Zero Evidence of Recession in The Data. Bonds Not Happy

It’s a surprisingly straightforward morning for the bond market. The two most important economic reports did exactly the opposite of what bond bulls wanted. The biggest shock was obviously the 1.0 vs 0.3 result in Retail Sales. Even though this was substantially driven by a bounce back in auto sales, the remaining improvement was broad-based.

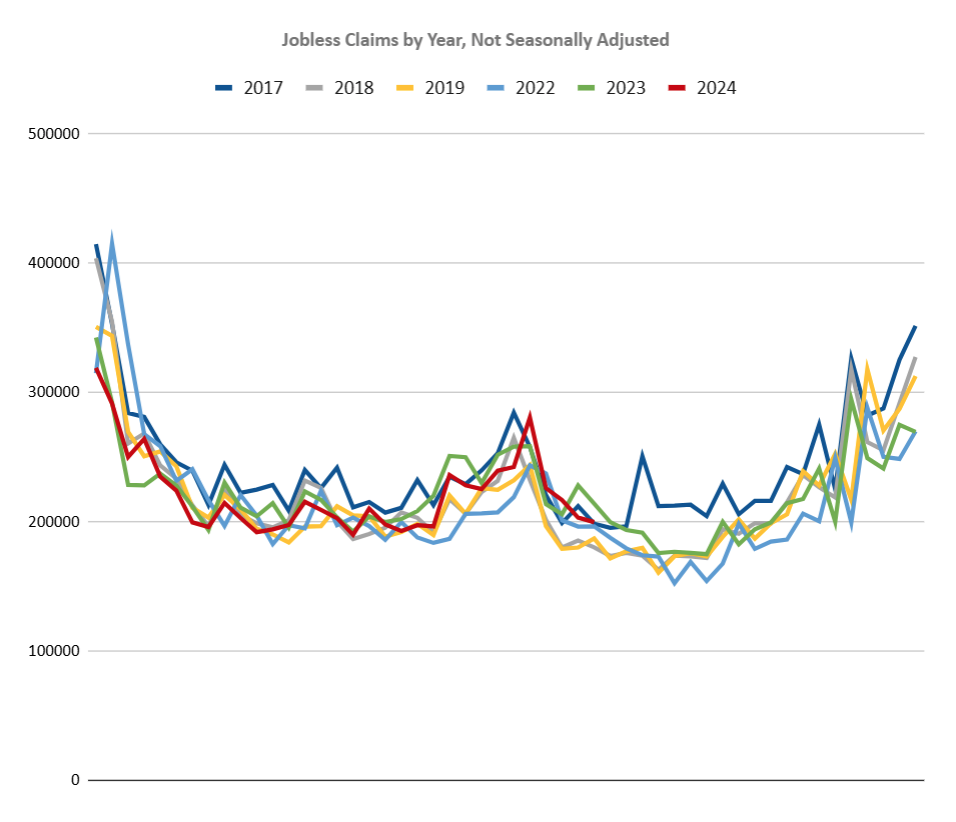

The other data was not as attention-grabbing, but arguably just as important to investors who’ve been on the edge of their seat waiting for more labor market evidence after the last jobs report. Weekly jobless claims continue coming in lower than the same week in 2023 for the 2nd straight week now. Moreover, the unadjusted trend is well in line with recent years (i.e. nothing dramatic happening in the labor market yet = no case for a 50bp rate cut).

Yields are sharply higher as a result.