Fitch Rates Vermont HFA’s $16.91MM Multiple Purpose Bonds 2024 Ser E-2 ‘AA+’; Outlook Stable

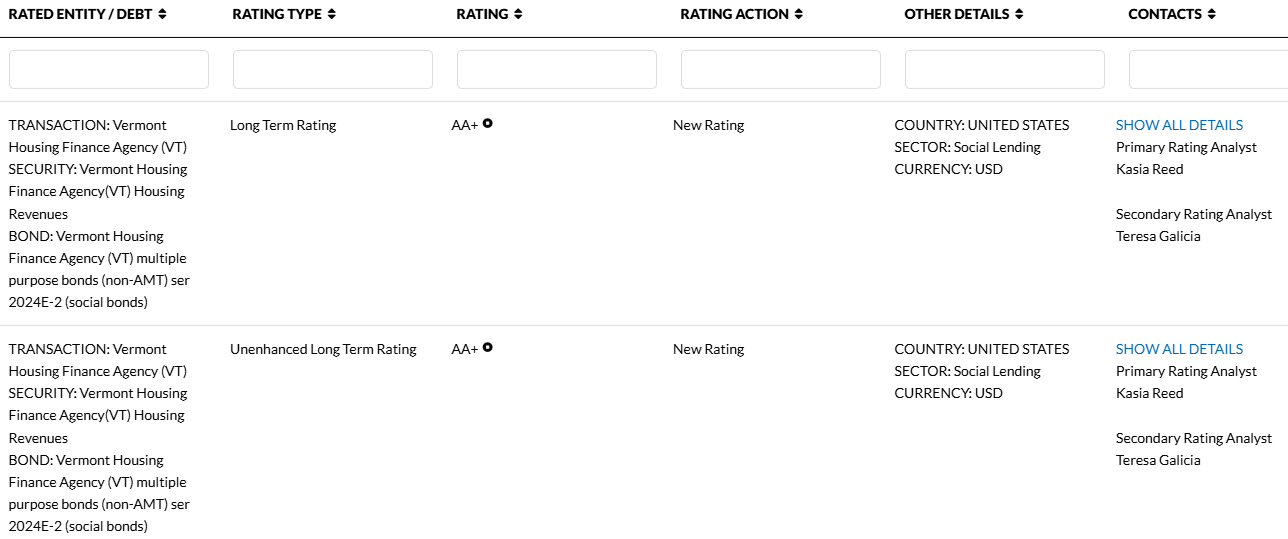

Vermont Business Magazine Fitch Ratings has assigned a ‘AA+’ rating to the following Vermont Housing Finance Agency (VHFA) multiple purpose bonds: $16.91 million 2024 series E-2 (Non-AMT) (Social Bonds).

The Rating Outlook is Stable.

The ‘AA+’ rating reflects the continued strengthening of the program’s asset quality, as indicated in the growing percentage of the mortgage-backed securities (MBS) portion of the portfolio; the program’s continued financial strength demonstrated by the FY23 results and cash flow asset parity levels; and the low percentage (2%) of variable rate debt exposure.

VHFA expects to finance single-family new issuance through the purchase of MBS going forward, which will lead to a continued increase in the portfolio’s MBS composition compared with the single-family whole loan portfolio. A portion of the bond proceeds will finance one short-term construction note. There is sufficient overcollateralization in the indenture to support the construction risk.

SECURITY

The bonds are general obligations of VHFA and are secured by: single-family whole loans; multifamily loans; MBS guaranteed by Government National Mortgage Association (Ginnie Mae), Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac); and certain cash and investments held under the resolution. The multiple purpose bond program rating does not rely on the general obligation pledge to maintain the ‘AA+’ rating currently assigned to the bonds.

KEY RATING DRIVERS

Asset Quality ‘Strong’: The rating reflects the continued strengthening of the asset quality of the loan portfolio, with the increase in the MBS portion of the portfolio to 81% as of March 31, 2024 compared with 75% as of FY23, 26% as of FY15 and 0% at program inception in July 2007. VHFA’s current single-family new origination program consists solely of the purchase of MBS, which will continue to increase the MBS compared with single family whole loan percentage of the portfolio following the 2024 series C, D, and E-1 and E-2 new issuance.

