New data from National Savings and Investments (NS&I) shared that more than £2.6million had not been claimed in the area.

Across the two counties at the end of March 2025, there were 766,243 Premium Bonds accounts with a combined value of more than £5.7billion.

Over 386,000 accounts had no activity for more than 20 years, with the value of these accounts standing at more than £25m.

In total, the number of unclaimed prizes in the two counties was 71,641, with a value of £2,662,125.

The highest unclaimed prize came to £25,000, with the winning band number listed as 504BM101136, which was drawn in April 2023.

The oldest unclaimed prize across the two counties was £25 drawn in August 1963, with the band given as 001AB421779.

How to claim an unclaimed Premium Bond

Nationally, over £100m of Premium Bonds remain unclaimed, with there being a possibility for people to trace them.

Since 2011, people have been able to choose to have prize money paid directly into their bank accounts.

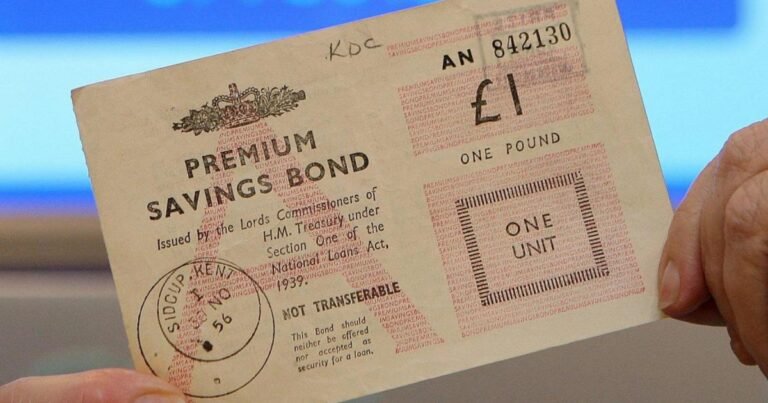

More than £100m of Premium Bonds have been left unclaimed nationally (Image: NS&I)

Before that, the bank would contact prize winners and send out cheques in the post.

This may have led to some going missing due to letters being lost in the post or people’s contact details not being updated.

Details about how to track down lost investments can be found on the NS&I website here.

Andrew Westhead, Retail Director at NS&I, said: “NS&I has successfully paid out over 99% of all Premium Bonds prizes to our winners since 1957.

“The £103m of prizes currently unclaimed represents just 0.28% of the total £37bn awarded by ERNIE [Electronic Random Number Indicator Equipment] over nearly seven decades.

Recommended reading:

“We want to reunite Premium Bonds holders with their winnings and original investment and provide information online and through our call centre on how to do this.

“We also regularly publicise details of unclaimed prizes and encourage customers to use our prize checker, register their Premium Bonds, and use our tracing service to track down mislaid Bonds.

“Opting to have Premium Bond prizes paid directly to a bank account or reinvested into more Premium Bonds reduces the chances of prizes going unclaimed, it is also quicker and easier than waiting for a cheque. Nine in 10 prizes are already paid this way.”