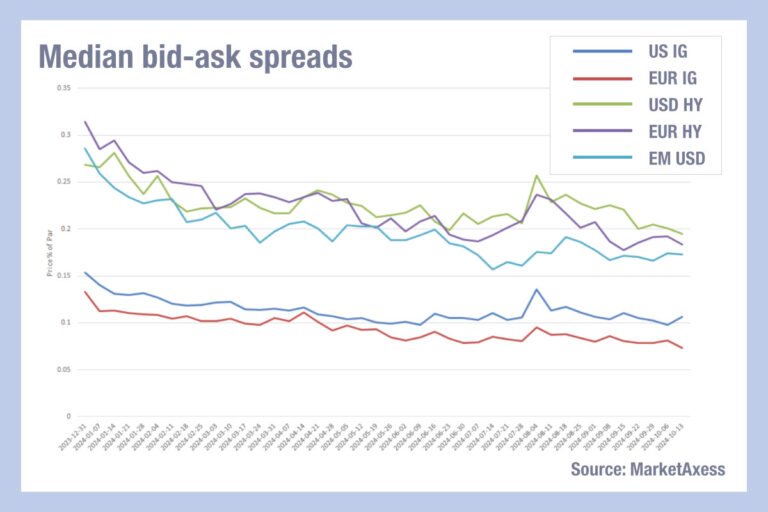

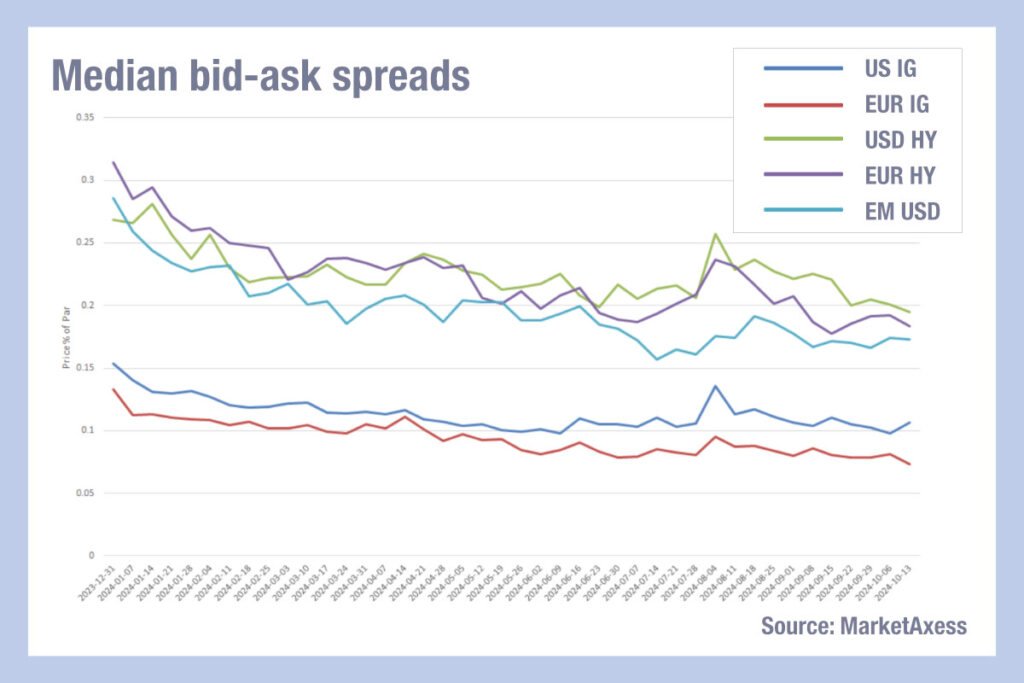

Secondary markets trading has seen a net trend towards tighter bid-ask spreads for trading across all corporate bond segments in US, Europe and emerging markets, according to data from MarketAxess’s CP+ pricing tool.

This is net positive for buy-side traders, as the bid-ask spread is a proxy for trading costs. For some dealers this is less positive, suggesting their margins are being squeezed, and potentially a factor in their recently reported revenue decline.

What is most curious is the consistent nature of the tightening spreads, with big declines January to June, a spike – some smaller and some larger – then less consistent falls since the summer, across debt markets. While competition and an increase in holdings are both factors, these are not typically consistent across all markets simultaneously.

Looking at the data in more detail, European investment grade (IG) has the lowest average cost to trade, with bid-ask spreads in single digit costs, a measure US IG spreads are still finding It hard to break.

Emerging market dollar-denominated bonds have cut the bid-ask spread nearly in half since the start of 2024. High yield (HY) spreads have not dropped so consistently or far.

New issuance has been less linear and so the cost of secondary market liquidity does not appear to tie closely to primary activity. The combination of electronic trading and indexation is a likely catalyst for this change. The level of activity in the markets reflecting greater competition and therefore competitive pressure on spreads, but also more efficient trading and risk position management.

There is correlation between the volume of market activity and levels of price pressure, although it is not an exact correlation.

On the sell-side, getting the best possible inputs into price formation will clearly be a major input into competitive pricing, as will the speed of pricing and risk managing positions.

For buy-side desks there are clearly tight spreads out there if the right counterparty can be found for a trade. While good data is the input, using the right interface to take pre-trade data into It would appear to be a buyers’ market right now, with greater competition across market makers and markets.