Yes, that has been our advice since mid-August. Our August 19, 2024 Morning Briefing was titled, “Get Ready To Short Bonds?” We wrote:

“Bond investors may be expecting too many interest-rate cuts too soon if August’s economic indicators rebound from July levels and the Fed pushes back against the markets’ current expectations for monetary policy. So we are expecting to see the 10-year Treasury yield back in a range between 4.00% and 4.50% next month.”

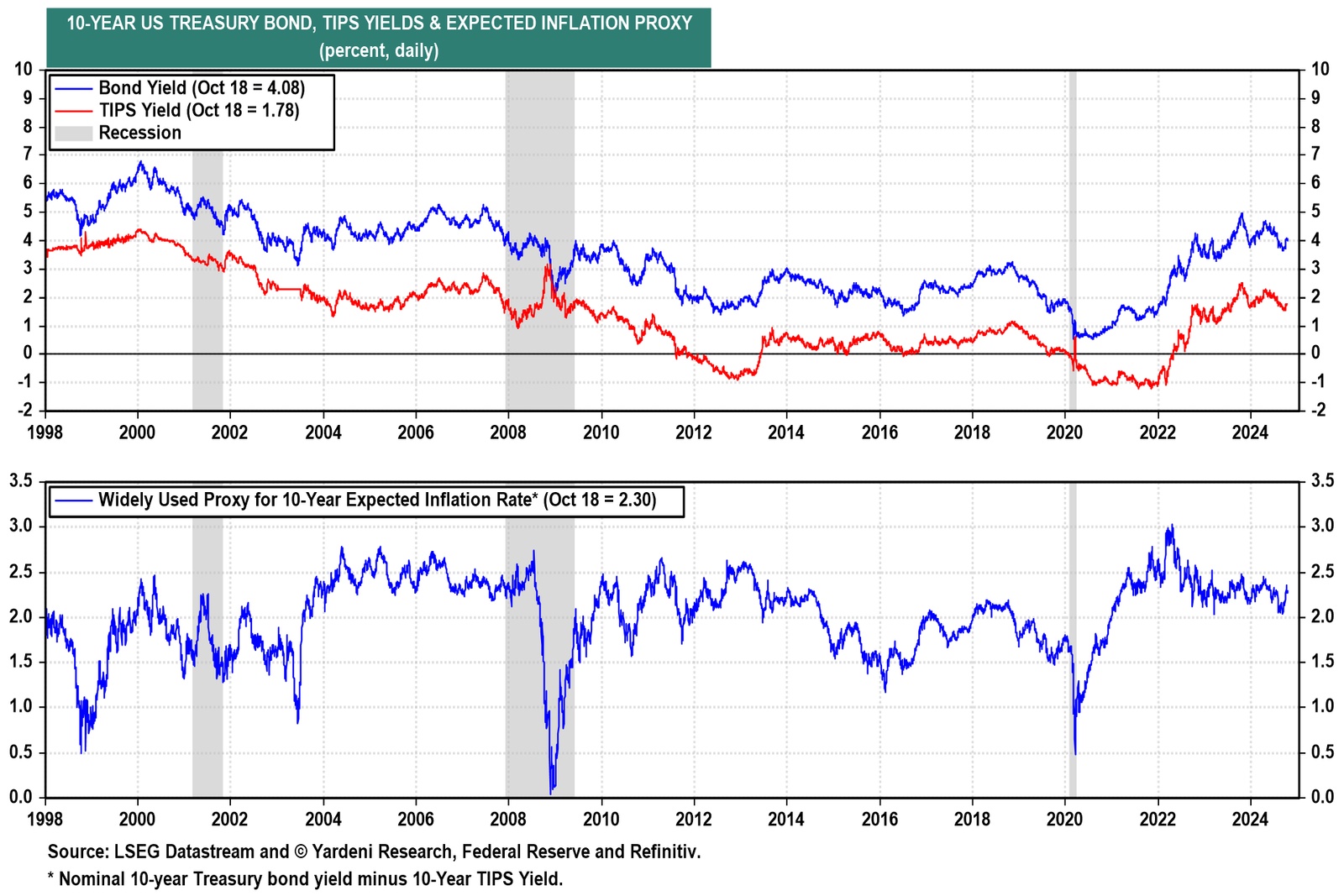

At the time, the Treasury bond yield was 3.88% (chart).

We were right about the economy and bond yields despite the Fed’s reaction function turning out differently than we expected. Instead of remaining moderately hawkish, Fed Chair Jerome Powell turned extremely dovish in his August 23 Jackson Hole speech.

