National Savings and Investments (NS&I) Premium Bonds allow investors to buy bonds, with a minimum of £25, and have the chance of winning money in return.

With a max prize of £1 million, many use Premium Bonds accounts as a way to save money whilst being in with a chance to win.

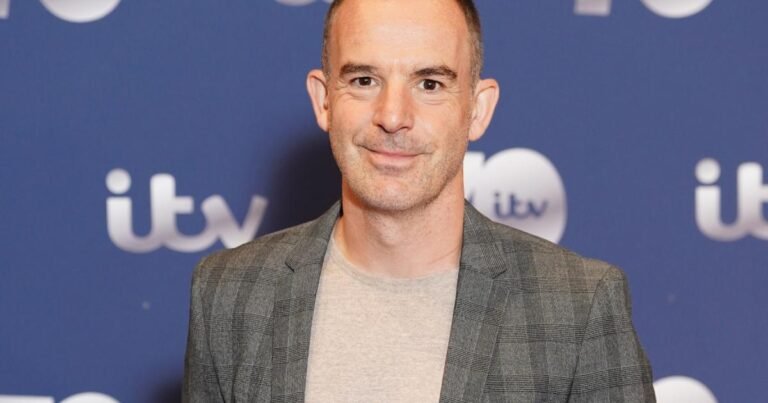

However, now Lewis has shared his verdict on whether the NS&I products are really worth investing in.

Martin Lewis shares if Premium Bonds are ‘worth it’

Speaking on ITV’s This Morning, Lewis was asked by viewer Rebecca: “Are premium bonds worth considering?”

Responding to the question from The Martin Lewis Money Show studio, the presenter said: “For some people. It’s quite complicated.”

Adding: “The Premium Bonds prize rate is 3.80%, which is less than the top savings accounts.

“But actually, if you have typical luck, which is based on the median average, you will earn less than 4.65%.”

Lewis then explained how for two to win big, many have to lose: “Think about it this way, for every person that wins £1 million, a lot of people have to win nothing, which is why on average, with typical luck, you get less than 4.65%.

“The maximum is £50,000. So as a general rule of thumb, if you are a higher or top-rate taxpayer, you have enough savings that you pay interest on it, and you’re looking at putting a large amount in, they can be a pretty good bet.

Recommended Reading

“If you’re looking at putting a few hundred quid in and you don’t pay tax on your savings, you would be a lot better off with a normal savings account where you’re guaranteed to get the interest.”

Although the Money Saving Expert has shared his thoughts on Premium Bonds, he does confirm that people’s money is safe with NS&I, adding: “It’s a savings account where the interest is dictated by a lottery.”

Lewis added that anyone with investments in Premium Bonds can take their money out safely: “Yes, you can take your money out – but you can take your money out of any easy access account.”