Paul Souders/DigitalVision via Getty Images

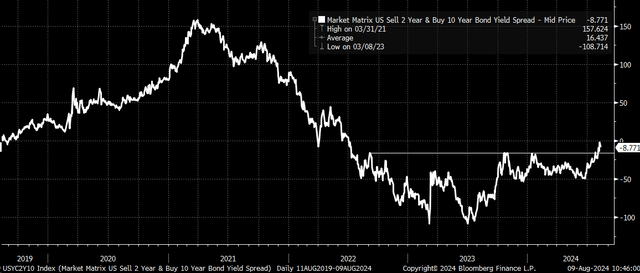

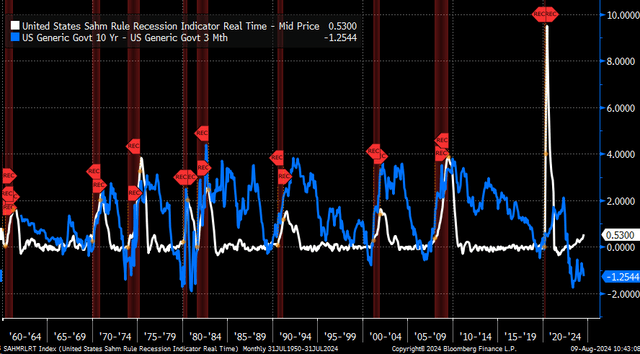

The bond market is sending a clear warning message that’s hard to miss. This message came last week following the weaker-than-expected job report. It led to a big break-out in the yield curve, crossing above -15bps for the first time since the summer of 2022, a sign that the steepening is likely to accelerate going forward. It’s that initial steepening process that should have investors worried.

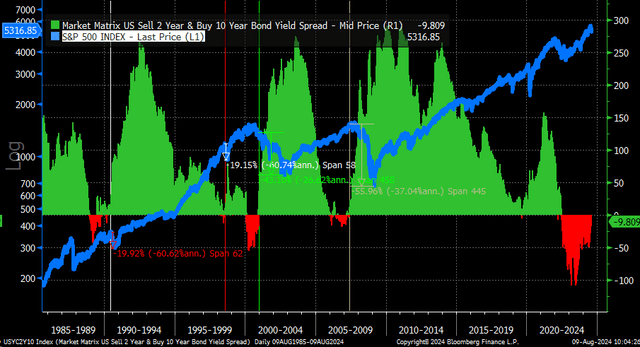

Since 1985, when the 10/2 spread began to steepen materially after being inverted, the equity market has undergone large drawdowns four times since 1990. The declines were sizable and came in 1990, 1998, 2000 and 2008. They led to a recession three out of four times. The pandemic steepening has been left out of the equation due to the nature of the event, and since a pandemic, will hopefully not be repeated anytime soon.

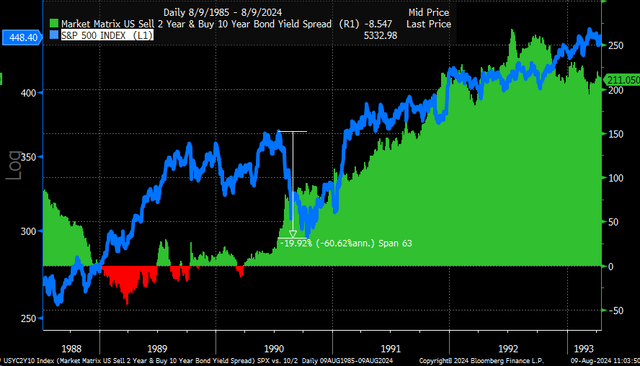

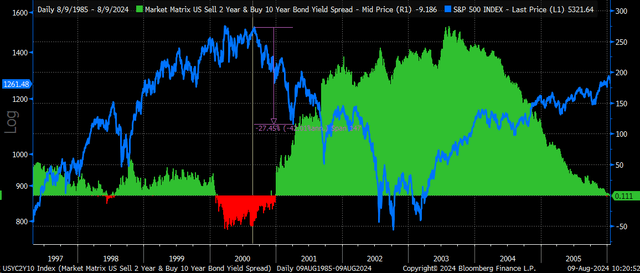

1989

From 1989 to mid-1990, the yield curve’s 10/2 spread was negative and then hovered around 10 bps. Then, in June 1990, the spread started to widen materially, climbing from roughly 13 bps to almost 95 bps by mid-October. During that time period, the S&P 500 fell by roughly 20%.

