(Bloomberg) — The county of Lancashire is eyeing a return to the municipal bond market in what would be the UK’s first local authority deal in four years.

Most Read from Bloomberg

Officials in north-west England are preparing to refinance a £350 million ($452 million) floating-rate note maturing in March 2025, according to Mike Jensen, chief investment officer at Lancashire County Council. While they may still opt for financing from a government facility, which most councils prefer, the aim is to secure better rates in the bond market.

Any deal would provide a boost to a moribund market for UK council bonds, with Lancashire the last to issue in 2020. Since then, two prospective deals have been scrapped and a series of local authorities have fallen into financial distress.

Lancashire is not one of them, and Jensen believes these cases have shown investors that support measures are in place to protect creditors.

“Bad news has actually become good news for the remainder of the sector because it does prove that there is a solution pathway that doesn’t involve insolvency,” Jensen said in an interview, noting that no councils have defaulted. “Any local authority debt has a super-senior claim on the budget. We have to pay debt before we pay salaries, social care, children’s care.”

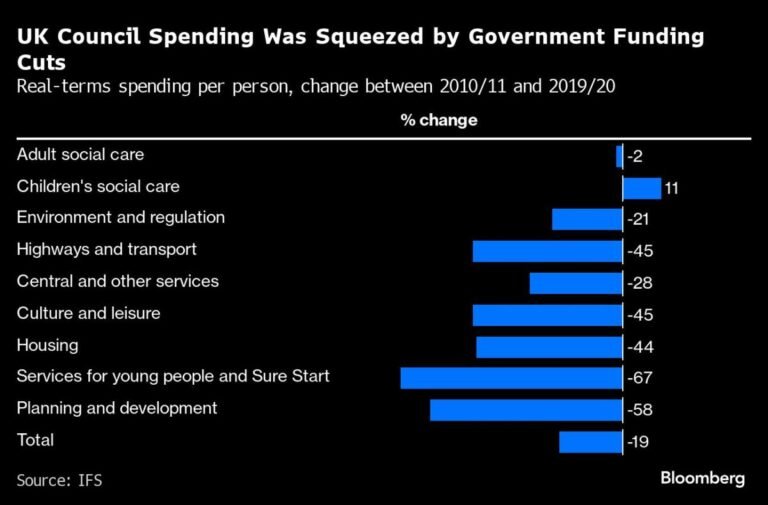

Council finances have been squeezed by real-term cuts in funding from central government since 2010, as well as by high inflation and soaring demand for services such as social care. Local authorities, which provide a range of frontline services from bin collections to libraries, have said huge shortfalls in budgets could trigger more distress.

Lancashire is working with the UK Municipal Bonds Agency, which ran its previous sales for the 2025 note as well as a 2060 bond. Banks have not yet been hired to run a sale, Jensen said, though updated credit ratings have been secured. S&P Global Ratings views Lancashire as an AA- credit while Fitch Ratings gave it A+.

Jensen is planning an investor roadshow to help confirm Lancashire can get a better rate than the government’s Public Works Loan Board facility. The rate at which local authorities borrow from the PWLB is normally set at 80 basis points above the UK’s gilts, where five-year yields are currently around 3.7%.

“We’ve proved the case twice,” said Jensen, a former banker for the likes of Morgan Stanley and Bank of America Corp. “We now need to prove the case again but see no reason why we shouldn’t be able to.”

The maturity is likely to be longer than the five-year note being refinanced, Jensen said. Also being considered is whether the new note will maintain a floating-rate structure or have an ESG label.

A successful deal might demonstrate the financial appeal of bond issuance to other councils. Municipal bonds were used regularly throughout the early and mid-20th century, but fell into disuse during the 1970s and 1980s as central government introduced controls over capital finance.

The UKMBA was set up to develop the market in 2014 but only issued its first two bonds in 2020, both on behalf of Lancashire. Plans for the agency to sell notes for Warrington Borough Council were dropped after banks had been mandated, with the authority recently coming under fire for risky bond investments, while a deal for North London Waste Authority also failed to materialize.

“To a certain extent it’s lack of experience and lack of understanding,” said Jensen, on why more councils had not issued bonds. Investors are now more “comfortable” on the government support process, he said.

–With assistance from Tom Rees.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.