TLDR

- GXRP led all XRP ETFs with $7.86 million in daily net inflow and 3.68 million XRP tokens.

- XRCP followed with $2.73 million inflow and now holds the highest total net assets among the products.

- XRP (Bitwise) recorded a $2.39 million daily inflow and closed at $23.92, gaining 3.37%.

- XRZP and TOXR saw no new inflows but registered daily price increases of 3.34% and 3.20%, respectively.

- Combined daily trading volume reached $30.90 million, with all ETFs showing price gains between 3.20% and 3.37%.

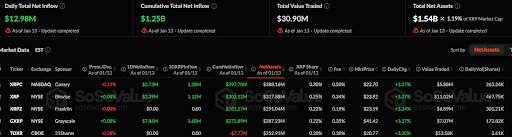

As of January 13, the daily total net inflow for XRP ETFs reached $12.98 million. According to SoSoValue, the cumulative total net inflow now stands at $1.25 billion. Meanwhile, total net assets across all listed products reached $1.54 billion, representing 1.19% of XRP’s market capitalization.

GXRP, XRCP, and XRP ETFs All Record Daily Inflows

A deep look at the performance of individual XRP ETFs, the highest 1-day net inflow was recorded by the GXRP product listed on the NYSE, with $7.86 million. GXRP also showed the highest daily XRP inflow, contributing 3.68 million tokens. Its cumulative net inflow stood at $272.89 million, with total net assets valued at $287.23 million.

The XRCP product on NASDAQ, sponsored by Canary, recorded $2.73 million in 1-day net inflow and 1.28 million XRP tokens. XRCP maintains the highest cumulative inflow at $397.70 million and leads in total net assets with $388.16 million. Its price changed by +3.37%, reaching $22.70 per unit.

XRP, issued on the NYSE and sponsored by Bitwise, saw $2.39 million in daily net inflow and 1.12 million XRP inflow. It holds $302.12 million in cumulative net inflows and $317.88 million in net assets. The token closed at $23.92 with a daily gain of 3.37%.

XRZP and TOXR XRP ETFs Record No Inflows but See Price Gains

XRZP, backed by Franklin, had no inflows recorded on January 13 and holds a cumulative net inflow of $281.27 million. Its net assets are reported at $291.04 million with a unit price of $23.19. XRZP still experienced a price increase of 3.34% on the day.

TOXR, sponsored by 21Shares and listed on CBOE, had a stable performance with no daily inflow or outflow and a cumulative net outflow of -$7.77 million. It holds net assets of $252.91 million, with the lowest volume traded and daily share volume of 2.61K. Its unit price rose 3.20%, reaching $20.77.

Across the board, all products experienced a daily price increase ranging from 3.20% to 3.37%. Combined trading volume on January 13 was $30.90 million, with XRZP and XRP leading in traded volume. The XRP Share across products ranged from 0.20% to 0.30% based on net assets.