Over the past few days, the yield on the 10-Year U.S. Treasury notes (or the “Tens,” as they are often called) has fallen as low as 4.17%, a level not seen since March. But it still has a long way to go to where it started the year, into the 3.8% area. Will it fall that low?

The answer has huge implications for the question that’s been dominating the financial news: Will the Federal Reserve raise interest rates, keep them the same, or lower them later this year?

It’s the lowering scenario that everyone from Wall Street to Main Street is hoping for. Wall Street has been pushing the major stock indexes higher and higher on the hopes of a rate cut. (Because that, in theory, would lower the appeal of the so-called fixed-income assets, whose returns are directly tied to the Fed’s rate policy.) And Main Street needs lower borrowing costs on everything from business and consumer loans to mortgage rates. Come on, Fed!

Now, how does the Fed’s decisions tie in with Treasury yields, you may ask?

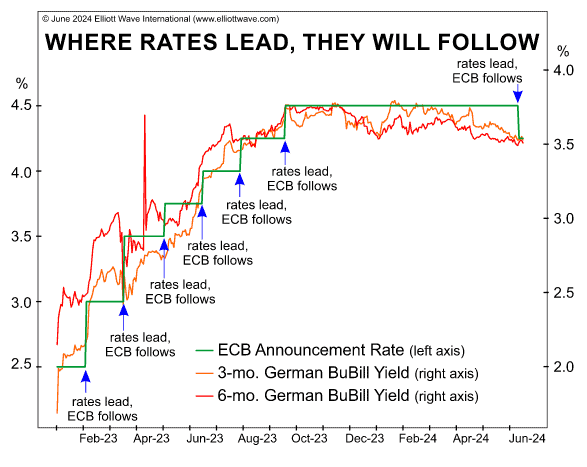

Here’s how. Over the many years of observing Fed’s behavior, we noticed that central banks don’t lead anything or anyone on interest rates. They follow. Central bankers follow the yields on the short-term givernment debt. (In the U.S., it goes by the name “Treasury Bills.”)

The U.S. Fed, Bank of Japan, Australian Central Bank – they all follow the short-term yield. We’ve shown multiple charts in our publications proving this point. If you’re still in doubt, here’s a handy chart our Global Market Perspective subscribers saw recently that proves that the European Central Bank also follows the yields on the local short-term government debt to guide its interest rate decisions:

Here in the U.S., the Fed follows the yields on the 3-month U.S. Treasury Bills. They don’t always go in lockstep with the yields on the Tens day in and day out, but they broadly trend together. So, it’s not a coincidence that the 3-month U.S. Treasury Bills yields have just made a new low for 2024, in-line with the decline in the yield on the Tens we’ve just discussed.

So, why is all this important?

Because if you can forecast the price of U.S. Treasuries – and, by extension, their yield (because in bonds, prices and yields move inversely) – then you have a pretty good idea whether the yields are headed lower…

…and whether the Fed will lower interest rates soon.

Enter our U.S. Interest Rates Pro Service. Daily, its team of analysts tracks Elliott wave patterns across U.S. Treasuries of various maturities. And lately, those patterns have been exceptionally clear.

This video shows you with red dots the timing of bullish and bearish U.S. Treasury forecasts our U.S. Interest Rates Pro Service made for subscribers going back to April of this year.

Bullish, April 30: “A bottom is in or at hand.”

Bearish, May 16: “Retreat should prove corrective, setting the stage for further advance.”

Bullish, May 30: “The retreat from the previous call reached the anticipated levels.”

Bearish, June 6: “A temporary top is forming.”

Bullish, June 10: “A bottom is forming, larger-degree uptrend is about to resume.”

Now, again, keep in mind that bond yields and prices move inversely to each other.

Meaning: That June 10 bullish forecast above, the one that called for the larger-degree uptrend in prices to resume also meant that we would soon see a corresponding decline in Treasury yields!

Which brings us full circle back to where we started: The yield on the 10-Year U.S. Treasury notes has just fallen to levels not seen since March while the 3-month U.S. Treasury Bills yields have just made a new low for 2024. As forecast by Elliott waves.

Be prepared for the next move in bonds, rates and yields.

The market calls you just read came from our intensive service for traders, Interest Rates Pro Services.

If you don’t need intraday coverage of rates, we have other services that can help you get in front of the next big move.