9h05 ▪

3

min read ▪ by

The world of Bitcoin ETFs is going through a difficult phase after the recent crypto market crash. The post-crash plunge triggered a wave of massive fund outflows, denting investor confidence. While the situation seems concerning, there is a glimmer of hope with new inflows into Bitcoin ETFs that could reverse the trend. But what is really going on in the minds of investors amidst this turbulence? An analysis of the latest fund movements reveals interesting signs to watch.

Bitcoin: Falls and Fund Reactions

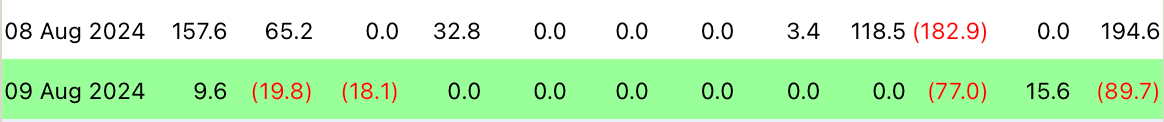

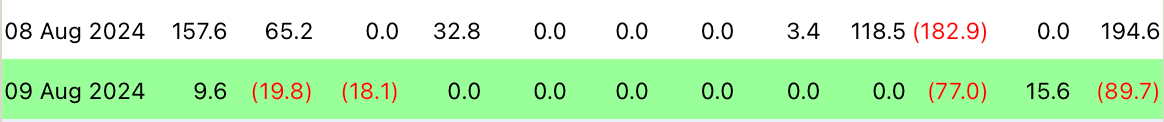

A few days ago, Bitcoin ETFs made a strong comeback that crushed Ethereum. Just a mirage? Because the same trackers recorded colossal net outflows of $89.7 million on August 9 in the United States, after attracting $194 million the previous day.

Farside reports that Grayscale’s GBTC fund was the hardest hit with outflows of $77 million, followed by Fidelity’s FBTC and Bitwise’s BITB.

However, there is a glimmer of hope with $9.6 million flowing into BlackRock’s Bitcoin fund (IBIT) and $15.6 million into Hashdex’s DEFI fund.

Despite this, BlackRock’s IBIT, the largest Bitcoin ETF by net value, recorded no flows the previous day. Ethereum ETFs also suffered outflows totaling $15.8 million, although BlackRock’s ETHA fund recorded an inflow of $19.6 million.

Crypto: Ethereum ETFs Make a Strong Comeback

The performance of Ethereum ETFs is more resilient compared to Bitcoin funds. After the “black Monday” of August 5, the day Bitcoin plunged below $50,000, Bitcoin ETFs saw outflows of $148.5 million.

But the next day, Ethereum ETFs experienced positive inflows, reaching $98.4 million.

BlackRock’s ETHA fund led the charge with an inflow of $109.9 million, and other funds like Fidelity’s FETH and Grayscale’s ETH also benefited from new entries.

This contrast highlights the growing robustness of Ethereum ETFs, despite increased Ether price volatility. Expectations are optimistic for a possible surge in Ether prices if the current trend continues. Although some analysts predict a slower rise than expected for the prince of cryptos.

Meanwhile, the approval of the first Solana ETF in Brazil marks a turning point in the acceleration of crypto trackers. Good news for investors, after a tumultuous period.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.