Municipals were little changed Monday as U.S. Treasuries were firmer and equities ended mixed.

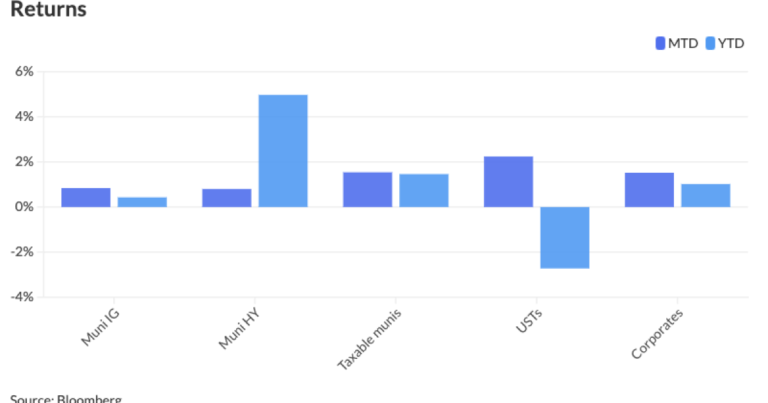

While munis have been steady over the past several trading sessions, changed no more than a basis point or two, munis “continue to rally [this month] as yields have fallen an average of 15 basis points across the curve,” said Jason Wong, vice president of municipals at AmeriVet Securities.

“Despite this rally, yields are still higher year-to-date,” he said.

The 10-year muni fell 2.2 basis points last week to end Friday at 2.78%, Wong noted.

However, this is still 50 basis points higher than the start of the year when 10-year muni was at 2.28%, he noted.

“Munis are still cheaper compared to Treasuries as the 10-year ratio was at 58.48% at the start of the year but still remain rich overall as the 10-year average is 86.50%,” Wong said.

The two-year muni-to-Treasury ratio Monday was at 65%, the three-year at 66%, the five-year at 68%, the 10-year at 67% and the 30-year at 83%, according to Refinitiv Municipal Market Data’s 3 p.m. EST read. ICE Data Services had the two-year at 65%, the three-year at 67%, the five-year at 68%, the 10-year at 67% and the 30-year at 82% at 3:30 p.m.

This week’s Federal Open Market Committee meeting should benefit from last week’s “Fed-friendly numbers … indicating that inflation is easing,” Wong said.

Due to this, Federal Reserve Chair Jerome Powell is expected to mention “a rate cut which could come as early as September,” he said.

“With this, we could expect to see ratios fall closer to levels we saw back at the start of the year and possibly see yields return back to January levels,” Wong said. “If the Fed cuts rates in September, we should expect to see issuers flock back to the markets.

“The overall muni market appears to be in a good balance despite the hefty slate of primary issuance that has occurred over the past few months,” Birch Creek Capital strategists said.

Issuance slows this week to around $6.6 billion due to the FOMC meeting,

In the primary market Monday, Wells Fargo held a one-day retail period on

The second tranche, $24.275 million of Fiscal Series 2025 B, saw 5s of 8/2025 at 3.01% and 5s of 2029 at 3.01%, make whole call.

Goldman Sachs priced for the Black Belt Energy Gas District (Aa3///) $638.745 million of gas project revenue bonds, 2024 Series C, with 5s of 7/2025 at 3.82%, 5s of 2029 at 3.87% and 5s of 2031 at 3.94%, make whole call.

With slowing issuance and the August 1 cash hitting on Thursday, Birch Creek strategists said they would “not be surprised to see the muni market heat up, especially if the Fed signals their intent to begin the cutting cycle in September.”

LSEG Lipper reported

In the secondary market last week, J.P. Morgan reported customer buying activity “only up marginally relative to recent volumes,” Birch Creek strategists said.

This occurred “though demand was aligned with fund flows and concentrated in longer duration bonds,” they said.

“Customer selling was elevated, with [bid wanted in competition] volumes +35% [last] week as accounts continued to rotate out of existing positions and structures and into the more attractive new issues,” they added.

AAA scales

Refinitiv MMD’s scale was little changed: The one-year was at 2.86% (-2) and 2.85% (unch) in two years. The five-year was at 2.75% (unch), the 10-year at 2.82% (unch) and the 30-year at 3.68% (unch) at 3 p.m.

