Quick take:

- Analysts predict trading on the two ETH Spot ETFs will begin on Tuesday.

- This follows news last week that the CBOE was preparing to list five new Spot Ethereum ETFs.

- The NYSE said in a statement Monday it approved the listing and registration of common shares of the two funds.

The New York Stock Exchange (NYSE) has approved the listing and registration of the Ethereum Trust Spot ETFs for Bitwise and Grayscale. The NY-based exchange announced the clearance of the two funds on Monday, paving the way for trading of the two ETFs to begin.

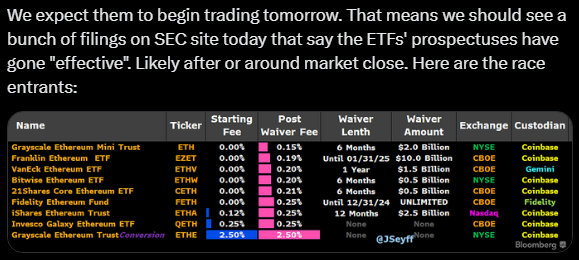

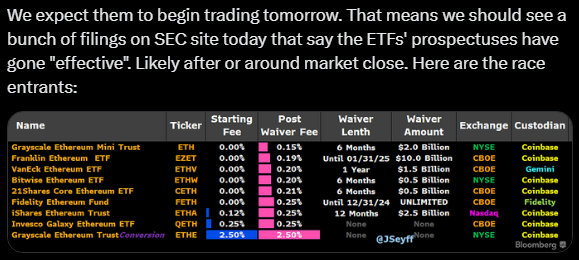

Bloomberg ETF Analyst James Seyffart shared that he and his colleague Eric Balchunas anticipate the Spot ETF funds to begin trading on Tuesday.

The NYSE statement comes just days after the Chicago Board Options Exchange (CBOE) indicated it was preparing for the listing of five new Spot Ethereum Exchange-Traded Funds (ETFs).

Grayscale’s and Bitwise’s were on the list, and featured post-waiver fees of 0.15% and 0.20%, respectively.

Coinbase is listed as the custodian of the two ETFs, as per the table shared by Seyffart on his X account.

Seyffart also expects more Spot ETH ETF approvals for Franklin Templeton, VanEck, 21Shares, Fidelity, Ishares, and Invesco, among others.

It is barely six months since Spot Bitcoin ETFs started trading. With Spot Ethereum ETFs now getting the green light, it paves the way for investors to gain access to two of the largest cryptocurrencies by market capitalisation.

Now all eyes will be on Spot Solana ETFs. VanEck on June 27 and 21Shares on June 28 are among the first to file for Spot Solana ETFs. The filings are still in the early stages with no fees and tickers revealed yet.

Stay on top of things:

Subscribe to our newsletter using this link – we won’t spam!