Spot Bitcoin (BTC) exchange-traded funds (ETFs) witnessed a significant surge on July 12, with inflows surpassing $310 million—the highest since June 5.

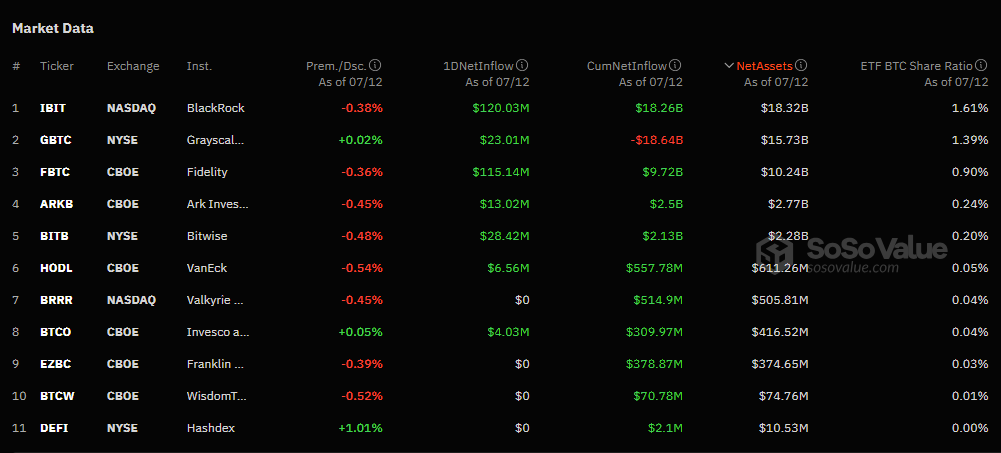

BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC) led the inflows, bringing in $120.03 million and $115.14 million respectively, as per information from SoSoValue. The Bitwise Bitcoin ETF (BITB) followed with $28.42 million, and the Grayscale Bitcoin Trust (GBTC) experienced a rare inflow of $23.01 million.

The VanEck Bitcoin Trust ETF (HODL) and Invesco Galaxy Bitcoin ETF (BTCO) recorded additional inflows, $6.56 million and $4.03 million, respectively. However, ETFs from Hashdex, Franklin Templeton, Valkyrie, and WisdomTree did not register any inflows on the same day.

The July 12 results mark the largest inflow since June 5, when spot Bitcoin ETFs amassed just north of $488 million. Notably, there was no day with an outflow at that time.

Additionally, according to ETF market watcher HODL15Capital, U.S.-based spot Bitcoin ETFs now hold an all-time high amount of BTC at 888,607 coins.

Per data from Farside Investors, the recent activity brings the total inflows since the start of the week to $1.04 billion. Since their launch at the beginning of the year, spot Bitcoin ETFs have accumulated nearly $16 billion in net inflows.

Notably, this tally includes more than $18.6 billion that has flowed out of GBTC since it transitioned into a spot ETF 6 months ago. Interestingly, despite the outflows, the Grayscale Bitcoin product is still the second-largest ETF by net assets, boasting about $15.73 billion worth of Bitcoins.

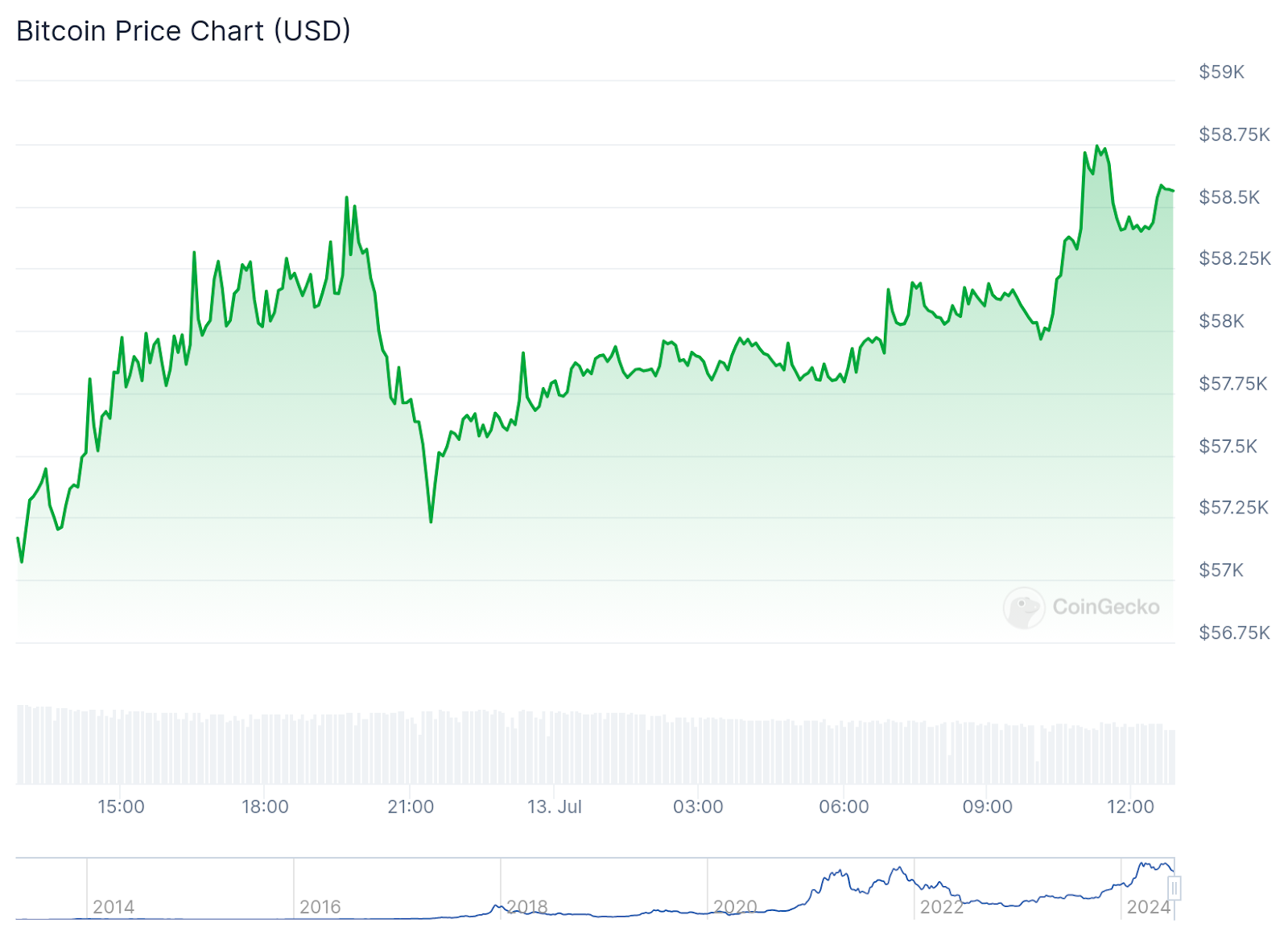

News of the record spot Bitcoin ETF inflows seem to have nudged the price of the cryptocurrency, which at the time of writing was trading at $58,543, 2.4% higher than its level from 24 hours ago.

However, the price uptick came against a backdrop of reduced trading volumes, with about $21.76 billion worth of Bitcoin traded in the last 24 hours, a 23.29% dip from the previous day.