These might be the only ETFs you’ll ever need.

Investing in individual stocks can be a fun, rewarding experience. But if you want your money to grow as much as possible over your lifetime, you’re probably better off sticking with exchange-traded funds (ETFs). After all, the vast majority of professional traders fail to beat the market over the long term. The two ETFs below have a strong track record, and can be held for decades to come.

This could become the best-performing ETF of all time

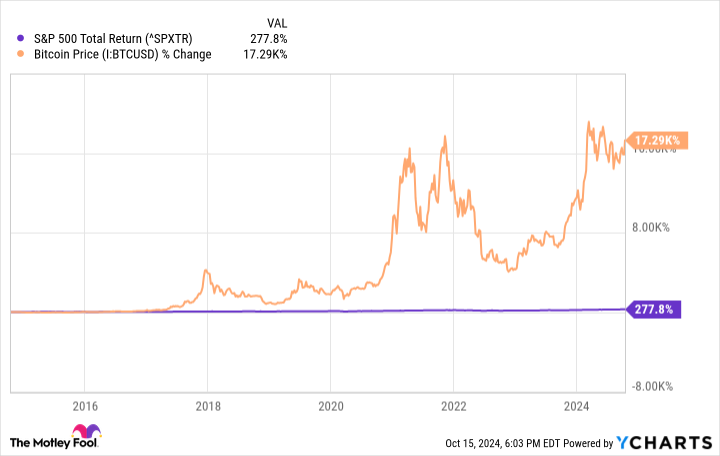

Few investments have performed as well as Bitcoin (BTC 0.22%) has since its creation in 2009. At the start, a single Bitcoin could be purchased for pennies. Today, a single Bitcoin fetches more than $60,000. Over the past decade alone, Bitcoin’s price has beaten the S&P 500 by more than 17,000%.

Of course, Bitcoin’s growth in the future may not be as impressive as in the past. But there’s a good chance that the crypto takeover is still in the early innings. Even just as a store of value, Bitcoin has a lot of room to run. The total market cap of Bitcoin, for instance, is currently around $1.3 trillion. Gold, meanwhile, has a total market cap of roughly $18 trillion. So even just to match gold’s position as a store of value — a reasonable long-term expectation — Bitcoin would potentially have 1,800% in additional upside. And that’s not even including any utility value from its place in the wider crypto universe.

Buying Bitcoin directly can be difficult from a custodial and tax perspective. The iShares Bitcoin Trust ETF (IBIT 2.68%) removes this complexity, allowing you to gain exposure to Bitcoin’s price movements through a simple ETF tradable using basically any brokerage account. The ETF’s expense ratio is reasonable at 0.12%. And its simplicity allows you to dollar-cost average over time. So you can start with as little as $100, gradually adding to your position over time. If Bitcoin’s future is anywhere close to as exciting as its past, ETFs like this could top the charts of history’s best-performing investment vehicles.

If you can’t beat ’em, join ’em

Investing in Bitcoin ETFs is a great way to create significant upside to your portfolio. But don’t forget about the most classic wealth generator of all time: the Vanguard S&P 500 ETF (VOO 0.39%).

According to research, most professional money managers fail to beat the market over any given year. The longer the holding period, the fewer professionals are able to keep up with market indexes like the S&P 500. Over the past 20 years, for example, less than 10% of actively managed funds beat the market.

By buying Vanguard’s S&P 500 ETF and holding for the long term, you’ll instantly become one of the best-performing investors in the industry, as your turnover will be far lower than active traders. You’ll likely have a lower tax bill, too, considering the tax structure for ETFs.

So while branching out into exciting categories like Bitcoin ETFs can give your portfolio a long-term edge, don’t neglect to invest the majority of your portfolio in one of the most time proven investments of all time: a low-cost ETF that tracks a major market index like Vanguard’s S&P 500 ETF. You can start with as little as $100, dollar-cost averaging your way into a sizable fortune over time.

But whether you invest solely in a Bitcoin ETF or a market index ETF — or perhaps simply split your savings evenly between the two — don’t forget to turn on automatic investments. This way, your brokerage account can automatically invest $50, $100, or $200 into these ETFs every month without you needing to lift a finger. Because apart from choosing the right ETFs, the most important thing you can do for your financial future is to establish a regular investing schedule that puts your money to work.

Ryan Vanzo has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.