The crypto world is gaining positive sentiment again as Bitcoin (BTC) pulls off an incredible 3.16% jump in just one hour though the market is showing brarish movements. At the time of pressing, Bitcoin stands at $54,600 which is a significant recovery from its earlier dip to $49,000. Let’s Explore the reasons causing this drive in the price of bitcoin.

Massive Pump in Bitcoin ETF

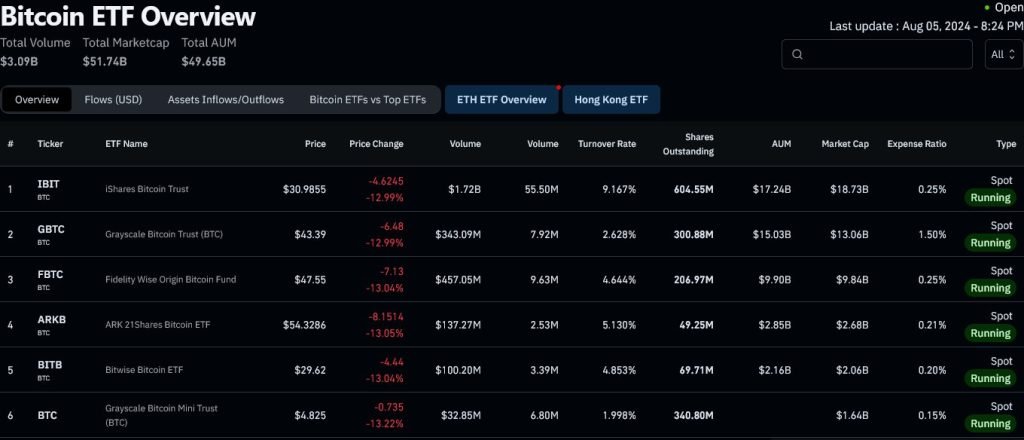

The falling market caused the whole ecosystem to panic. A large number of traders were expecting btc to go back to $35,000. Experts believe that Bitcoin took the rebounce because of the iShares Bitcoin ETF Trust (IBIT). BlackRock launched this BTC ETF in January 2024. It broke records by pulling in over $3 billion in trading volume within just one hour. Trading began today with spot Bitcoin ETFs reaching $700 million in volume within seconds. This high volume in such a short period of time, caused rise in market confidence and helped BTC to rise. Bitcoin price has surged by around 12% from its bottom at $49,600.

IBIT: The Market Shaker

The IBIT ETF, trading on the Nasdaq under the ticker $IBIT, is a spot Bitcoin ETF that owns Bitcoin and tracks its price closely. This ETF registered a mind blowing $1 billion trade volume in the first 30 minutes of the session, ranking it 10th among all ETFs, nestled between the giants IVV and HYG. Even before the market opened, IBIT saw a pre-market volume of $166 million, whereas, 30% were active buy orders and 38% were sell orders.

BlackRock’s Bitcoin ETF: A Record-Breaker

BlackRock’s Bitcoin ETF didn’t just stop there. It surpassed the average daily volume of most ETFs within the first 10 minutes of trading. It took only 10 minutes for BlackRock’s Bitcoin ETF $IBIT to exceed the daily volume that other ETFs strive for in an entire trading day.

IncomeSharks’ Bold Prediction: $80K Bitcoin Is Just the Beginning!

The renowned market analyst, IncomeSharks, didn’t mince words:

The lower green line is acting as life support, but closing and holding above this once again shows there is still demand. You have to squint now to make the squiggles work, but I’m not ready to remove them. $80k is still on the table. Elections can still bring insane action.

This isn’t just a hopeful prediction – it’s a roadmap to a possible Bitcoin boom. IncomeSharks’ insight is clear: the demand for Bitcoin is stronger than ever. With the explosive debut of BlackRock’s Bitcoin ETF and the upcoming elections, Bitcoin is primed for a historic surge to $80K and beyond!