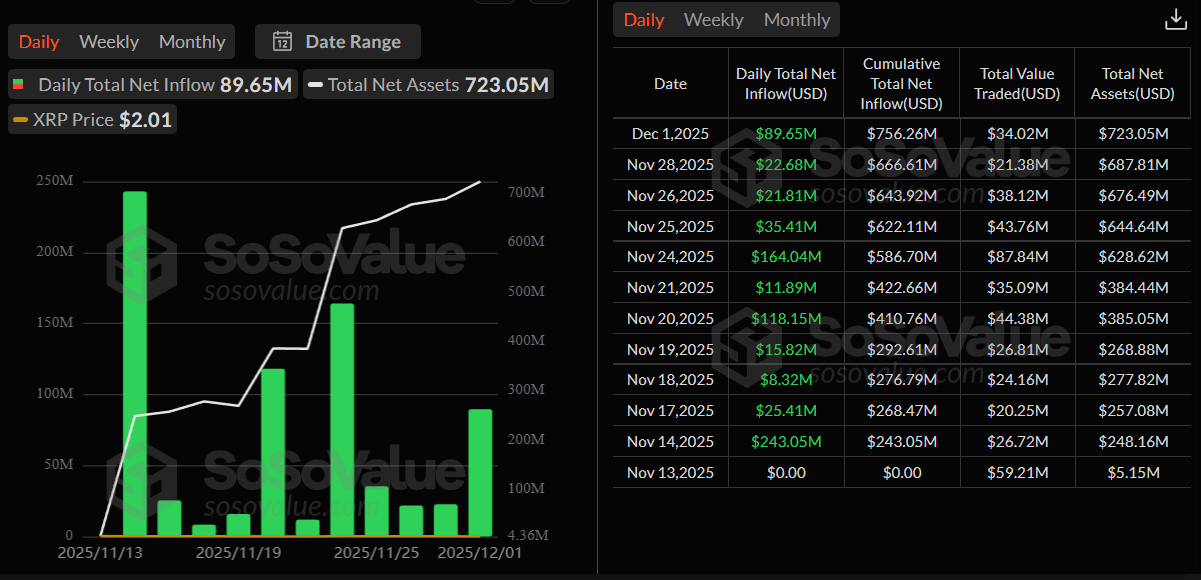

XRP spot ETFs have recorded inflows for 11 consecutive trading days, pushing cumulative inflows to $756.26 million as of December 1, according to SoSoValue data.

The products added another $89.65 million on Monday alone, marking one of their strongest sessions since launch.

Sponsored

Sponsored

Strong Momentum Across All Issuers

The latest inflows lifted total net assets across the four US funds to $723.05 million, equal to 0.60% of XRP’s market capitalization.

The trend places the category within reach of the $1 billion asset milestone, a level analysts view as a key threshold for long-term institutional adoption.

All four XRP ETFs—Canary, Bitwise, Grayscale, and Franklin Templeton—finished the day in positive territory. Their market prices rose between 8.30% and 8.54%, reflecting a broad rebound in XRP after last week’s decline.

Monday’s inflow was led by Franklin’s XRPZ, followed by Grayscale. The consistent demand has also pushed cumulative inflows sharply higher.

Sponsored

Sponsored

Over the past two weeks, the category saw multiple high-volume days, including $243.05 million on November 14 and $164.04 million on November 24.

XRP price also reflected the positive ETF performance. The altcoin rallied nearly 9% today, after dropping to $2 earlier in the week.

$1 Billion Is Now in Sight

At the current pace, analysts expect XRP ETFs to cross $1 billion in assets within days. The category added more than $500 million in the past week alone, reflecting accelerating participation from large buyers.

If inflows remain positive this week, XRP would become one of the fastest-growing altcoin ETF markets launched in 2025. The surge also signals expanding demand for non-Bitcoin digital asset products under the new regulatory framework.

The run of 11 consecutive green days highlights rising appetite for XRP exposures through ETFs. With cumulative inflows nearing the $1 billion level and net assets climbing steadily, the products have quickly become a significant part of XRP’s market structure.

However, continued momentum will depend on broader market conditions and how institutional investors respond to price volatility in the weeks ahead.