On July 29, 2025, the U.S. Securities and Exchange Commission (SEC) authorised spot BTC and ETH-based exchange-traded products (ETPs) via in-kind creations and redemptions. This is a significant turning point, as in the past, there was only a cash-only redemption. That is why crypto ETFs can now adhere to the structure of the traditional commodity funds, permitting authorised participants to trade ETF shares with crypto funds without using fiat.

According to Paul Atkins, SEC Chair, the change in policy offers crypto ETFs with reduced costs and efficiency for the issuers and investors. It has been predicted that within the in-kind form, the bid-ask spreads will be reduced, arbitrage efficiencies will be enhanced, and the market pricing will become easier- this enhances the overall liquidity and the structural strength of those funds.

In addition to this revolutionary move, the SEC also doubled options position limits to 250,000 contracts and greenlighted mixed BTC-ETH ETPs and FLEX options on Bitcoin products, continuing to indicate its trust in the maturation of crypto markets. Analysts have perceived the unison of these regulatory measures as a process that has evened the score between crypto and traditional asset classes, and crypto ETFs are now set to pursue wide, encompassing institutional admissions.

The response of the industry has been encouraging in general. The market watchers consider this to be the last structural improvement to welcome institutional-scale involvement with crypto assets. In bringing down operational friction and enhanced tax treatment, ETFs have become attractive propositions to asset managers, hedge funds, and pension accounts seeking their own diversification interests in digital assets.

To sum everything up, the SEC approval of in-kind redemption and the possibility of a wider range of product features are bound to increase liquidity, promote lower fees, and open up the next stage of institutional participation in the Bitcoin and Ethereum markets.

And with the SEC having recently approved in-kind redemptions of both Bitcoin and Ethereum ETFs, investor confidence in cryptocurrency just keeps growing, so now is the ideal time to take a look at the ideal cryptocurrencies to buy now.

Listed Below are the Next Crypto to Explode:

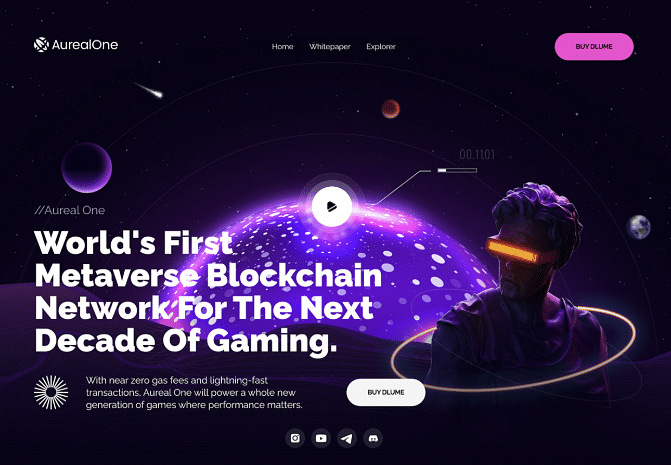

1. AurealOne (DLUME)

AurealOne is a pioneering Web3 gaming platform that integrates the latest Web3 technology with competitive gameplay, involving skills. It embraces a merit based eco system that rewards players in real cryptocurrency with a win-win situation being determined by results as opposed to luck.

Click here to visit next crypto to explode – AurealOne

During its pre-sale period, there are 21 stages AurealOne will go through, and tokens will be priced at $0.0013 and will raise funds in an attempt at achieving $50 million.

The platform is built on a proprietary Aureal Chain and will operate on a $DLUME token that will allow staking and rewards, transactions, and community-level interaction. Such features as match replays and a large variety of games improve the quality of gameplay and give more transparency to the platform.

2. DexBoss (DEBO)

DexBoss is a minimalist, streamlined wallet-tracking and trade alert app that was developed with Solana in mind. It tracks large trades made by upcoming-performing wallets and provides real-time notifications of which purchases have the highest potential, giving traders an advantage before the trend becomes too expensive.

At the current stage, $0.011, the second pre-sale, DexBoss has been prepared to comprise 17 phases in total.

It is distinguished by its sophisticated wallet tracking, custom alarms, and classified wallet groupings like Meme Coin Snipers and Whale Swing Traders, so it looks like a great tool to not only casual, but professional investors as well.

3. Jupiter (JUP)

Jupiter is a Solana-powered DEX aggregator that taps into the liquidity across more than 20 decentralised exchanges to provide the ideal trading rates with extremely low slippage and super low fees. It introduces such sophisticated features as limit orders, DCA (dollar-cost averaging), and perpetual trading, as well as a bridge comparator to transfer assets between chains. JUP token is the Governance token that gives a person the right to vote and rewards the individual in the Jupiter DAO.

4. Toncoin (TON)

Toncoin is the native asset of The Open Network (TON), a high-position-of-scale Layer-1 blockchain initially created by Telegram and presently supported by the TON Foundation. It makes millions of transactions in a single second with a dynamic sharding architecture combined with instant hypercube routing, providing lightning-fast and low-cost transfers between multiple workchains and shards.

5. Decentraland (MANA)

Decentraland (MANA) is the native ERC-20 utility and metaverse governance token of Decentraland, which is deployed on the Ethereum blockchain, and it symbolises a virtual reality platform enabling the ownership and trade of virtual land and avatars, as well as wearables, based upon its metaverse marketplace (LAND NFTs). Every LAND purchase and marketplace sells MANA and has the power to regulate the supply of the tokens.

Conclusion!

With the crypto world taking the lead in utility-based innovation, AurealOne will transform the gaming market by integrating NFTs with high-level game-related data analytics and will present the game to its players as an immersive and highly skill-based experience. On the other hand, DexBoss is on crackers as an impressive crypto trading app that provides real-time updates on the market, intelligent tagging of wallets, and fully customizable trade alert functions, so the users can keep abreast of the market developments. These two represent some of the next big cryptocurrency projects with crypto with 100× potential.

Meanwhile, Toncoin is a high-speed and freely scalable blockchain that uses Telegram, Decentraland is a metaverse that is entirely owned by the user, and Jupiter offers advanced DeFi trading and liquidity aggregation on Solana – each of which qualifies as upcoming altcoins to watch in the evolving Web3 space.

Editor’s Takeaway:

The Editor Pick is Nexchain AI (NEX) which is an emerging crypto that combines AI and blockchain in helping to enhance automation, prediction, and efficiency. It has an intelligent, scalable design that presents it as a tough competitor in the AI-enhanced crypto scene. In the interim, the seasoned investors are turning to the next generation of trendy cryptocurrencies like AurealOne and DexBoss, which, besides the high technology, feature the real-life implementation.

Again, research and careful attention to the risks that might happen should be made when preparing any investment decision.

ThePrint BrandIt content is a paid-for, sponsored article. Journalists of ThePrint are not involved in reporting or writing it.