“Bonds have been awful. It’s a good time to buy.”

— The New York Times, Oct. 16, 2023

British banker and politician Baron Rothschild once said “the best time to buy is when there is blood in the streets.”

In simple terms, when everyone else is selling, it’s time to buy.

Or as Warren Buffett says, “be fearful when others are greedy — and be greedy when other are fearful.”

This can be tough advice to take — and it’s been my experience that investors need to have strong stomachs and a often a lot of patience to follow it.

But if this advice is wise, the idea of buying bonds could make sense.

Please note that I’m not talking about trying to “time the market” — but if you sold out of bonds during the 2022 rout or don’t have much (if any) in your portfolio, it might be time to think about adding a reasonable allocation of bonds to your portfolio.

While seemingly simple in concept, bonds can actually be quite complex investments. In plain terms, bonds are loans made to gpvernments or corporations. The borrower promises to pay back the loan along with interest.

As humorist Will Rogers once said, “I’m not as concerned about the return ON my money as the return OF my money,” making it important to consider the borrower’s finances and reputation.

Credit rating services like Standard & Poor’s, Moody’s and Fitch can help — but even bonds with high quality ratings have surprised investors when things turn south.

One need only think back to the “Great Recession” when mortgage-backed securities that got top ratings were actually backed by risky mortgages that defaulted in record amounts.

But there are two bigger risks when it comes to investing in bonds: interest rates and inflation.

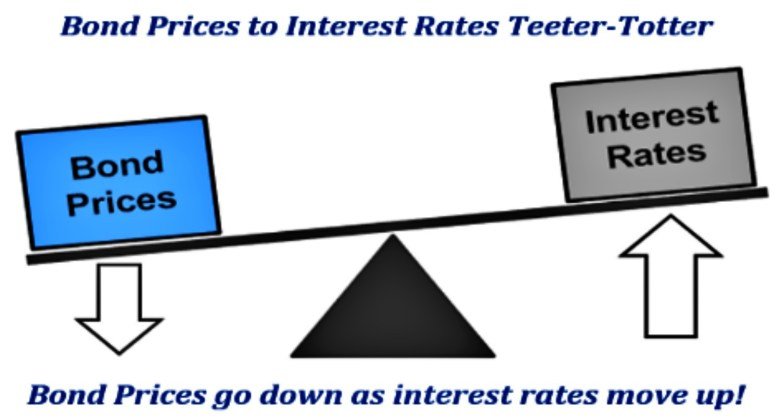

The Teeter-Totter Effect of Interest Rates

It has long amazed me how few people really understand bond math — which is easily illustrated by a popular childhood playground toy: the teeter-totter.

Let’s use a simple example: you buy a $100,000 U.S. Treasury bond (which is Triple-A rated and widely considered the world’s safest investment, backed by the full faith and credit of the United States) — issued for 10 years with a stated interest rate of 5%.

That means you collect $5,000 of interest for 10 years — and then get back your $100,000.

Simple, right?

Yes, if you hold the bond to maturity in 10 years. But, the bond’s value in the meantime will change daily — up or down — based primarily on interest rate changes along with, to a lesser extent, supply and demand.

As depicted in the nearby teeter-totter illustration, if interest rates rise, bond prices fall, and vice versa. And the longer the teeter-totter, the bigger the ups and downs.

So, after a decade of near-zero rates, when the Fed hiked rates 11 times beginning in March 2022, bond prices got hit — and the longer the bond maturity, the bigger the hit.

In fact, 2022 was the worst year for bonds in recent history. The iShares Core U.S. Aggregate Bond ETF (AGG) with an average duration of about six years was down 13%; the iShares 20+ Year Treasury Bond ETF (TLT) lost an eye-popping 31%.

Both are low-cost/well-diversified funds holding high credit quality bonds — so this was all about rising interest rates.

Fortunately, both funds saw a modest rebound in 2023 (up 2.9% and 5.5%, respectively), but again are down 1.5% and 5.5% year to date as of May 15.

Why Bonds Are Becoming Appealing Again

So, why even think about buying bonds now?

The answer, my friends, is YIELD. After a decade of near-zero (and even negative yields overseas), aggressive inflation-fighting Fed rate hikes now provide some attractive yields.

The current 30-day SEC Yields on AGG is 4.7% and is 4.6% for TLT, and rates on high-grade corporate bonds are even higher.

And there are signs that the Fed may hold rates steady for a while to see if they have indeed pushed inflation down to the 2% target, at which point we may well see some rate cuts.

Remember, if interest rates go DOWN, bond prices go UP. Over longer time periods, the overall bond market typically produce returns fairly consistent with rates on the 10-year Treasury.

Vanguard’s 10-year rerturn forecasts show U.S. aggregate bonds in a range of 3.9% to 4.9% with treasuries slightly lower and high-yield bonds in a 5.2% to 6.2% range.

Interestingly, Vanguard’s 10-year forecast shows U.S. equities at 3.7% to 5.7% and global equities (ex-US) at 6.9% to 8.9%, in large part reflecting today’s relatively high valuations.

Of course, accurately predicting the future can be a humbling game, arguing for hedging bets with a well-diversified portfolio.

Then there is the debate between bond funds versus individual bonds. The argument for each is fairly simple, and both are reasonable.

If you buy an individual bond and hold it to maturity, you collect interest along the way and get your money back when the bond matures — assuming the borrower doesn’t default.

But if you need to sell it before it matures, the price will still vary depending on changes in interest rates, credit quality and demand.

Also, buying/selling indvidual bonds can be pricey, especially in smaller amounts.

And it’s tough to get enough diversification to spread credit risk. By contrast, bond funds offer diversification (funds often hold hundreds if not thousands of bonds), can be purchased/sold in small amounts, and funds buy in large amounts to get good pricing.

However, you don’t have the benefit of a fixed maturity date, so there is no guarantee you’ll ever get your money back when you sell.

Incorporating Bonds in Your Portfolio

It’s been my experience that over long time periods, both strategies produce similar resuts, but using individual bonds with shorter maturities might work best if your time horizon is short.

Click here for a more in-depth discussion of pros and cons from Schwab.

Finally, there is the important matter of credit quality. High yield (aka “junk bonds”) have higher coupon rates for a reason: they carry a higher risk of default.

And in challenging economic times, junk bonds often behave more like stocks as fears of default rise, while at the same time, U.S. Treasury bonds tend to rally as investors flock to safety.

While a modest allocation to high yield (“junk”) bonds can make sense, an “aggregage bond market” core exposure should be your core exposure.

Finally, remember that bonds historically provide balance against volatile stock markets.

While there are times when both stock and bond markets sink together, most of the time bonds are negatively correlated to stocks, smoothing out market ups and downs.

And even with yields now looking pretty atrocious at 4% to 6%, it’s important to keep investment costs low so they don’t eat up returns.

And if you’re a high-bracket taxpayer, consider the benefits of municipal bonds, and especially California tax-exempts and U.S. Treasury bonds to reduce your state taxes.

Cheers.