The right ETF can supercharge your savings with little effort.

Investing in exchange-traded funds (ETFs) can be a fantastic way to generate wealth with less time and effort than buying individual stocks. When you buy one share of an ETF, you’ll instantly own a stake in all of the stocks within the fund. This can make it nearly effortless to build a diversified portfolio, which can significantly reduce your risk.

Growth ETFs, specifically, can help put you on the path toward earning above-average returns. These funds include stocks with the potential for higher-than-average earnings and are designed to beat the market over time.

With the market surging at the moment, it can be a fantastic time to buy and take advantage of rising stock prices. If you’re looking to supercharge your earnings while still playing it safer with an ETF, you may want to stock up on these three funds right now.

1. Schwab U.S. Large-Cap Growth ETF

The Schwab U.S. Large-Cap Growth ETF (SCHG 0.31%) contains 231 large-cap stocks with the potential for above-average growth. Just under half of the fund is allocated to stocks in the tech sector, which carries both risk and reward.

Tech stocks can often be more volatile than stocks from more established industries but also tend to see higher average returns over time. And this ETF has a consistent history of beating the market.

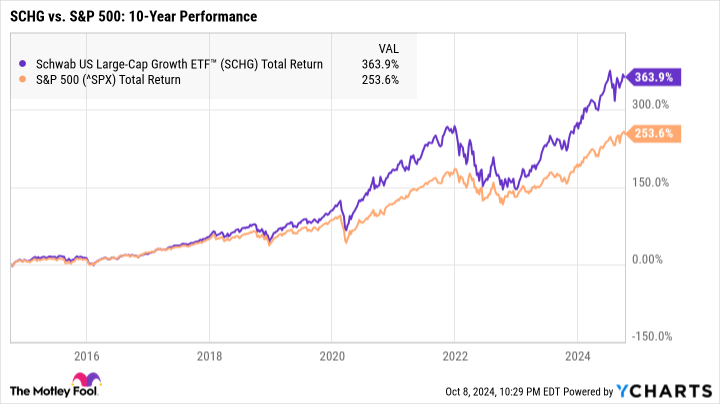

Over the past 10 years, the Schwab Growth ETF has earned an average rate of return of 16.48% per year — substantially higher than the market’s historic average of around 10% per year.

SCHG Total Return Level data by YCharts.

One other advantage of this fund is its low expense ratio of just 0.04%, so you’ll pay $4 per year in fees for every $10,000 in your account. ETFs, in general, boast lower fees than many other types of investments, which can help you save thousands of dollars over time.

2. Vanguard Mega Cap Growth ETF

The Vanguard Mega Cap Growth ETF (MGK 0.07%) is a more specific fund but still can pack a punch. This ETF contains only 71 stocks from megacap companies, which are generally defined as companies with market caps of at least $200 billion. For comparison, a large-cap stock will have a market cap of at least $10 billion.

If you’re looking for an ETF that allows you to invest in nothing but the biggest companies in the world, this fund may be the one for you.

In some ways, this ETF carries less risk than large-cap funds like the Schwab Growth ETF. Because megacap stocks are from industry-leading juggernaut companies, there’s less of a chance that they’ll struggle long term. If you’re worried about market volatility, investing in an ETF containing the largest of the large stocks can help mitigate some of that risk.

That said, it can sometimes be helpful to have smaller stocks in your portfolio for diversification purposes and to help maximize your earnings. Smaller companies often have more room for growth, and all it takes is one superstar performer to see massive returns. If you’re only investing in megacap stocks, you may miss some of those opportunities for more growth.

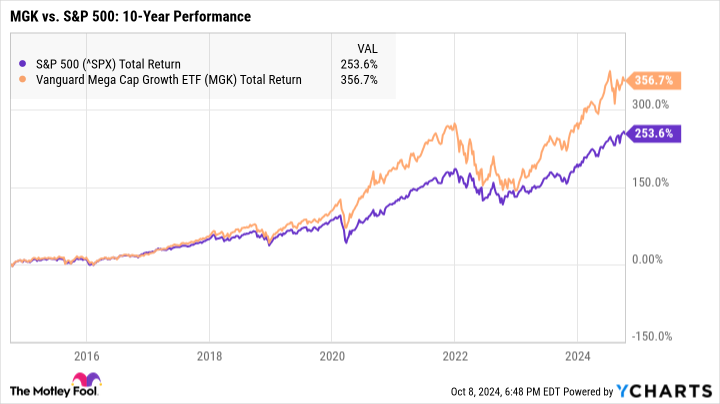

Despite only containing behemoth companies, though, this ETF is still earning substantial returns, with a 16.35% average annual return over the past 10 years.

3. Vanguard Information Technology ETF

The Vanguard Information Technology ETF (VGT 0.31%) is a tech-focused ETF with 317 stocks spanning all areas of the technology sector. Its largest holdings include Apple, Nvidia, and Microsoft, and those three stocks alone make up more than 44% of the entire fund.

If you’re looking to gain exposure to the tech sector without investing in individual stocks, this ETF could be a fantastic option. It offers a smart balance of risk and reward as it heavily focuses on massive companies yet still contains hundreds of other smaller stocks poised for significant growth.

Keep in mind, however, that any ETF focused on a single industry is going to be much riskier than a fund that contains stocks from multiple sectors. For that reason, if you decide to invest in this ETF, it’s wise to ensure you’re investing in other stocks or funds, as well, for proper diversification.

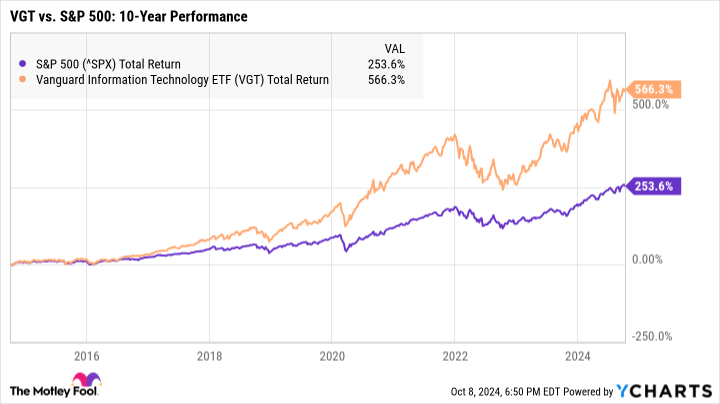

Higher levels of risk can come with higher rewards, though. Over the past 10 years, this ETF has earned an average rate of return of 20.68% per year — the highest of the three funds on this list. While returns aren’t everything and it’s important to look at the full picture before deciding to buy, this ETF’s history of higher earnings is tough to ignore.

Where you choose to invest will depend on your goals and risk tolerance, but growth ETFs can be a fantastic way to potentially earn above-average returns with less effort and greater diversification. By weighing your options and considering your priorities, it will be easier to decide on the best investment for your portfolio.

Katie Brockman has positions in Vanguard World Fund-Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.