Key Notes

- Bitcoin spot ETFs logged four straight weeks of withdrawals.

- Total outflow reached $4.349 billion over the past month.

- Analysts hint that BTC has likely formed the bottom.

Bitcoin

BTC

$86 024

24h volatility:

0.1%

Market cap:

$1.71 T

Vol. 24h:

$69.85 B

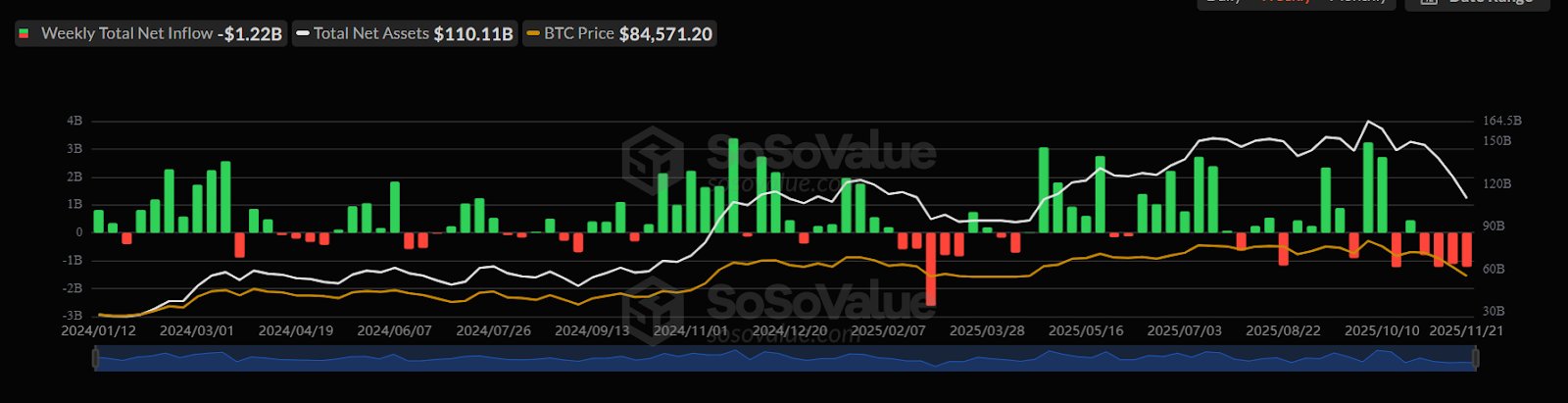

spot ETFs recorded another tough week with $1.22 billion weekly outflow between Nov. 17 to Nov. 21. Across the past month, these funds posted a total outflow of $4.349 billion, the second-largest four-week slide on record.

The only larger Bitcoin ETF selling wave happened from mid-February to mid-March, when $4.806 billion exited, according to SoSoValue.

Bitcoin spot ETF weekly inflow | Source: SoSoValue

NYDIG head of research Greg Cipolaro noted that ETF inflows and digital asset treasury demand largely influenced the past cycle. He added that a heavy selling event in early October flipped ETF inflows into outflows and dragged down stablecoin supply.

He explained that the largest cryptocurrency is also guided by broader forces such as global money trends, market fragility, and trader behavior.

After dropping to the $82,000 zone over the weekend, BTC has drawn fresh interest. The cryptocurrency is currently trading around $87,221 with a 1.8% daily gain, but it is down 21% over the past month.

Despite price pullback and massive ETF inflows, Bitcoin’s total market dominance sits near 59% as of writing. During market pullbacks, traders often rotate their funds from altcoins into BTC.

Market Pressure Eases as Traders Look for a Base

The market is eyeing a year-end rally as analysts say Bitcoin may be taking its “first real step” toward forming a base. The Risk-Off Signal, which tracks waves of selling, is pulling back quickly.

The last time such a massive sell-off wave pattern showed up, BTC later climbed 47% to a new peak.

According to Swissblock analysts, this drop in the Risk-Off signal hints that selling pressure is easing and the worst phase is over for now. They added that this week would be important for traders to monitor selling behavior.

Bitcoin has taken its first real step toward forming a bottom.

The Risk-Off Signal is dropping sharply, which tells us two things: selling pressure has eased, and the worst of the capitulation is likely behind us, for now. 👇https://t.co/Y2JTyqD93f pic.twitter.com/zjfkmVwCru

— Swissblock (@swissblock__) November 24, 2025

In many past cycles, a second but smaller wave of sales often marked buyers regaining control. This suggests that BTC could see consolidation in the near-term with prices holding recent lows.

Sideways Movement for BTC?

