The combined holdings of spot Bitcoin exchange-traded funds (ETFs) are on the verge of surpassing one million BTC, less than a year after their launch.

Last week saw a significant influx, with $2.1 billion in new capital flowing into these funds over just five days, making it one of their strongest weeks to date.

BlackRock’s iShares Bitcoin Trust (IBIT) is nearing a major milestone, currently holding 396,922 BTC. It could soon surpass the 400,000 BTC mark, cementing its status as one of the largest holders of Bitcoin globally.

As it stands, spot Bitcoin ETFs collectively hold 967,459 BTC, and a continued uptick in inflows would push them past the one-million-BTC threshold within weeks.

For context, Satoshi Nakamoto‘s estimated holdings sit at around 1.1 million BTC, making this a significant moment for institutional Bitcoin accumulation.

Meanwhile, Binance remains the second-largest holder of Bitcoin, with 636,000 BTC in its reserves as of October 1, though most of that is presumed to be customer-owned.

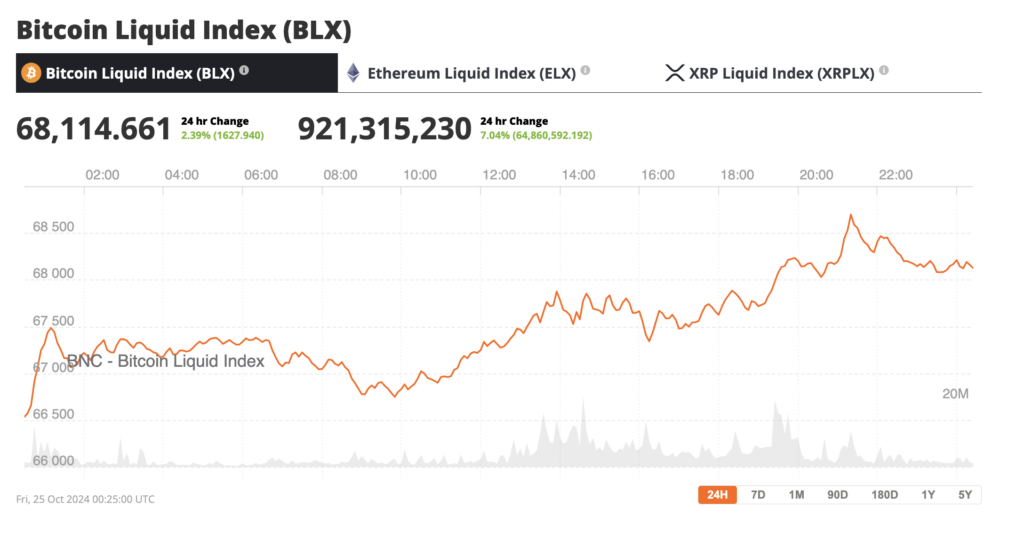

Investor interest in Bitcoin ETFs, which had slowed earlier in the year, has picked up again as Bitcoin’s price nears its highest point in three months, approaching $68,000. According to Farside Investors, October 14 saw the largest single-day inflow since June, with $555 million flowing into the funds. The strong performance last week, with $2.1 billion added, is the highest since March.

Bitcoin ETFs Surpass $20 Billion Inflows

Since their launch in January, these funds have collectively amassed $20.9 billion in net inflows.

Last Wednesday, their cumulative inflows surpassed the $20 billion mark, a milestone that Bloomberg’s senior ETF analyst Eric Balchunas described as the “most difficult metric” to achieve in the ETF world. Balchunas noted, “For context, it took gold ETFs about five years to reach [the] same number.”

Source: X

Several factors may be driving this resurgence, including speculation that a crypto-friendly candidate like Donald Trump could win the U.S. presidential election, boosting sentiment among Bitcoin investors. His pledge to push the U.S. to the forefront of blockchain innovation and strip away regulatory hurdles—potentially ousting SEC Chair Gary Gensler—has only bolstered investor confidence. This political tailwind is seen as a major catalyst, driving Bitcoin’s upward momentum and drawing fresh interest in cryptocurrency ETFs.

Today, Bitcoin is holding steady at $68,211, up 2.4% over the last 24 hours.

Source: BNC Bitcoin Liquid Index