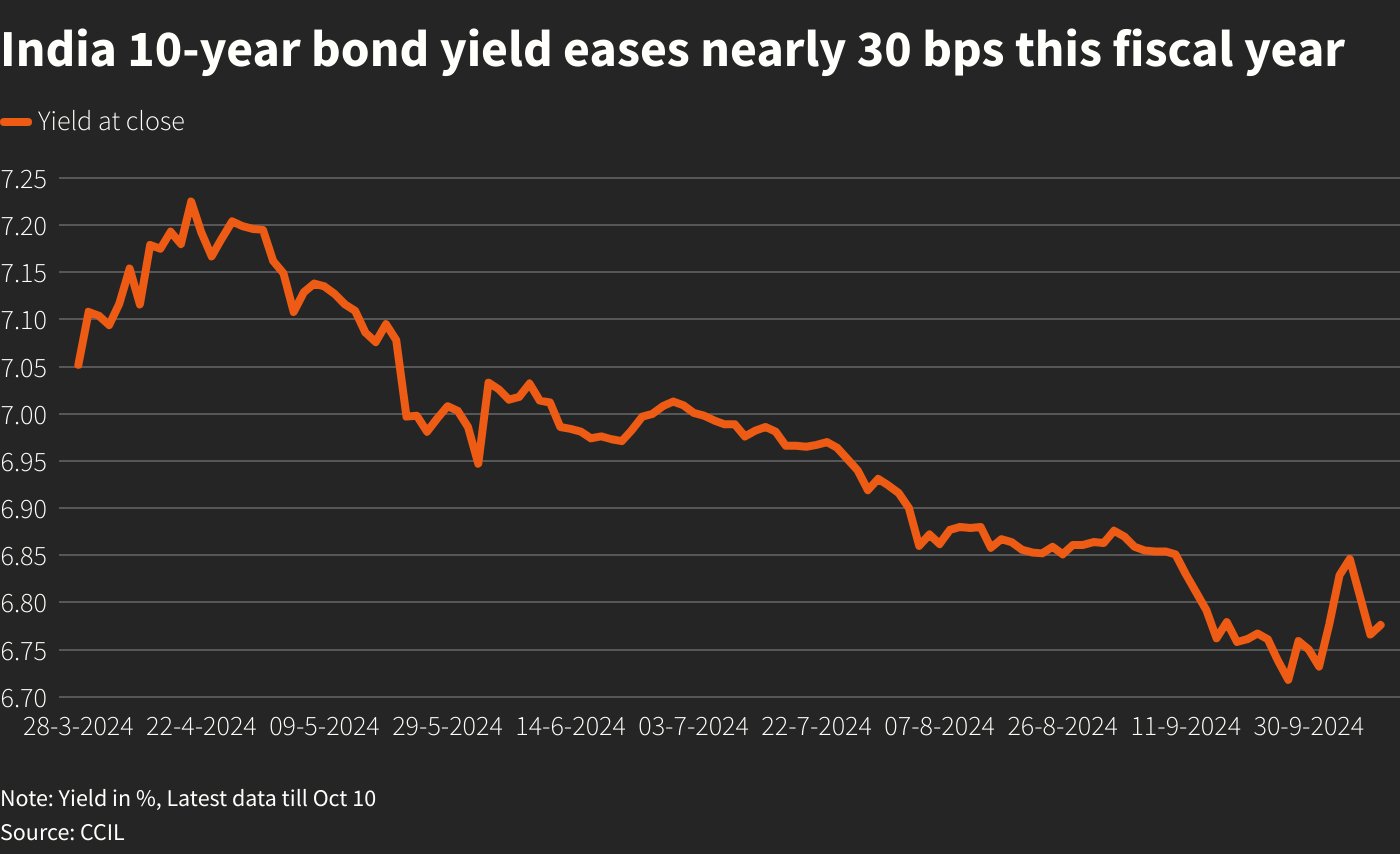

India’s benchmark bond yield has dropped 28 basis points since April on strong demand and a modest increase in the supply of federal government debt.

The government market borrowing is seen easing 9% this year compared to the previous year and its fiscal deficit is seen reducing to 4.9% of GDP.

Demand for government securities from local mutual funds, insurers and pension funds has been strong while foreign purchases have been resilient.

“We believe local markets are still under-owned by market participants, and this represents a secular theme that foreigners will want to access… We anticipate inflows to accelerate as India’s weight in benchmark continues to rise,” Sambor said.

Foreigners hold nearly 6% of government bonds with no investment limits, while overall ownership is at around 3% of outstanding Indian government debt.

A larger-than-normal interest rate cut from the Federal Reserve last month should also be a “game changer for local currency bonds in EM”, Sambor said.

The central bank changed its policy stance to ‘neutral’ in its latest meeting.

($1 = 83.9740 Indian rupees)

Sign up here.

Reporting by Dharamraj Dhutia; Editing by Eileen Soreng

Our Standards: The Thomson Reuters Trust Principles.