A rate cut could set the stage for a rally in small and mid-cap stocks later this year.

Wall Street is laser-focused on the Federal Reserve’s next move. Recent comments from top Fed officials suggest rate cuts could be coming sooner rather than later.

This shift in monetary policy could light a fire under small and mid-cap stocks. These market segments tend to thrive when borrowing costs drop.

For investors looking to capitalize on this potential trend, two Vanguard exchange-traded funds (ETFs) stand out. These funds offer broad exposure to the small and mid-cap universe at rock-bottom prices.

Image Source: Getty Images.

Here’s a breakdown of why these Vanguard ETFs could be primed for strong growth in a falling interest rate environment.

Vanguard Mid-Cap Index Fund ETF Shares

The Vanguard Mid-Cap Index Fund ETF Shares (VO -0.51%) is a powerhouse in the mid-cap space. It tracks the CRSP US Mid Cap Index, which measures the performance of U.S. companies that fall in the top 70th to 85th percentile of market capitalization. The index includes stocks traded on every major exchange.

Mid-cap stocks often deliver the best of both worlds. They offer more growth potential than most mature blue chips (except red-hot tech companies), but with less volatility than their small-cap counterparts.

This fund’s diverse portfolio spans key sectors like tech, healthcare, and industrials. It’s a one-stop shop for mid-cap exposure. And with an ultra-low expense ratio of 0.04%, this ETF is a cost-efficient way to play the mid-cap space. More of your money stays invested, potentially supercharging long-term returns.

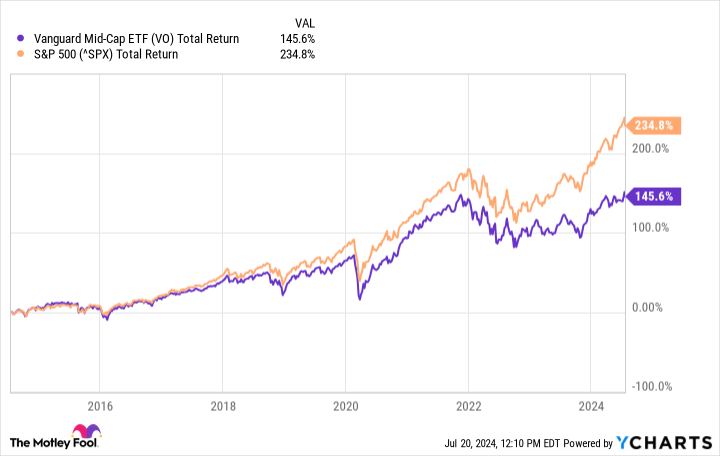

The fund has delivered a healthy 9.1% average annual return over the past 10 years. While it trailed the S&P 500 over this period, it’s still an impressive showing for a mid-cap stock fund.

VO Total Return Level data by YCharts

The Vanguard Mid-Cap Index Fund ETF Shares also offers a respectable income opportunity with a current SEC yield of 1.56%. For context, the S&P 500 sports an average yield of 1.32%. Equally as important, this Vanguard fund has a relatively lower turnover ratio of 12.1% over the prior 12 months. A low turnover rate can help lower your tax bill.

Vanguard Small-Cap Index Fund ETF Shares

For investors with a higher risk tolerance, the Vanguard Small-Cap Index Fund ETF Shares (VB -0.40%) offers a ticket to the small-cap landscape. This fund tracks the CRSP US Small Cap Index, which measures the performance of U.S. companies that comprise the bottom second to 15th percentile of market capitalization.

Lower interest rates are typically a boon for small caps. Cheaper borrowing costs can fuel expansion and turbocharge growth for smaller firms. With over 1,403 holdings, the Vanguard Small-Cap Index Fund ETF Shares is a tour de force in terms of diversification within the small-cap space, making it an ideal vehicle to play this upcoming catalyst.

The fund’s wallet-friendly 0.05% expense ratio is also a big plus for buy-and-hold investors. In the long run, the Vanguard Small-Cap Index Fund ETF Shares’ cost efficiency can significantly boost your returns.

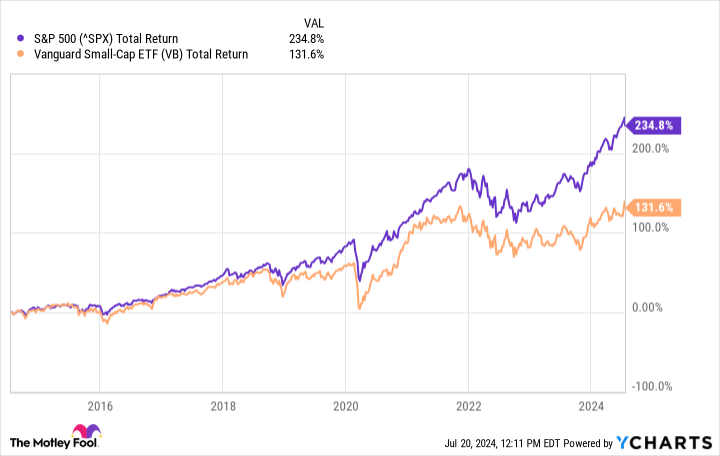

Speaking to this point, the ETF has churned out a solid 8.08% average annual return over the prior 10 years. Although it dramatically underperformed the S&P 500, it’s still an above-average showing for a small-cap stock fund.

On the income side, this Vanguard small-cap ETF sports a current SEC yield of 1.44%, which is exceptional for a fund in this market segment. It also has a 12% turnover ratio over the prior 12 months, which is among the lowest within its category.

Key takeaways

The Fed’s dovish turn could ignite a rally in small and mid-cap stocks. The Vanguard Mid-Cap Index Fund ETF Shares and Vanguard Small-Cap Index Fund ETF Shares offer investors a low-cost ticket to this potential growth party.

These ETFs provide attractive long-term growth opportunities in a changing economic landscape. However, investors should be prepared for potential short-term volatility, as smaller companies can be more sensitive to economic conditions.

George Budwell has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Mid-Cap ETF and Vanguard Index Funds-Vanguard Small-Cap ETF. The Motley Fool has a disclosure policy.