That drove the bond yield down to 3.62% on September 16. On September 18, the Fed cut the federal funds rate by 50bps. We concluded that was too much, too soon. We reiterated our view that the yield would climb back up over 4.00% on better-than-expected economic data and on a none-and-done outlook for rate cutting by the Fed over the rest of the year.

The 10-year yield rose to 4.18% today, up 56bps since September 16. The expected inflation spread between the 10-year nominal and TIPS yields rose 26bps. The inflation spread has widened despite the recent drop in prices (chart). The bond market seems to agree with our view that the Fed may be stimulating an economy that doesn’t need it.

In our April 7 QuickTakes, we wrote:

“We would also add to precious metals positions under the circumstances.”

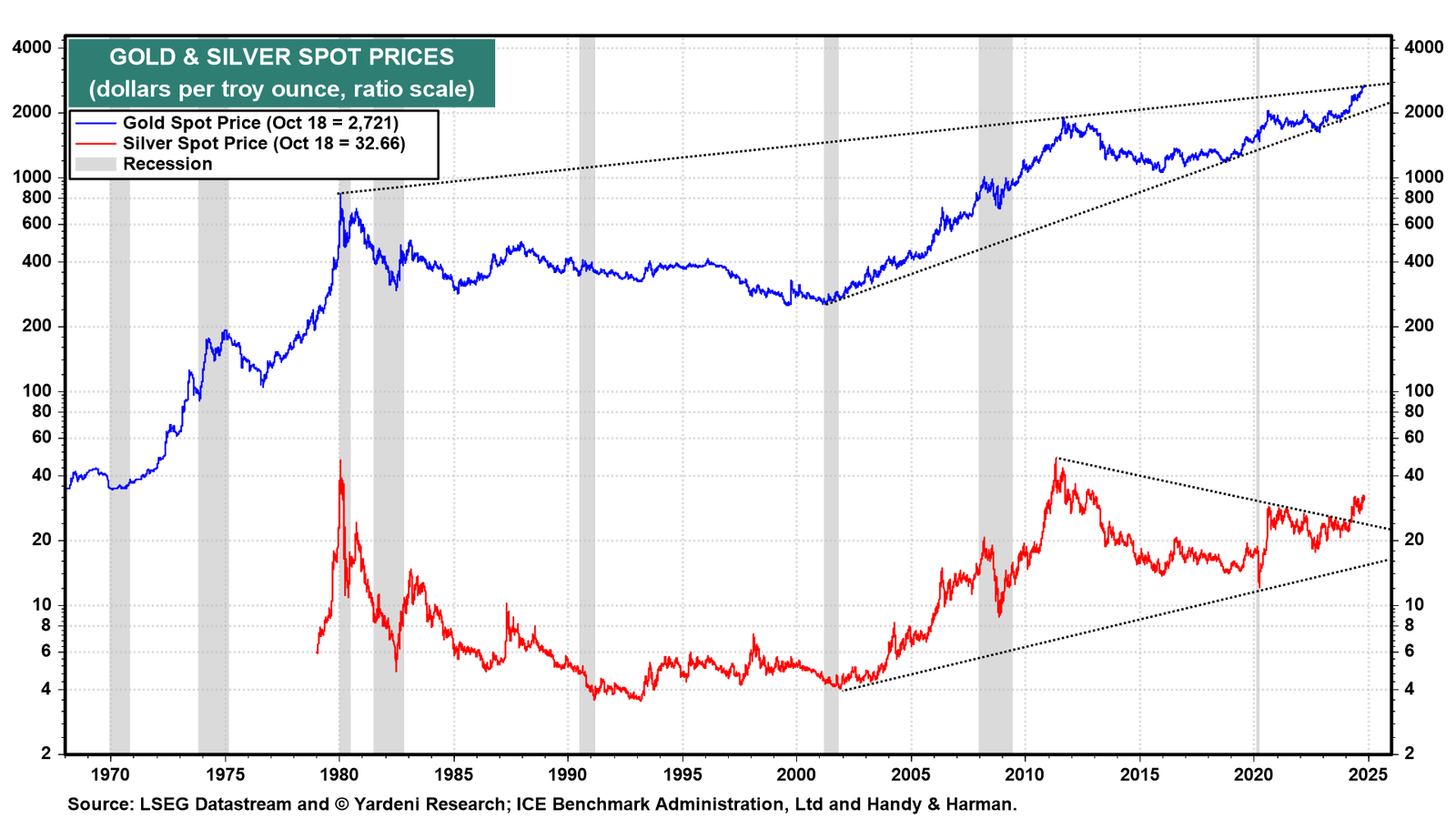

We were alluding to rising geopolitical risks as a good reason for being bullish on and . We noted that the prices of both gold and silver were breaking out to the upside (chart).