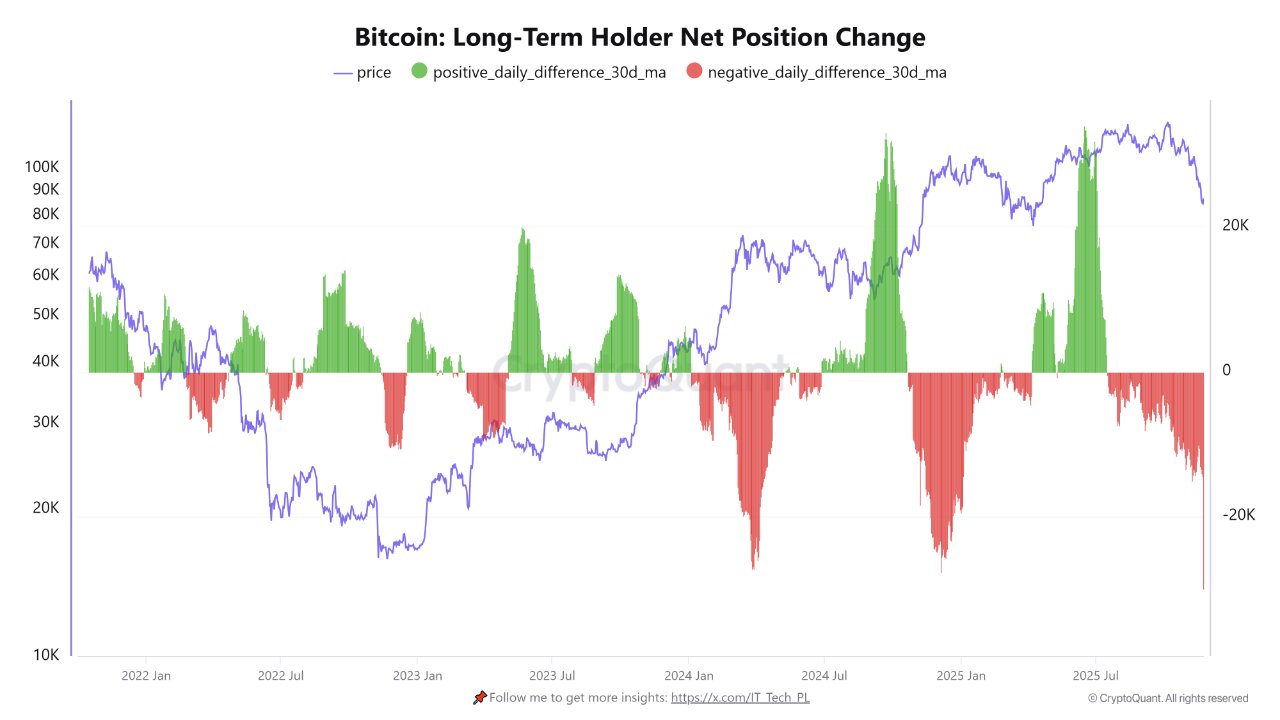

Meanwhile, long-term holder wallet flows show heavy selling from older crypto wallets. This pattern often takes place during strong market phases when early investors decide to lock in gains.

Bitcoin long-term holder net position change | Source: CryptoQuant

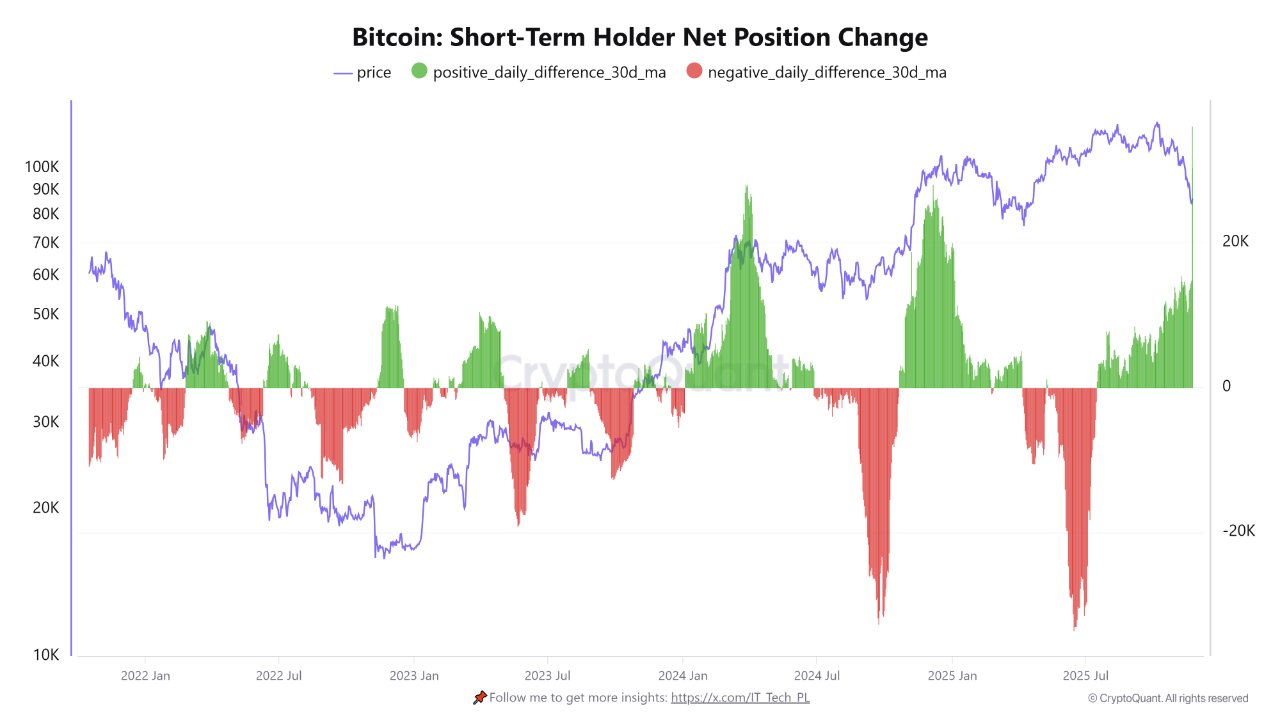

At the same time, the chart that tracks short-term holder flows shows that newer buyers are stepping in and absorbing the coins sold by long-term holders. This group often enters the market during fast-moving phases and is currently adding to its positions.

Bitcoin short-term holder net position change | Source: CryptoQuant

According to a CryptoQuant contributor, this setup does not always point to an immediate drop, but it does show a high level of supply hitting the market. If fresh demand does not keep up, traders could face deeper pullbacks or a stretch of sideways movement.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.