(Bloomberg) — JPMorgan Chase & Co. sold $9 billion of bonds in the US investment-grade market, the first in what’s expected to be a flood of issuance from Wall Street’s six biggest banks.

Most Read from Bloomberg

The biggest US bank issued bonds in four parts, according to a person with knowledge of the matter. The longest portion of the offering, an 11-year security, yields 1.07 percentage point, or 107 basis points above Treasuries, after initial discussions of around 135 basis points, said the person, who asked not to be identified as the details are private.

The deal comes after the bank reported record profit as investment bankers and equities traders smashed expectations and the firm took a multibillion-dollar gain tied to a Visa Inc. share exchange.

A representative for JPMorgan declined to comment.

Wells Fargo & Co., meanwhile, tapped the European debt market with a €2.75 billion ($3 billion), two-part offering on Monday. Citigroup Inc. and Goldman Sachs Group Inc. have also posted earnings and are candidates to sell debt. Bank of America Corp. and Morgan Stanley are scheduled to report on Tuesday.

The risk of a hard landing in the US economy remains low, which makes bonds from financial institutions attractive, according to Matt Brill, head of North America investment-grade credit at Invesco Ltd.

“While slowing, the economy is still strong, and when the Fed starts cutting, banks should benefit,” said Brill in an emailed response to questions on Monday.

The top banks are expected to borrow more than they usually do after they post earnings as they take advantage of falling yields and get ahead of upcoming US elections that could potentially bring market turmoil.

JPMorgan credit analyst Kabir Caprihan expects $21 billion to $24 billion of issuance from the six biggest domestic banks, more than the 10-year July average of roughly $17 billion. Barclays Plc is calling for about $30 billion of sales from the set in the third quarter, with most of that expected this month.

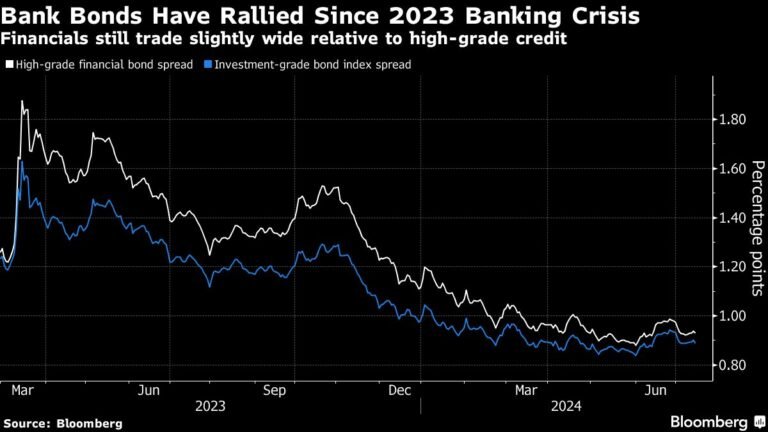

The funding backdrop is attractive for bank issuers. Risk premiums on investment-grade bonds — the added premium over US Treasuries investors get paid to hold riskier debt — narrowed 1 basis point to 89 basis points Friday. The average spread on a financial institution bond is just 4 basis points wider than the broader high-grade index.

Moreover, the overall cost to sell debt has fallen to the lowest in five months.

JPMorgan was among six companies issuing $18.1 billion of dollar bonds Monday. Bank of New York Mellon Corp. sold a four-part deal while PepsiCo Inc. borrowed in a three-tranche offering to partly repay commercial paper. Syndicate desks are calling for as much as $30 billion in new bond sales this week.

(Updates with pricing details in first and second paragraphs.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.