Spot Bitcoin (BTC) ETFs in the U.S. recorded their fifth consecutive day of inflows on July 11, with $72.1 million in net inflows as Bitcoin surpassed the $59,000 mark.

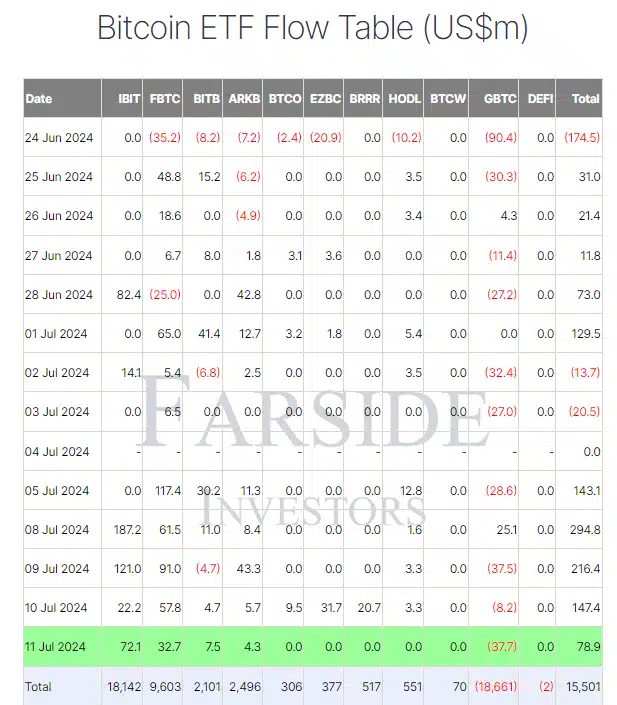

According to data provided by Farside Investors, these investment products recorded $72.1 million in positive net flows on July 11. This follows a positive week that began with $143.1 million in capital inflows on July 5.

Leading the pack is BlackRock’s IBIT, which captured $72.1 million in inflows, pushing its total to an extraordinary $18.1 billion. Following next is Fidelity’s FBTC, which garnered $32.7 million, elevating its cumulative inflows to $9.6 billion.

Bitwise’s BITB and ARK’s ARKB also reported increases, with inflows of $7.5 million and $4.3 million, respectively, thereby enhancing their total inflows to $2.1 billion and $2.5 billion.

Contrarily, Grayscale’s GBTC experienced a withdrawal of $37.7 million, marking its total outflows at $18.7 billion, despite a brief inflow spike on July 8.

Other notable funds, such as Invesco Galaxy’s BTCO, Franklin Templeton’s EZBC, Valkyrie Bitcoin’s BRRR, VanEck’s HODL, and WisdomTree’s BTCW, saw no significant changes in their flow activities. Nevertheless, the overall landscape for Bitcoin ETFs remains robust, with cumulative inflows standing at $15.5 billion, according to Farside Investors’ data.

This influx into Bitcoin ETFs coincides with encouraging economic indicators, as inflation rates in the U.S. have been decelerating for the fourth consecutive month.

June notably saw a 0.1% reduction in inflation, the first monthly decrease since May 2020, signaling progress in the Federal Reserve’s efforts to manage inflationary pressures.

Simultaneously, Bitcoin prices had rebounded from a four-month low, exceeding the $59,000 mark on July 11, currently an increase of 3.4% over the past week.

Despite potential supply pressures from the distribution of assets by Mt. Gox creditors and the sale of seized Bitcoin by the German Government, the influx of capital into Bitcoin ETFs has helped stabilize the cryptocurrency’s price during this turbulent period.