For the MBS portion of the portfolio, Ginnie Mae, Freddie Mac and Fannie Mae guarantee the full and timely payment of principal and interest on the respective MBS regardless of actual performance of the underlying loans. As government sponsored entities (GSEs), the ratings of Ginnie Mae, Fannie Mae and Freddie Mac are currently linked to the U.S. sovereign rating (AA+/Stable).

With the increase in the MBS portion of the portfolio, the single-family whole loan portfolio has correspondingly decreased and comprised 13% of the portfolio as of March 31, 2024, a decline from 17.5% as of FY23. The insurance breakdown of the single-family whole loans is: 85% uninsured (with a loan-to-value of 80% or lower), 13% Rural Development guaranteed, and 2% insured by Mortgage Guaranty Insurance Corporation. The multifamily loans, which were 33% of the portfolio at program inception, have decreased to 6% of the portfolio.

Both the single-family whole loans and multifamily loans have exhibited strong performance, mitigating the potential for losses to the program. As of March 31, 2024, the single-family whole loan delinquency rate was 4.3% (60+ days by loan count), a decline from 5.0% as of June 30, 2023, and also below the June 30, 2020 rate of 6.9%. There are currently no loans in forbearance and no multifamily delinquent loans. Actual loan losses for this program have been minimal over time, approximately $6.9 million in aggregate since program inception in 2007.

Cash Flow Asset Parity ‘Strong’: The rating also reflects the program’s continued high levels of cash flow asset parity. After incorporating Fitch stress assumptions, which include interest rate stresses, prepayment stresses, increased fees upon liquidity renewal, and loan loss assumptions, the program maintains a cash flow asset parity position above approximately 123% for the life of the bonds.

This does not account for the construction risk during the two-year construction note term. When considering the construction note risk as 100% of the loan’s principal amount less reserve set-asides, the parity is approximately 118% during the two-year construction note period and then increases to above 123% for the duration of the cash flows.

This level of overcollateralization is sufficient to support the ‘AA+’ rating on the program given the current composition of the portfolio. The stressed overcollateralization calculation excludes approximately $7 million of non-amortizing, non-interest-bearing multifamily loans, as repayments of such loans may not be available for the repayment of the bonds.

Financial Resources and Program Structure ‘Strong’: The program remains financially strong as illustrated in recent financial performance. As of FY23, the program’s financial asset parity decreased to 125% from 130% in FY22, still in line with the five-year average asset parity of 126% and sufficient to support the rating. The program demonstrated a positive net operating revenue of $3.7 million in FY23. The overall decline in net assets in FY23 reflected a $7 million change in the fair value of investments as well as a net transfer of $2 million.

The program’s profitability, as measured by the net interest spread and net operating revenues as a percentage of total revenues, both remained strong in FY23, and stable from the prior year levels. The supplemental indentures’ provisions restrict the release of excess funds, allowing for program funds to be withdrawn to 102% asset parity. Historically, management has not withdrawn substantial amounts from the Indenture’s surplus funds and has maintained high asset parity ratios in the Indenture.

Asymmetric Risk ‘Neutral’: The multiple purpose bond program is neutral to any asymmetric risks that would constrain the rating.

RATING SENSITIVITIES

Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

–Weakening asset quality, with significant increases to the uninsured multifamily, construction notes, or whole loan portion of the portfolio, which could cause higher delinquencies and loan losses to the program;

–Negative financial performance or loan performance that leads to declines in program retained earnings;

–Withdrawal of program funds resulting in a stressed cash flow asset parity ratio (including construction loan risk) that falls below 102%.

Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

–Should the program transition to a primarily MBS portfolio, a positive rating action on the U.S sovereign rating could positively affect the rating on the bonds.

CREDIT PROFILE

VHFA’s goals include ensuring that all Vermont residents have access to affordable homeownership and affordable rental housing; keeping people in safe and healthy homes; and building livable and sustainable communities. The multiple purpose bond indenture was adopted in July 2007 for the purpose of financing mortgage loans on single-family residential housing units and multifamily residential units for persons and families of low and moderate income in Vermont. As of March 31, 2024, there was $261.27 million in outstanding parity debt under the multiple purpose bond indenture.