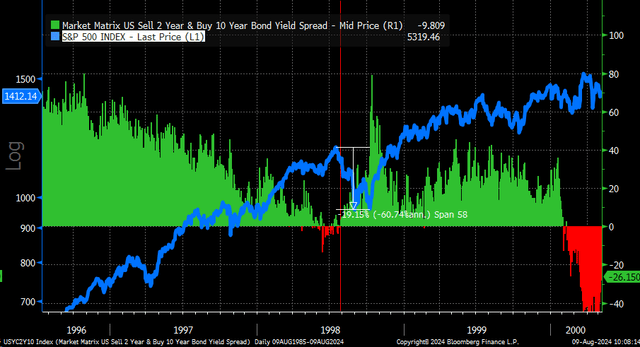

1998

In June 1998, the spread was also inverted; by July, it had quickly risen from around -5 bps to around 77 bps by October 1998. During that period, the S&P 500 declined by just over 19%.

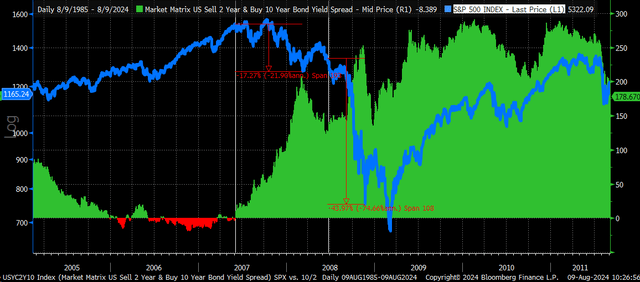

2000

In August 2000, the yield curve started steepening after reaching roughly -50 bps. By early May 2001, the spread had risen to 90 bps, resulting in the S&P 500 falling by around 27.5%.

2007-08

In May 2007, the spread was around 0%, and by February 2008, it had steepened to around 213 bps, leading to a decline in the S&P 500 of around 17.5%. Starting in June 2008, there was a secondary surge in the yield curve that took the spread from 129 bps to 250 bps. That burst led to a 44% decline in the S&P 500 on top of the earlier 17% decline.

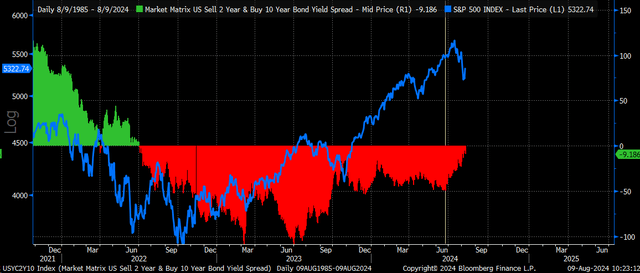

2024

Currently, it seems that the yield curve is trying to rise, moving from around -46 bps at the end of June to around -9 bps as of Aug. 9. History would suggest that the yield curve steepening process is only starting and that the equity market has likely peaked and is due to see a steeper decline.

The data appears to show that the initial burst of steepening that takes place following a prolonged inversion is what gets the equity market moving lower and has tended to lead to sharp and sudden declines.

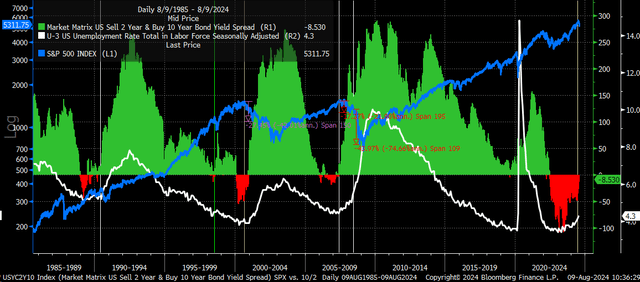

Ties To Unemployment

This seems to be the case because a sudden and sharp move higher in the yield curve seems to go along with a sharp and sudden rise in the unemployment rate. In fact, it would seem that the yield curve anticipated the rising unemployment rates and steepened in front of them.

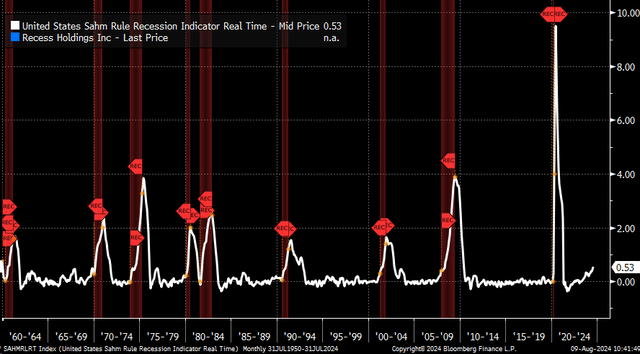

Right now, the bond market is sending a message that the unemployment rate is due to rise. Additionally, now that the Sahm Rule has been triggered, which occurs when the unemployment rate’s three-month moving average rises by 0.5% more than its lowest point in the past 12 months, the warning message is clear.

The interesting thing is that the 10-year minus the three-month Treasury spread tracks the Sahm rule fairly well. This seems to be yet another indication that if the Sahm rule is moving higher, the yield curve is likely to continue steepening in the weeks to come.

It would seem that the bond market’s message is that the unemployment rate is due to rise further in the coming months and that the equity market’s move lower has just started.