After hiking rates at their fastest pace in four decades – and then keeping them “higher for longer” – it seems that the Federal Reserve is finally getting ready to cut interest rates, with expectations for a September rate cut gathering momentum. The central bank kept rates unchanged for the sixth consecutive meeting in June, and is widely expected to do so again this month – but the CME FedWatch Tool points to 94% odds for a much-anticipated cut in September.

With inflation trending lower amid signs that the labor market is cooling off, the case for a rate cut is becoming even stronger. That’s good news for small-cap stocks, which tend to rely more heavily on floating rate financing to fuel growth.

But that’s just one reason to like small-cap stocks right now, according to Tom Lee, the head of research at Fundstrat. “The astonishingly low June CPI, in our view, is giving the ‘green light’ for small caps to continue to rally,” said Lee. The analyst, who previously predicted that the small-cap Russell 2000 Index (RUT) would gain 50% in 2024, outlined five reasons why he expects a sustained move higher in small-cap stocks of up to 40% from here – including improving sentiment toward regional banking stocks.

As small-caps continue to lead, here are three top ETFs from the space for investors who want to gain exposure to this high-growth corner of the market, but without the relatively higher risk associated with individual stock picking.

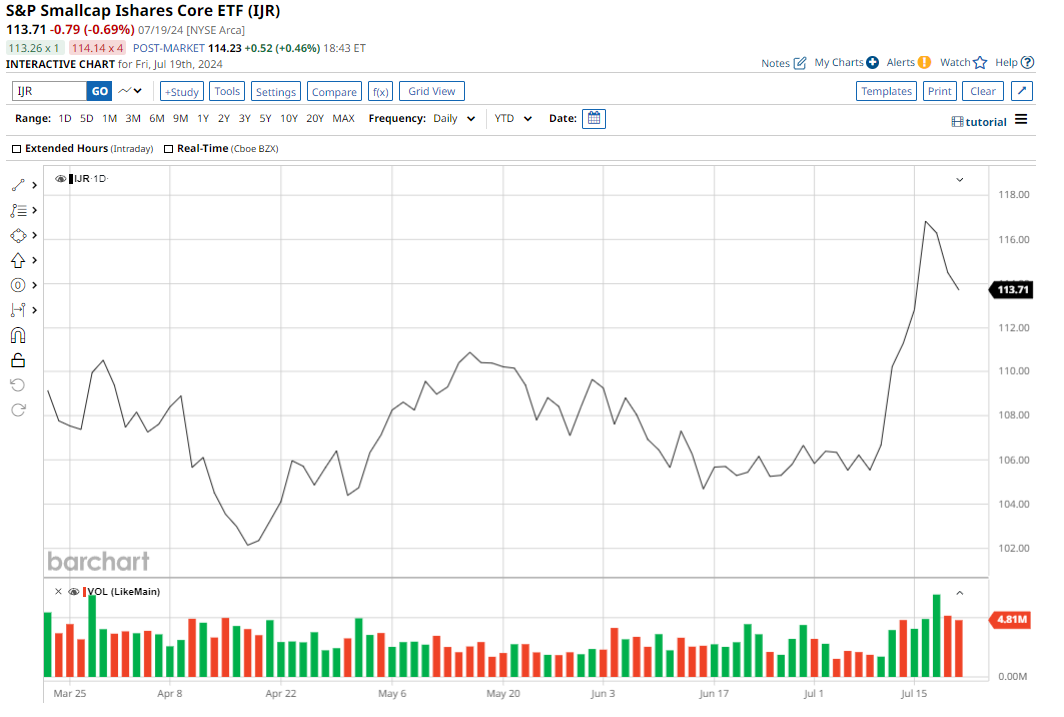

#1. iShares Core S&P Small-Cap ETF

From the family of the world’s largest asset manager, BlackRock (BLK), the iShares Core S&P Small-Cap ETF (IJR) was launched in 2000. The ETF tracks the performance of the S&P SmallCap 600 Index ($IQY), which includes 600 of the smallest publicly traded companies in the U.S., offering broad exposure to the small-cap segment of the domestic stock market.

With assets under management (AUM) of $82.8 billion, shares of the IJR ETF are up 6.6% on a YTD basis.

The ETF has an expense ratio of 0.06%, and offers a dividend yield of 1.27%.

