The riskiest segments of the corporate fixed income market are experiencing a massive influx of investor capital in recent weeks as traders bet the Federal Reserve will cut interest rates at its September meeting and continue with a swift rate-cut cycle.

U.S. corporate bonds rated CCC or lower — which are at the bottom of the credit rating scale and represent companies with a high likelihood of default — have rallied nearly 3% this month. This surge positions junk bonds for their best monthly performance to date in 2024.

Disinflation Fuels Rate-Cut Frenzy: High-Yield Bonds Benefit

Following the lower-than-expected June Consumer Price Index report released earlier this month, speculation on interest-rate cuts have gone wild.

According to CMEGroup‘s Fed Watch tool, markets are fully pricing in a rate cut in September, followed by additional cuts in November and December 2024.

Interest rate futures indicate the fed funds rate could drop to 4.5%-4.75% by the end of the year and further to 4%-4.25% by June 2026.

Similar to the recent stock market trends, where traders are gravitating toward interest-rate sensitive assets like small caps, the bond market is seeing increased interest in high-yield or junk bonds in anticipation of the Federal Reserve’s rate cuts reducing borrowing costs for issuers and mitigating default risks.

These bonds are also becoming relatively more attractive compared to the diminishing returns on safer investments, offering higher income as the interest rate environment shifts.

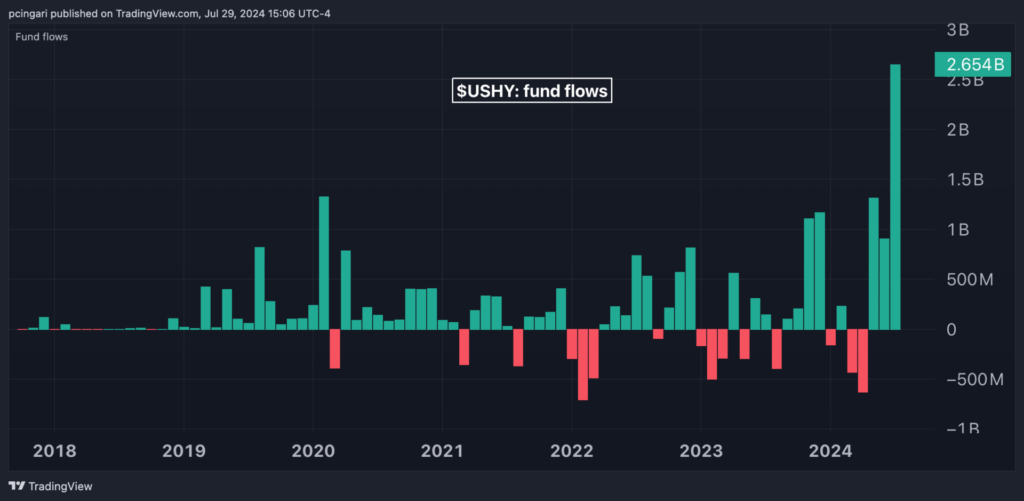

The iShares Broad USD High Yield Corporate Bond ETF USHY has posted gains for four consecutive weeks, a streak not seen since July 2022.

Additionally, the fund has attracted an impressive $2.65 billion in inflows this month alone, on track to achieve the largest one-month inflow since its inception in 2017, according to data from ETFdb.com.

iShares Broad USD High Yield Corporate Bond ETF Attracts $2.65B This Month

Stretched Valuations

Despite the significant influx of capital into high-yield U.S. corporate bond strategies via exchange traded funds, the valuations of this asset class appear quite stretched and subject to price-reversal risks.

The option adjusted spread (OAS) for high yield corporate bonds is hovering around 310 basis points. This spread measures the additional yield that investors demand to compensate for the higher risk associated with high-yield (or “junk”) bonds compared to the virtually risk-free U.S. Treasuries.

This level is at the very bottom of the historical range. Episodes of crisis, recession and geopolitical uncertainties have caused this spread to widen abruptly and substantially.

For example, while the U.S. high-yield OAS spread was 240 basis points in June 2007, it skyrocketed to over 2,000 basis points by December 2008. Similarly, the junk credit OAS spread tripled from February 2020 to April 2020, reaching double-digit levels.

If the Federal Reserve does not deliver the rate cuts implied by the market, it could lead to turbulence in high-yield corporate bonds. The same could happen if an unexpected recession occurs or if inflation reawakens from here. Historical moves suggest that fluctuations can be nothing short of wild.

High-Yield Corporate Bond Spread To Treasuries Nears Historical Lows

Read Now:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.