The ICE AAA yield curve was changed up to a basis point: 2.90% (unch) in 2025 and 2.86% (unch) in 2026. The five-year was at 2.77% (-1), the 10-year was at 2.82% (+1) and the 30-year was at 3.64% (-1) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was bumped up to a basis point: The one-year was at 2.89% (-1) in 2025 and 2.87% (-1) in 2026. The five-year was at 2.77% (unch), the 10-year was at 2.81% (unch) and the 30-year yield was at 3.65% (-1) at 3 p.m.

Bloomberg BVAL was little changed: 2.88% (-1) in 2025 and 2.83% (unch) in 2026. The five-year at 2.74% (unch), the 10-year at 2.76% (unch) and the 30-year at 3.65% (unch) at 3:30 p.m.

Treasuries were firmer.

The two-year UST was yielding 4.382% (flat), the three-year was at 4.192% (-1), the five-year at 4.058% (-2), the 10-year at 4.166% (-3), the 20-year at 4.512% (-2) and the 30-year at 4.419% (-3) at 3:30 p.m.

Primary to come

The Port of Seattle (A1/AA-/AA-/) is set to price Thursday $822.225 million of intermediate lien revenue refunding bonds, consisting of $170.825 million of non-AMT bonds, Series 2024A, serials 2025-2044, and $651.4 million of AMT bonds, Series 2024B, serials 2025-2044, term 2049. BofA Securities.

The Port of Portland (/AA-/AA-/) is set to price Tuesday $592.03 million of AMT Portland International Airport revenue bonds, consisting of $520.065 million of green bonds Series 2024A, serials 2025-2054, and $71.965 million of refunding bonds Series 2024B, serial 2025-2044s. BofA Securities.

The Central Florida Expressway Authority (A1/AA-//) is set to price Tuesday $366.515 million of senior lien revenue bonds, consisting of $148.185 million of Series 2024A, serials 2025-2044, terms 2049, 3054, and $218.33 million of Series 2024B, serials 2029-2030, 2032-2035. J.P. Morgan.

The Industrial Development Authority of Fairfax County, Virginia, (Aa2/AA+//) is set to price Tuesday $362.245 million of Inova Health System Project healthcare revenue Series 2024. J.P. Morgan.

The Allegheny County Sanitary Authority, Pennsylvania, (Aa3/AA-//) is set to price Monday $361.595 million of sewer revenue refunding bonds, Series 2024, serials 2024-2044, terms 2049, 2055. PNC Capital Markets.

The Illinois Housing Development Authority (Aaa///) is set to price Tuesday $327.335 million of taxable social revenue bonds, Series 2024F, serials 2025-2036, terms 2039, 2044, 2046, 2054. BofA Securities.

The authority is also set to price $66.665 million of non-AMT social revenue bonds, Series 2024E, serials 2025-2036, terms 2039, 2043, 2055. Raymond James.

Tallahassee, Florida, (Aa3/AA//) is set to price Thursday $201.295 million of energy system refunding revenue bonds, Series 2024, serials 2025-2042. Raymond James.

The Fayette County Development Authority, Georgia, (//BBB/) is set to price Thursday $200 million of United States Soccer Federation revenue bonds, Series 2024. Goldman Sachs.

The Northampton County General Purpose Authority, Pennsylvania, (Aa3/AA-//) is set to price Tuesday $125.785 million of Lehigh University higher education fixed-rate revenue bonds, Series A of 2024, serials 2024-2034. Wells Fargo.

The Minnesota Housing Finance Authority (Aa1/AA+//) is set to price Tuesday $110 million of taxable residential housing finance bonds, 2024 Series P, serials 2025-2035, terms 2039, 2044, 2049, 2051. RBC Capital Markets.

The Detroit Regional Convention Facility Authority (/A+/AA-/) is set to price Thursday $107.98 million of convention facility special tax revenue refunding bonds, Series 2024C. J.P. Morgan.

Competitive

Miami-Dade County, Florida, is set to sell $234.03 million of capital asset acquisition special obligation bonds, Series 2024A, at 10 a.m. Eastern Wednesday.

New Orleans is set to sell $183 million of public improvement bonds, Issue of 2024A, at 10:30 a.m. Eastern Wednesday.

Glendale, California, is set to sell $166.88 million of electric revenue bonds, 2024 Second Series, at 11 a.m. Eastern Thursday.

Layla Kennington contributed to this story.