The average volume of shares traded in the IJR ETF is about 3.5 million, offering healthy liquidity. The top holdings include Fabrinet (FN), Ensign Group (ENSG), and SPS Commerce (SPSC).

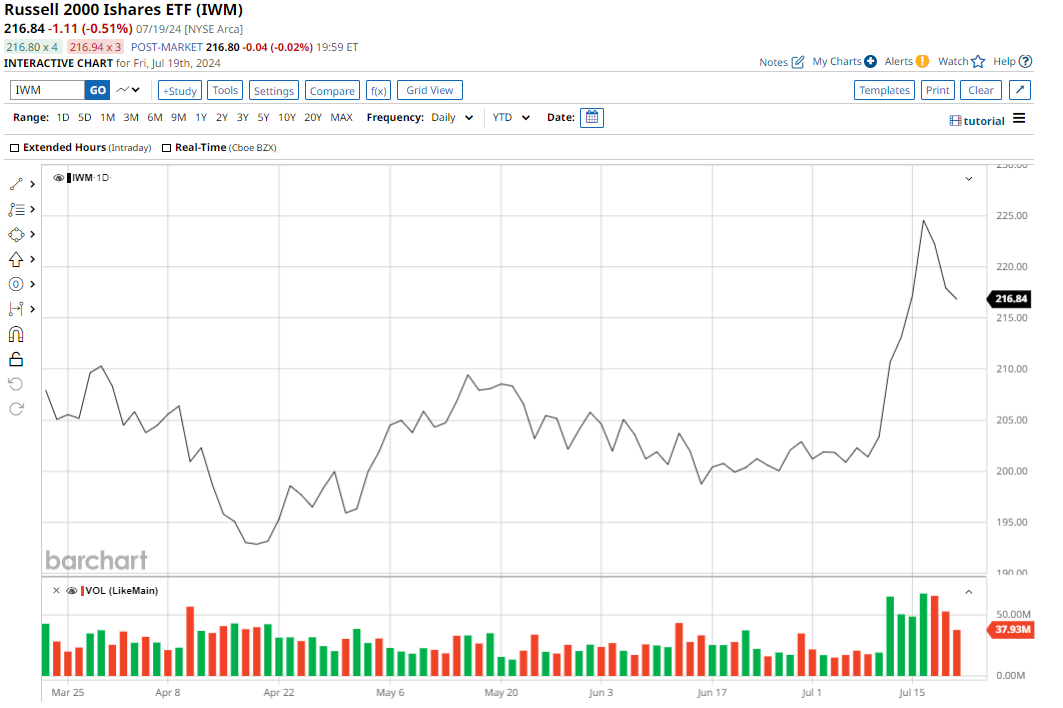

#2. iShares Russell 2000 ETF

Another small-cap ETF from the BlackRock stable is the iShares Russell 2000 ETF (IWM). One of the most popular ETFs to gain exposure to the small-cap space, the ETF tracks the investment results of the Russell 2000 Index, which includes approximately 2,000 small-cap U.S. equities.

IWM’s AUM currently stands at about $68.8 billion, and the shares are up 9.8% on a YTD basis.

Offering a dividend yield of 1.22%, the IWM ETF charges a management fee of 0.19%. About 33.4 million shares of IWM are traded on an average day, making this an incredibly liquid ETF – and the options market is quite active, too, with average volume of over 1.5 million contracts.

Top IWM holdings include Insmed (INSM), FTAI Aviation (FTAI), and Vaxcyte (PCVX).

#3. Vanguard Small-Cap Index Fund ETF

We conclude our list of top small-cap ETFs with the Vanguard Small-Cap Index Fund ETF (VB). Backed by the pioneers of index funding, the Vanguard Group, the Vanguard Small-Cap Index Fund ETF tracks the performance of the CRSP US Small Cap Index, which Vanguard says aims to represent the universe of small-cap companies in the U.S. equity market with low turnover.

Shares of the ETF, which has an AUM of $56.9 billion, are up 7.8% on a YTD basis.

VB also offers a dividend yield of 1.46%, with an expense ratio of 0.05%. It’s less active than IJR or IWM, but with average volume over 600,000 shares, it’s reasonably liquid.

Top VB holdings include Targa Resources (TRGP), Deckers Outdoor (DECK), and Axon Enterprise (AXON), with about 1,400 equities represented in all.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.