Gold is traditionally viewed as a hedge against , yet it has rallied to new highs as inflation has moderated. Perhaps, gold is now a hedge against US economic sanctions. After Russia invaded Ukraine in February 2022, Russia’s foreign exchange reserves held by the US and its allies were frozen.

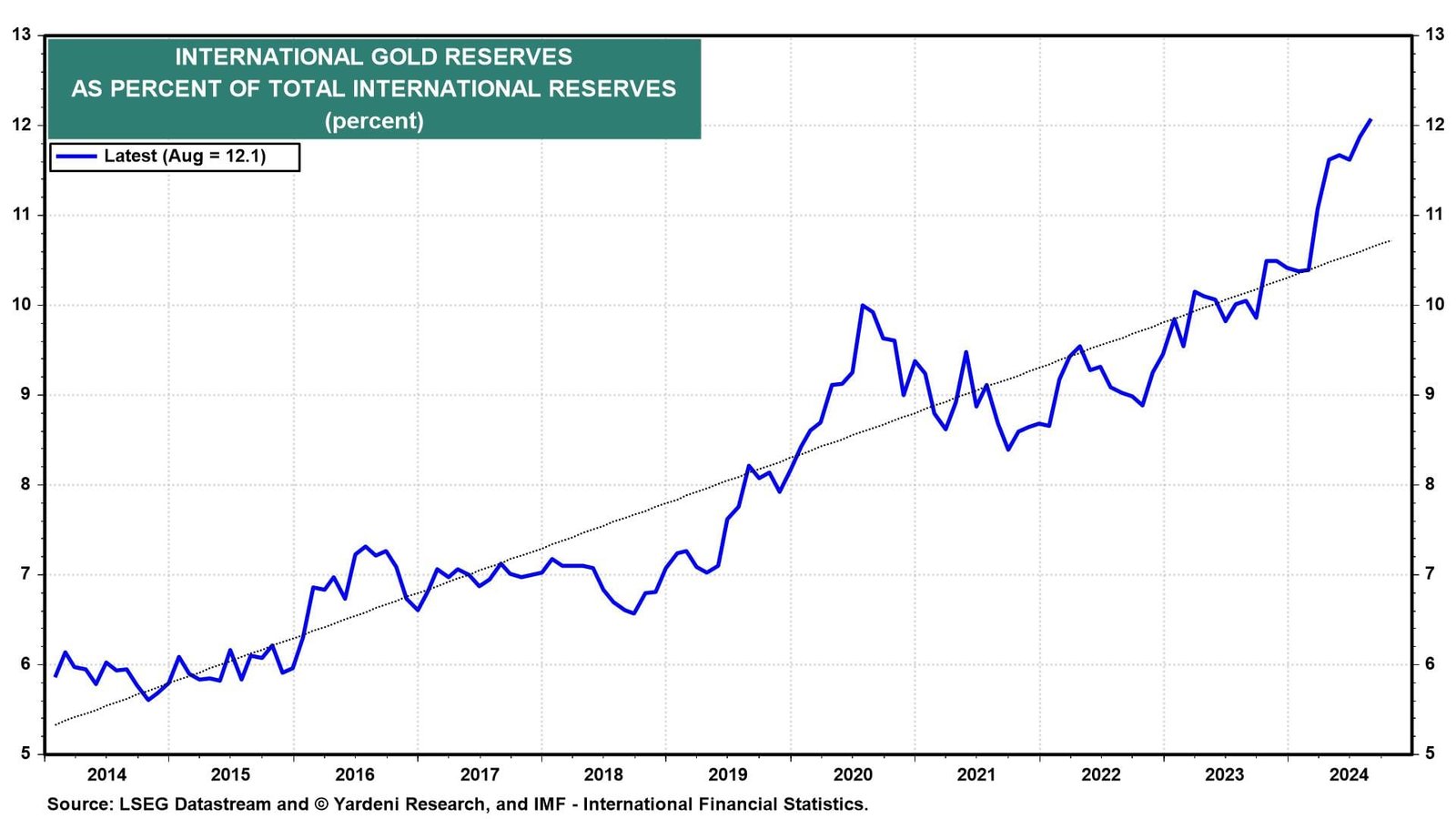

Since then, some officials and commentators have proposed seizing those assets, which amount to nearly $300 billion, and using the proceeds to defend and rebuild Ukraine. Not surprisingly, China and other countries have been increasing their allocations of gold in their countries’ international reserves (chart).