As of March 31, 2024, the $290.4 million loan portfolio consisted of: 81% MBS certificates, 13% single-family whole loans, and 6% multifamily loans. An additional $42.5 million was held in reserve accounts in high credit quality investments. Following the 2024 Series C-E issuance, not accounting for the two-year construction note, the MBS portion of the portfolio will increase to approximately 82%, the single-family whole loans will decrease to 11% of the portfolio and the multifamily loans will increase slightly to 7% of the portfolio. Fitch’s ongoing credit analysis will be driven by the indenture’s portfolio composition and performance, asset parity position, financial results, and cash flow strength.

The 2024 series E-2 bond proceeds, along with the 2024 series C, D, and E-1 bond proceeds, will be used to: (i) finance single family loans through the purchase of MBS; (ii) finance one permanent multifamily loan; (iii) finance one construction note; and (ii) fund the reserve fund (sized at one year of interest on the construction loan), revenue fund, and cost of issuance amounts. The 2024 series C, D, and E-1 and E-2 bonds are on parity with the outstanding multiple purpose bonds.

VHFA is designating the 2024 series C and E-1 and E-2 Non-AMT bonds as Social Bonds based on the intended use of proceeds to finance the purchase or improvement of single-family housing and new multifamily mortgage loans related to affordable rental housing developments in the state.

DATE OF RELEVANT COMMITTEE

13 June 2024

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG CONSIDERATIONS

VHFA’s multiple purpose bonds have an ESG Relevance Score of ‘4’ [+] for Customer Welfare – Fair Messaging, Privacy & Data Security due to it being an HFA program focused on customer welfare and fair messaging, which contributes to reduced expected losses in the rating analysis. The focus on customer welfare includes fair lending practices, homebuyer education and counselling, and loss mitigation strategies that, when combined, strengthen the program loan performance. This has a positive impact on the credit profile, and is relevant to the rating in conjunction with other factors.

VHFA’s multiple purpose bonds have an ESG Relevance Score of ‘4’ [+] for Human Rights, Community Relations, Access & Affordability due to the GSE guarantee that addresses access and affordability while driving strong performance, which has a positive impact on the credit profile, and is relevant to the rating in conjunction with other factors.

The highest level of ESG credit relevance is a score of ‘3’, unless otherwise disclosed in this section. A score of ‘3’ means ESG issues are credit-neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch’s ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision. For more information on Fitch’s ESG Relevance Scores, visit https://www.fitchratings.com/topics/esg/products#esg-relevance-scores.

Additional information is available on www.fitchratings.com

PARTICIPATION STATUS

The rated entity (and/or its agents) or, in the case of structured finance, one or more of the transaction parties participated in the rating process except that the following issuer(s), if any, did not participate in the rating process, or provide additional information, beyond the issuer’s available public disclosure.

APPLICABLE CRITERIA

APPLICABLE MODELS

Numbers in parentheses accompanying applicable model(s) contain hyperlinks to criteria providing description of model(s).

ADDITIONAL DISCLOSURES

ENDORSEMENT STATUS

Vermont Housing Finance Agency (VT)

EU Endorsed, UK Endorsed

DISCLAIMER & DISCLOSURES

All Fitch Ratings (Fitch) credit ratings are subject to certain limitations and disclaimers. Please read these limitations and disclaimers by following this link: https://www.fitchratings.com/understandingcreditratings. In addition, the following https://www.fitchratings.com/rating-definitions-document details Fitch’s rating definitions for each rating s

SOLICITATION STATUS

The ratings above were solicited and assigned or maintained by Fitch at the request of the rated entity/issuer or a related third party. Any exceptions follow below.

ENDORSEMENT POLICY

Fitch’s international credit ratings produced outside the EU or the UK, as the case may be, are endorsed for use by regulated entities within the EU or the UK, respectively, for regulatory purposes, pursuant to the terms of the EU CRA Regulation or the UK Credit Rating Agencies (Amendment etc.) (EU Exit) Regulations 2019, as the case may be. Fitch’s approach to endorsement in the EU and the UK can be found on Fitch’s Regulatory Affairs page on Fitch’s website. The endorsement status of international credit ratings is provided within the entity summary page for each rated entity and in the transaction detail pages for structured finance transactions on the Fitch website. These disclosures are updated on a daily basis.

Source: Fitch Ratings – New York – 23 July 2024: