ZargonDesign

Volatility is back!

There’s a wide dispersion of economic outlooks today, from hardcore Panglossians confidently proclaiming that everything is fine to hardcore Eeyores confidently proclaiming that a deep recession is now inevitable.

After having dominated the market for many months, the recent triggering of the Sahm Rule (a historically reliable recession indicator) knocked the “soft landing” narrative down a peg and gave the recessionistas a second wind.

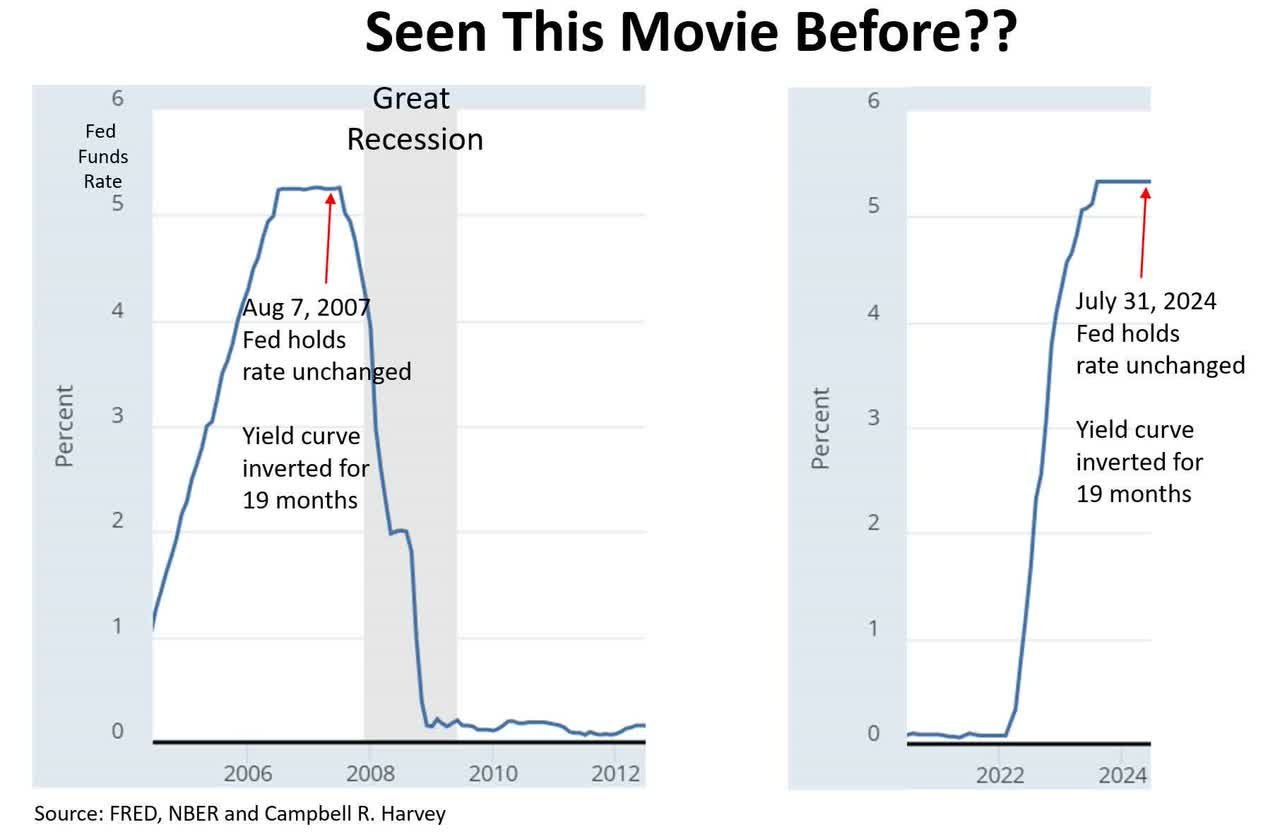

Campbell Harvey, “inventor” (discoverer?) of the inverted yield curve recession indicator, has been calling for the Fed to reduce interest rates for a while, recently pointing out a disturbing comparison between today and 2007-2008.

Back then, like today, lack of Fed action as the economy weakened ultimately facilitated and exacerbated the destructiveness of the ensuing recession.

“But not so fast!” exclaim the optimists. “Things aren’t so bad. Nothing is crashing. There are no mass layoffs. Banks are well-capitalized. The vast majority of the time, the economy is growing, so it’s better just to assume that will continue. Bears make sense, but bulls make money.”

Two things can be simultaneously true:

- The current situation isn’t bad

- The trend (where it appears we are going) is bad

Those who foresee a recession (such as myself) focus more on trends. Those who foresee a soft landing tend to point to snapshots in time. In a sense, they’re both right. “Things are okay right now” and “things are getting worse” are not mutually exclusive. I’d argue they are both true.

Even Claudia Sahm, inventor/discoverer of the Sahm Rule, came out in a Bloomberg article recently to clarify that her eponymous rule is more correlation than causation and that, in her view, the US economy is not currently in recession.

As I wrote last week in “Tug-Of-War Between Weakening Consumers And Forthcoming Rate Cuts: 3 Stocks I’m Buying“:

I have maintained for longer than I can recount that the economy is weakening and trending toward recession. There is mounting evidence to support this thesis, but it is taking a long time to play out. There has been no sudden drop in economic growth and dynamism. Rather, it’s been more of a slow, downward grind as the post-COVID boom fizzles out.

The tug-of-war continues. The slow, downward grind continues. And I maintain that the US economy exhibits all the signs of being late-cycle, trending toward recession and likely to end up in recession (sooner or later) unless some external force halts this trajectory.

If you’re not a fan of getting into the weeds, you can safely skip down to the recession buy list section. But for the true golfers who refuse to take the mulligan, let’s spend a moment in the weeds (i.e. details) to search for that ball (i.e. nuanced truth of the matter).

Here’s where we’re going today:

- Rummaging around in the economic weeds to find where that dadgum ball went

- Four ETFs I’m keen to buy if/when a recession renders them more attractively valued

- My current buy list of 5 dividend growth stocks

Onward.

A Complex Economic Situation

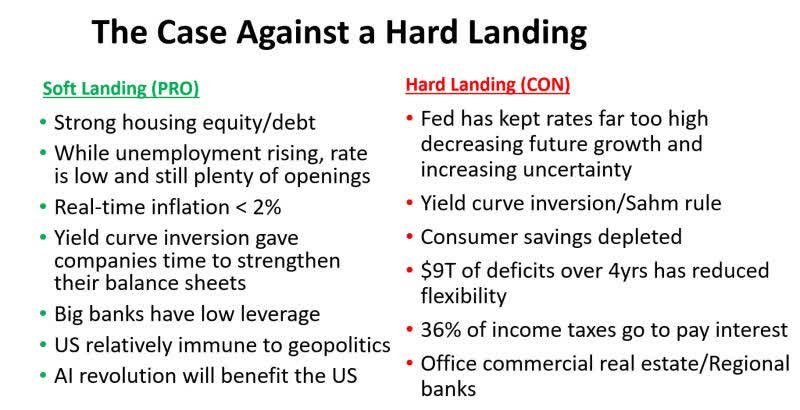

Duke University’s Campbell Harvey is a smart guy, and in a recent LinkedIn post he laid out his view that a soft landing is most likely to occur. The main risk, he says, is Fed inaction preventing the underlying weakening of the economy from being soothed by easier monetary policy.

Here’s his short pros and cons list for the US economy right now:

Campbell Harvey

Pretty fair portrayal of the economy, if you ask me.

But I would add, pertaining to Harvey’s first “con” point, that the vast majority of the time, Fed rate-hiking cycles facilitate and spur recessions. Only 10-15% of the time do Fed rate-hiking cycles end in a soft landing, and yet most commentators seem to always believe this time is one of those minority cases.

A major problem with Fed policymaking is that it is a ham-fisted way to try to push the economy a certain direction.

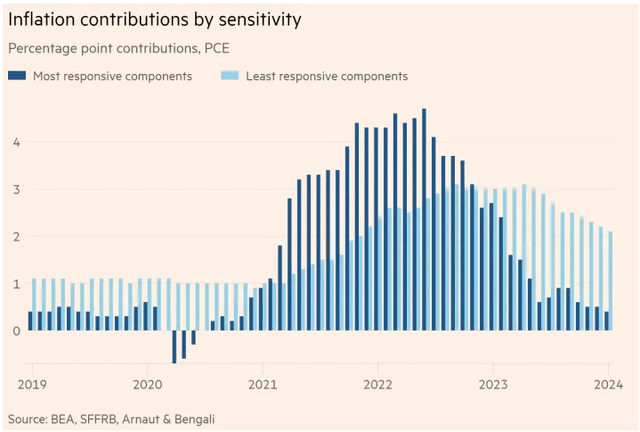

Some parts of the economy (housing, commercial real estate, banks, cars, furniture, appliances, etc.) are highly sensitive to interest rate movements, while many others are highly insensitive to them. Fed tightening has done a superb job of reining in the more responsive parts of the economy, but because the less responsive parts have been slower to normalize, Fed policy remains stubbornly tight.

The Fed has been successful for at least a year at controlling the controllables — that is, pulling down inflation in the parts of the economy that can be pulled down by tighter monetary policy.

But given the ~36% increase in the money supply since the beginning of COVID-19, there are many parts of the economy that were going to see sustained price increases regardless of Fed policy.

As I detailed in last week’s missive, most American consumers are now drained of that extra, post-pandemic spending power.

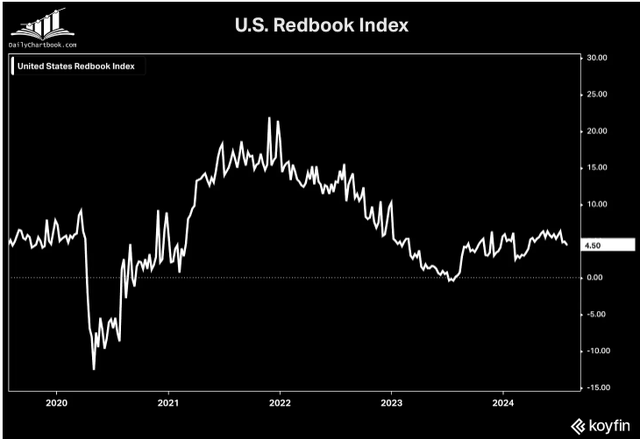

We can see the whipsaw from the last five years in Redbook’s retail same-store sales metric.

Retail sales collapsed during COVID-19 as consumers stopped shopping at most physical retail stores. During that time, credit card debt got paid off, savings got built up, and stimulus money topped up checking accounts.

Like a coiled spring, consumer spending exploded once the economy reopened in 2021-2022. All of those COVID-era savings (and then some) were deployed into a red-hot economy, pushing up prices and wages.

Then, in the second half of 2022 and over the course of 2023, that excess consumer spending power fizzled out. As you can see above, same-store retail sales growth has plateaued in the mid-single-digits but appears to be on the decline once again.

Keep in mind that’s a nominal number, meaning that it includes price increases. As I showed last week, real (inflation-adjusted) retail sales have been falling since the post-COVID boom of 2021-2022.

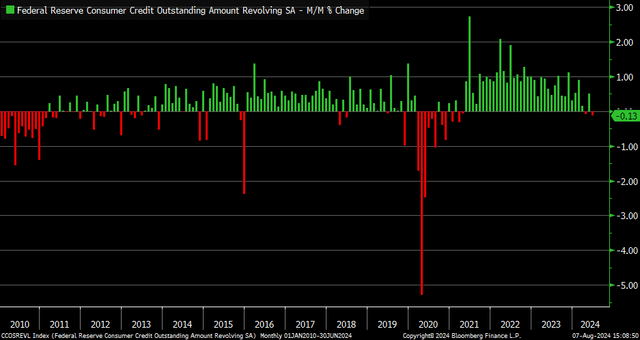

Meanwhile, almost immediately after the economy reopened in 2021, we saw big spikes in credit card debt, continuing robustly through 2023.

I believe this demonstrates that much of the COVID-era fiscal stimulus spending went to consumer deleveraging.

In other words, Uncle Sam generously transferred a lot of debt from consumer balance sheets to the federal government’s balance sheet. This gave consumers that much more spending power, as they had more capacity on their revolving credit lines to use on consumption.

As you can see above, the average credit cardholder is now beginning to slightly deleverage, at least as of the most recent reading.

Consumer deleveraging necessarily means less consumption.

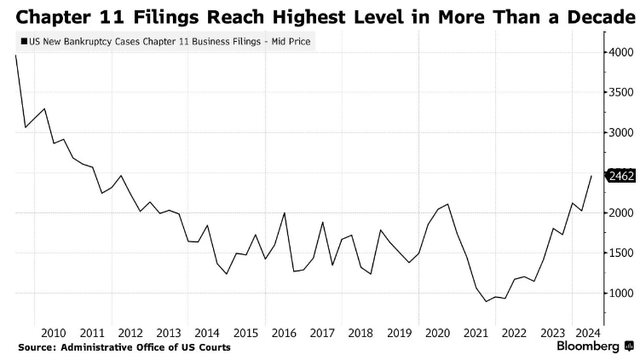

I believe this combination of weakening consumer spending and tight monetary policy disproportionately hurting small businesses and anyone with floating rate debt explains the sharp uptrend in bankruptcy filings since the beginning of 2022.

Like so many other pieces of economic data, this bankruptcy chart acts as a Rorschach Test to determine who is an economic bull and who is an economic bear.

Economy bulls say bankruptcies are still nowhere near where they were during the GFC or many other recessions. Many of those companies declaring bankruptcy had been holding on for dear life for a while anyway. Bed Bath & Beyond going belly up isn’t necessarily a sign of broader economic weakness.

But economy bears simply point to the trend. Even if many of these businesses declaring bankruptcy are ZIRP-era zombie companies, rising swells of bankruptcies like this usually don’t stop at just the zombies. The momentum often continues on to cause much broader destruction than just among those businesses that were going to die eventually anyway.

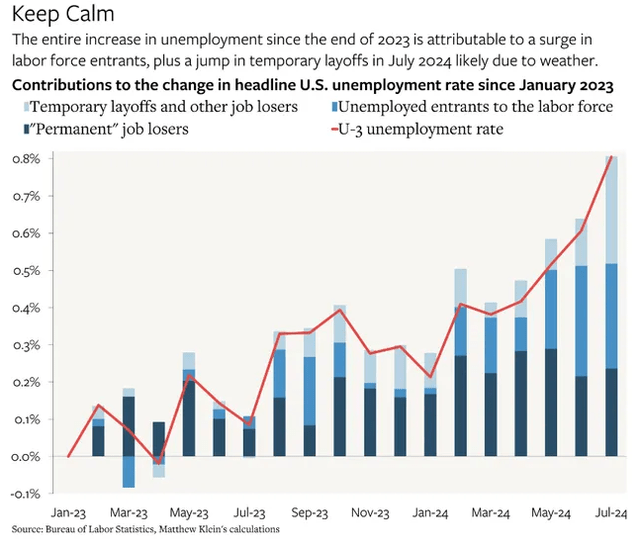

The unemployment report is another such Rorschach Test.

On the one hand, it triggered the Sahm Rule, and the momentum of a rising unemployment rate is rarely halted or reversed. Almost by necessity, you have to see job growth fall below the growth in job-seekers before you see the total number of jobs outright decline. But just because jobs are not in outright decline right now doesn’t mean they won’t be declining in the near future.

On the other hand, economy bulls correctly point out that the rise in the unemployment rate is mostly (though not entirely) due to increases in “temporary layoffs” and a surge in unemployed entrants to the labor force.

In other words, unemployment is not rising primarily because layoffs are swelling but rather because the number of people looking for work is outpacing the number of jobs available for them.

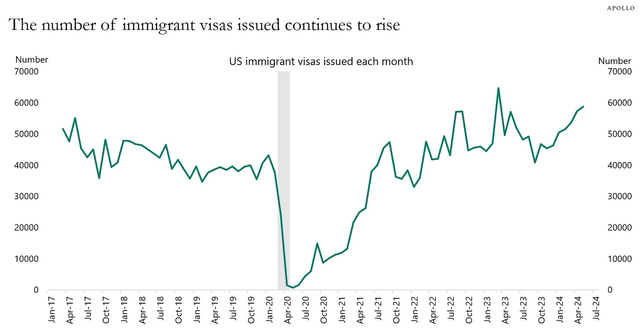

This can largely be attributed to the growth in legal (and, perhaps, illegal) immigration. As the government works through the COVID-era immigration backlog, more visas are being issued, thereby increasing the pool of eligible workers.

Immigration has been hugely positive for the US labor market over the last several years. (Much economic research suggests that the post-COVID labor shortage would have been dramatically worse, and inflation meaningfully higher, if not immigrant workers.) But if current labor market trends hold, it will continue to contribute to a rising unemployment rate and looser labor market conditions generally.

So, while layoffs are more painful than labor force entrants outpacing job gains, the effect on the labor market is similar.

Thus, I think we need to say that the Sahm Rule has been at least “half-triggered.”

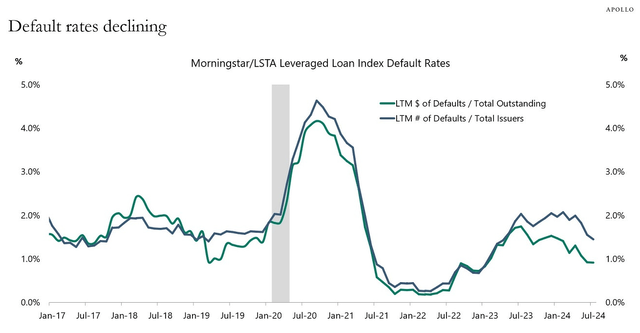

Another point in economy bulls’ favor is that high-yield bonds and private loans have not seen a spike in default rates.

Then again, spiking high-yield default rates is more of a coincident indicator of recession than a leading indicator. They don’t start to default until you’re already in recession.

Finally, consider US manufacturing.

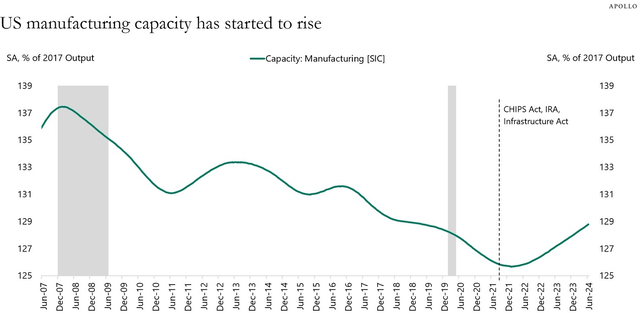

Apollo Global Management’s chief economist, Torsten Slok (a smart guy if a bit on the Panglossian side) points out that US manufacturing capacity has definitively bottomed and is in the midst of a robust rebound.

But it must be noted that this is manufacturing capacity — the amount of goods that US factories can produce — not manufacturing output, which is the actual amount of goods that US factories are churning out.

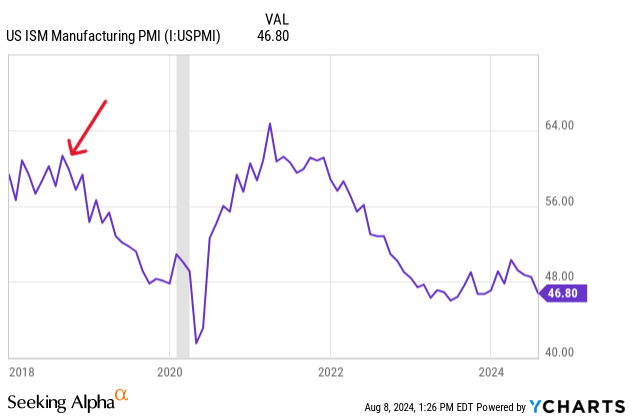

Real US manufacturing output has been basically flat since Q1 2022, and the ISM’s Manufacturing PMI index recently slumped further into what is typically considered recessionary territory.

YCharts

I’ve placed an arrow at September 2018, the month that Trump’s tariff regime began being implemented, to show how big of a negative effect it had on US manufacturing in the following months and years — at least until the post-COVID boom.

I would look at the post-COVID boom as the anomaly, not our current manufacturing malaise. In 2023-2024, US manufacturing simply went back to where it was in 2019 as the trade war reached its zenith.

On balance, I still find myself with the belief that the most likely course forward is a mild recession akin to the one experienced during the early 2000s.

My Recession Buy List

I’ve identified four ETFs with solid dividend growth track records that I’d like to own at lower cost bases than today’s prices.

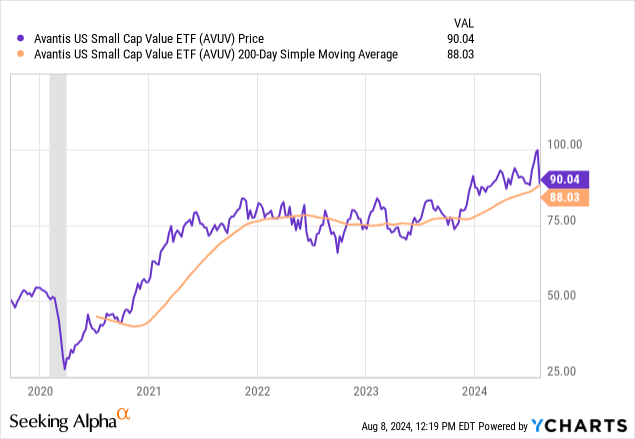

The first, a small cap ETF, is not explicitly geared toward dividend payers, but it has a surprisingly strong dividend profile.

| Expense Ratio | Dividend Yield | 5-Year Avg. Ann. Dividend Growth | |

| Avantis US Small Cap Value (AVUV) | 0.25% | 1.7% | 21% |

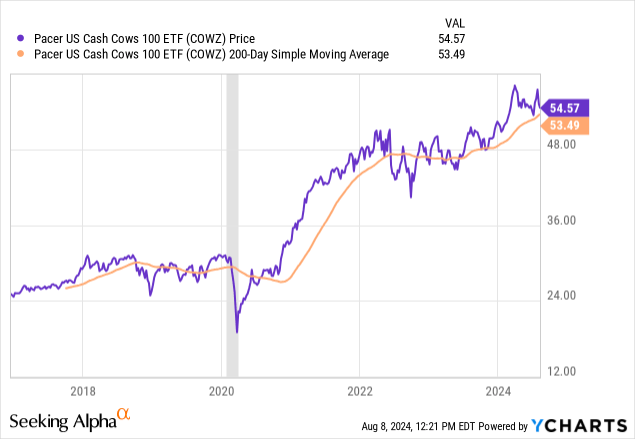

| Pacer US Cash Cows 100 (COWZ) | 0.49% | 2.1% | 19% |

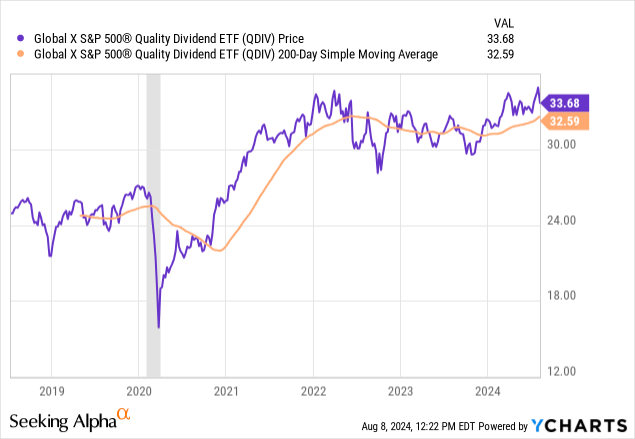

| Global X S&P 500 Quality Dividend (QDIV) | 0.20% | 3.1% | 7% |

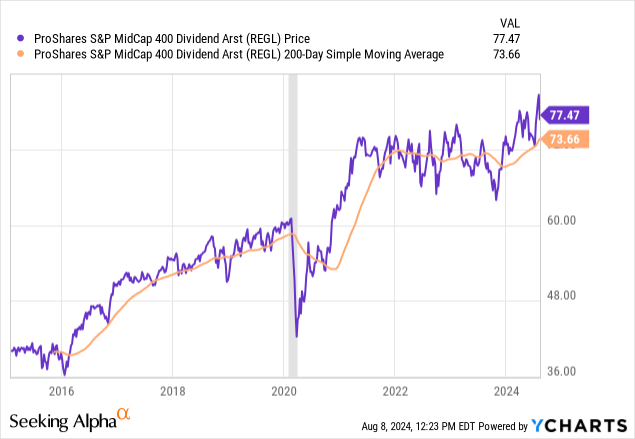

| ProShares S&P 400 MidCap Dividend Aristocrats (REGL) | 0.40% | 2.4% | 12% |

AVUV is primarily weighted toward regional banks, small industrial companies, and consumer discretionary names like KB Home (KBH), a homebuilder, and Air Lease Corporation (AL), an aircraft leasing company.

The small cap space is riddled with junk as something like 40% of the Russell 2000 index (IWM) are unprofitable companies. AVUV narrows down the small cap universe to a basket of about 750 names, focusing solely on profitable companies and weighting toward value. Since small caps are much more leveraged to the economic cycle than the large-cap tech corporations that dominate the major indices, I think AVUV would see some downside in a recession scenario.

COWZ targets companies generating high free cash flow that are trading at modest valuations and therefore offer relatively high FCF yields. As of the June 2024 rebalance, COWZ’s portfolio sported an average FCF yield slightly north of 8% and a P/E ratio of 12.5x. For a moderately high expense ratio of 0.49%, COWZ assembles 100 of these free cash flowing companies.

The portfolio is heavily weighted toward the top three sectors of consumer discretionary, technology, and energy. More recession-resistant sectors like consumer staples, communications, and healthcare make up only about a quarter of the fund, so I believe a better entry point would present itself in a recession.

QDIV is a defensive dividend investor’s ideal ETF, as it is anchored by its almost 25% weighting in consumer staples. By my reckoning, it owns every dividend-paying consumer staple stock in the S&P 500, or just about. The other top sectors are industrials, energy, and financials. These four sectors together account for about 80% of QDIV’s portfolio.

It’s yield may not be as high nor its dividend growth rate as strong as that of the Schwab US Dividend Equity ETF (SCHD), in which I already own a large position, but it does appear to have a more defensive tilt. That said, it doesn’t strike me as the most compelling buy right now.

Finally, REGL is the best pick for investors looking for a one-stop-shop solution for mid-cap dividend growth stocks. The ETF systematically picks mid-cap stocks that have grown their dividends for at least 15 consecutive years. Right now, it has 49 holdings, equal-weighted (rebalanced quarterly), and the portfolio is weighted toward financials (largely regional banks and insurance companies), utilities, and industrials.

I like it, just not at its current price.

If I’m wrong and no recession ever shows up, I’ll probably average into these four ETFs at some point, but I’d still like a more reasonable price than what’s available today.

The Buy List Today

Three names from my portfolio came back onto the buy list recently, either as a result of strong outlooks or stock price declines or both.

| Dividend Yield | Projected Forward Dividend Growth (Guesstimate) | |

| Alexandria Real Estate (ARE) | 4.6% | Mid-Single-Digit |

| Brookfield Infrastructure Partners (BIP) | 5.4% | Mid-Single-Digit |

| Chevron (CVX) | 4.5% | Mid-Single-Digit |

| Hannon Armstrong Sustainable Infrastructure (HASI) | 5.3% | Mid-Single-Digit |

| Rexford Industrial (REXR) | 3.4% | High-Single-Digit to Low-Double-Digit |

BIP reported decent results in Q2, with total AFFO growing a little over 4% YoY. Weak results in the utilities segment were more than offset by strength in the transportation and data segments. The company is putting a lot of investment into its data segment, growing both telecommunications and data center assets at a rapid clip. And returns on invested capital are holding steady at around 13%, which is inside the company’s historical range of 12-14%.

CVX is an interesting and complicated case. I fully admit to being outside my wheelhouse with an energy supermajor like CVX. If you are hoping for some insight into the Hess/Exxon/Guyana situation, I’m not the guy to go to. But from what I can tell, CVX increased both production and revenue, and it generated 11% returns on capital employed (similar to ROIC) in the first half of the year. FCF declined by about 8% YoY, but that’s to be expected given oil and gas prices.

Ultimately, CVX is an oil & gas play, and the oil and gas markets are global. If global consumption of oil & gas hold up, and certainly if they continue to rise, CVX should continue to grow its cash earnings.

The main things that spurred me to put HASI back on my buy list even after its recent rally are (1) its credit upgrade to BBB and (2) its major JV partnership with KKR (KKR), both of which should give it a significant boost in growing its size and scale as well as widening its investment spreads.

With a strong track record averaging ~20 basis points of credit losses over the company’s history, I’m more confident than ever that, regardless of the presidential election outcome in November, HASI will be able to achieve its 8-10% adjusted EPS target for the next several years.

HASI has a great business model with a skilled and shareholder-aligned management team to operate it.