Key Takeaways

- Bitcoin (BTC) briefly surpassed $65,000 while spot Bitcoin ETFs scored another successful day.

- Crypto analysts predict a potential new all-time high for Bitcoin by summer’s end due to renewed momentum.

Share this article

The price of Bitcoin (BTC) briefly crossed the $65,000 mark on Tuesday, recording a 14% increase over the past week, according to data from TradingView. The rally came on the heels of massive inflows into US spot Bitcoin exchange-traded funds (ETFs).

US spot Bitcoin ETFs have extended their bullish streak, collectively recording $301 million in net inflows on Monday, SoSoValue’s data shows. This marks the seventh consecutive day of positive flows.

BlackRock’s IBIT and ARK Invest’s ARKB shared the top spot, each reporting around $117 million in daily inflows. Fidelity’s FBTC and Bitwise’s BITB saw inflows of around $36 million and $15 million, respectively.

Other gains were also seen in Invesco’s BTCO, VanEck’s HODL, and Franklin’s EZBC. Meanwhile, the rest, including Grayscale’s GBTC, Valkyrie’s BRRR, WisdomTree’s BTCW, and Hashdex’s DEFI, reported zero flows yesterday.

Bitcoin has reversed its downward trend amid strong Bitcoin ETF inflows. The price broke through the $60,000 level on Sunday and extended its rally above $64,000 on Monday. At the time of reporting, Bitcoin is trading at around $64,200, slightly down in the last 24 hours, per TradingView’s data.

According to crypto trader Rekt Capital, Bitcoin could reach a new record high by the end of summer with renewed momentum.

Hank Wyatt, founder of DiamondSwap, told Crypto Briefing that the worst correction might be over as selling pressure from the German government eased. Last week, the government entity reportedly completed its Bitcoin liquidation.

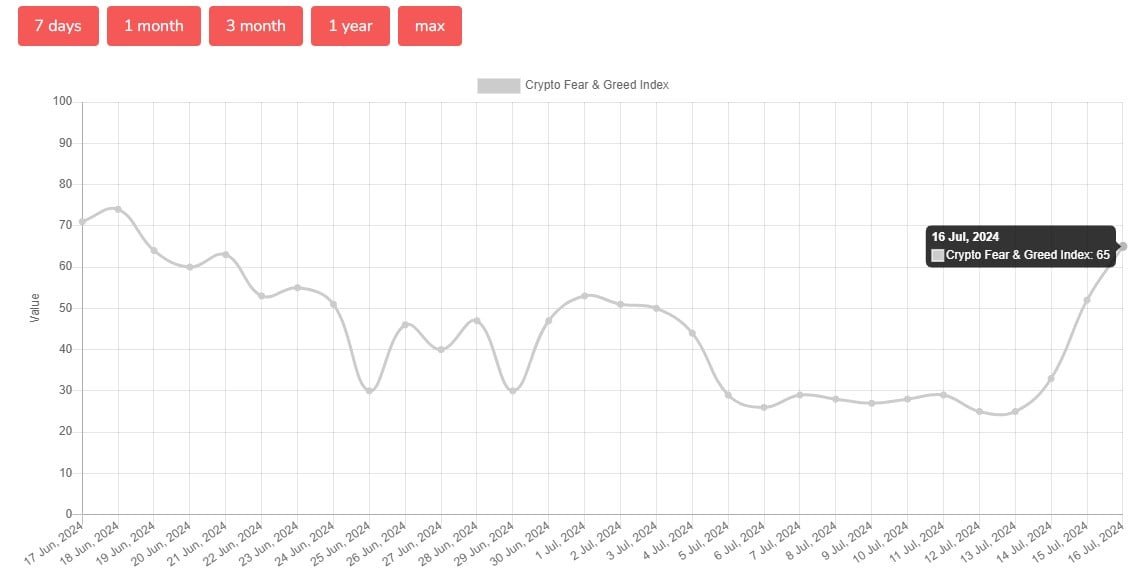

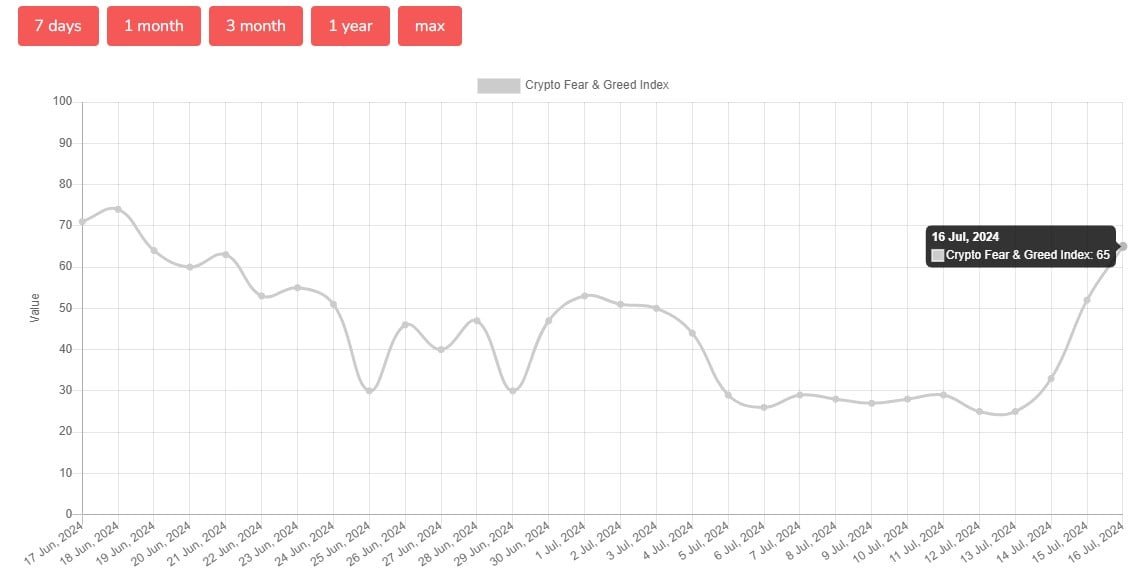

The Crypto Fear and Greed Index has shifted from last week’s “fear” to “greed” level, according to data from Alternative.me. The recent market rally has pushed the index to 65 today.

Share this article