Spot Bitcoin exchange-traded funds (ETFs) recorded inflows on January 26, 2026, the first positive flows in five trading days.

While modest, the net inflows signal a potential stabilisation in investor sentiment, with recent market volatility having coincided with Bitcoin price sharply falling below the $90,000 mark.

US spot Bitcoin ETFs snap outflows streak

According to SoSoValue data, US spot Bitcoin ETFs recorded total net inflows of $6.84 million on January 26, ending a five-day streak of net outflows.

The inflows pale in comparison to what the market has seen in previous cycles, but suggest capital flight could soon wane.

On Monday, BlackRock’s IBIT led the gains with $15.93 million in inflows.

However, Bitwise’s BITB saw the largest outflow at $10.97 million.

As Bitcoin spot ETFs flipped bullish, other assets followed suit: spot Ethereum ETFs posted $117 million in net inflows after four days of outflows.

Solana spot ETFs attracted $2.46 million, all from Bitwise’s BSOL, lifting their total net assets to $1.05 billion, while XRP spot ETFs recorded $7.76 million in inflows, led by Bitwise at $5.31 million.

Cumulative spot XRP ETFs inflows have surpassed $1.24 billion.

Global digital asset investment products saw over $1.73 billion in net outflows over the week ending January 23.

These marked the largest outflows since mid-November 2025, with Bitcoin products alone accounting for $1.09 billion.

Bitcoin price forecast

Bitcoin has struggled since falling below the $100,000 mark, with macroeconomic and geopolitical pressures recently pushing the benchmark cryptocurrency to levels below $87,000.

Market sentiment has weakened sharply in recent weeks, with Bitcoin coming under pressure as gold and silver rallied.

Modest ETF inflows on January 26 coincided with attempts by buyers to reclaim the $89,000–$90,000 range.

However, while prices appear to be entering a phase of consolidation, weekly crypto outflows of $1.73 billion underscore the degree of caution among institutional investors.

Analysts at CryptoQuant and QCP have offered views on the near-term outlook for Bitcoin.

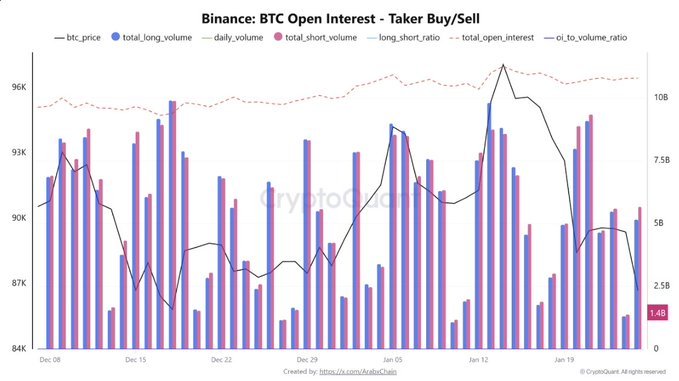

Data from Binance, cited by CryptoQuant, shows elevated open interest, alongside what the firm described as “balanced selling pressure.”

“This relatively high level suggests that the market remains heavily leveraged and has not yet experienced a significant unwinding of leverage, despite the recent price decline,” CryptoQuant said in a post on X.

Binance Data Shows Elevated Open Interest Alongside Balanced Selling Pressure

“This relatively high level suggests that the market remains heavily leveraged and has not yet experienced a significant unwinding of leverage, despite the recent price decline.” – By @ArabxChain

Meanwhile, QCP Group points to macroeconomic conditions, noting:

“The pressure looks macro-led rather than crypto-native, with tariff rhetoric, US fiscal brinkmanship and renewed nerves around potential US-Japan action to steady the yen stacking into a familiar cocktail of uncertainty and de-risking.”

Analysts project a potential dip to support below $85,000 is likely, with $70,000 in the mix if bearish pressure ramps up.

On the upside, navigating macroeconomic headwinds and rotation into BTC could catalyse a fresh rally to $100,000 and above.