PM Images

Large-cap stocks, typically defined as companies with a market capitalization of $10 billion or more, represent some of the most well-established and financially stable firms in the market. These companies often lead their industries in terms of innovation, market share, and profitability. They are generally safer investments than their mid- and small-cap counterparts because the companies are more settled, but their stocks usually may not offer the same potential for high returns.

If only there were an ETF that held big dominant companies, but also had that upside excitement. Enter Castleark Large Growth ETF (NYSEARCA:CARK): The fund is managed by CastleArk Management LLC and invests in public equity markets. They invest in stocks of companies operating across diversified sectors, primarily in growth stocks of large-cap companies. The fund employs fundamental and quantitative analysis with bottom-up stock picking approach to create its portfolio. Normally investing at least 80% of its net assets, plus borrowings for investment purposes, in common stock of large-capitalization companies. The index may also have up to 20% investment in mid cap companies.

Seeking Alpha

Seeking Alpha

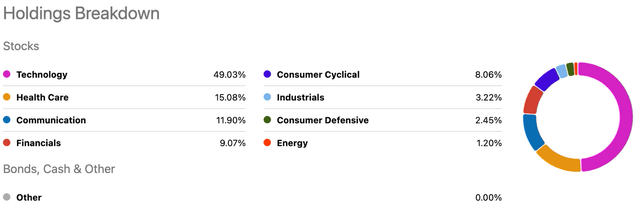

CARK hit the market with its IPO in December of 2023 and is nearly 50% composed of technology stocks with its meager 26 holdings. Seven other sectors make up the other half of the ETF with health care and communication next in line. There is no need to dive into any of the top holdings, as these have been some of the staples running through the news and media the last few years. This is the exact reason many investors gravitate to large caps; it’s the companies they know well and hear about all the time. Large-cap stocks may also recover sooner from any broad market declines because these companies are better suited to weather economic downturns.

YCharts

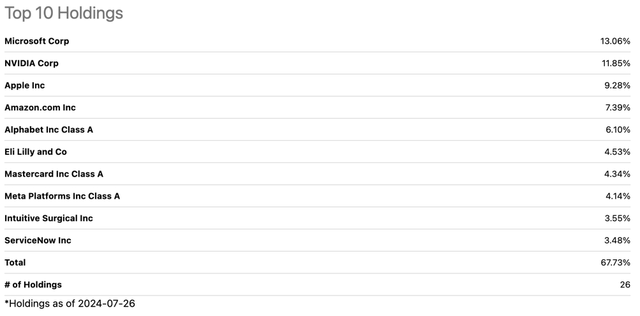

The weighted average P/E ratio of 38.42 suggests a fairly large overvaluation of the ETF. Higher valuations are especially common with tech stocks and often times healthcare stocks too. You can see in the chart above, the stocks of the three biggest sectors in CARK, carry some extremely high P/E ratios. Hardly any are below the market average, which currently is around 26. There is certainly not a lack of attention to CARK’s biggest players in terms of market capitalization. The ETF holds all six companies that have a market cap north of $1 trillion.

Seeking Alpha

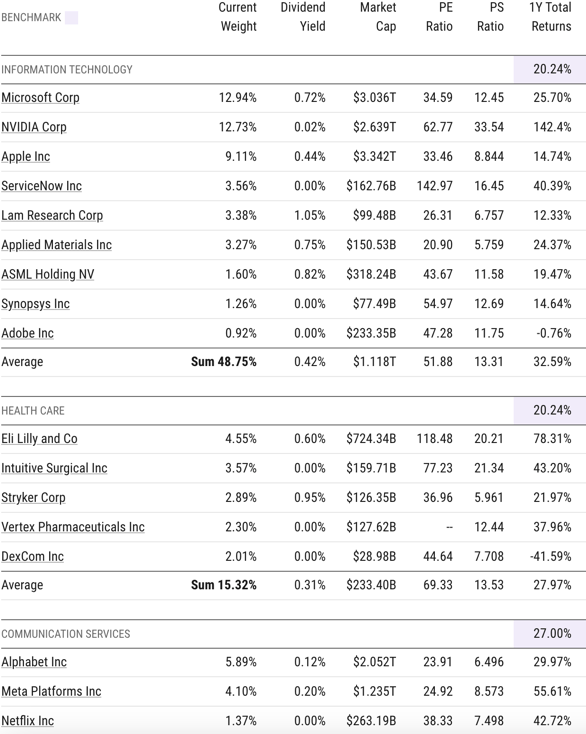

While the companies within CARK get considerable spotlight, the ETF itself is still largely undiscovered. The well-known Schwab U.S. Large-Cap Growth ETF (SCHG) has nearly 100 times the AUM and average daily share volume of CARK. The average daily dollar volume is an astronomical 300 times that of CARK. In the overall large cap growth ETF space, undiscovered is an understatement.

Seeking Alpha

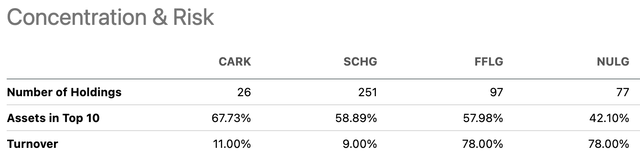

Of course, the largest driver to this discrepancy in liquidity and AUM is the mere fact CARK has only been around for 7 months or so. The other, as seen above, is the huge gap in number of holdings in comparison to several of its peers, specifically SCHG.

Seeking Alpha

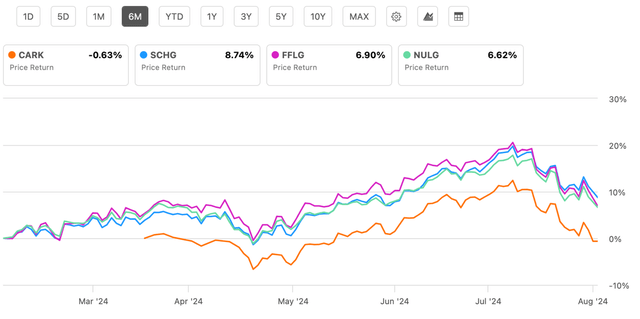

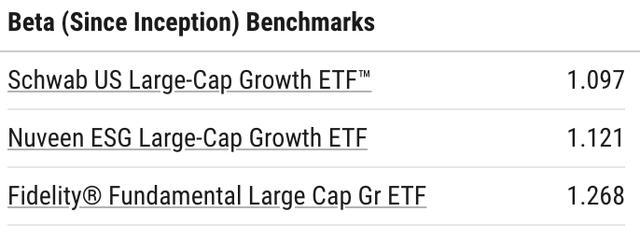

CARK’s performance has really mirrored that of its peers since its inception. Naturally, as a small ETF, most all the holdings are companies also within its ETF counterparts. This brings me to my biggest concern for CARK as the new ETF still gets its feet under itself. The sizable possibility for high volatility, also computed as beta.

Beta is a risk metric that measures the risk associated with a security in comparison to the risk associated with the market overall. A beta of 1 would signify that the beta is neutral with the market. CARK has a current beta of 1.52, meaning investment in the ETF is essentially over 1.5 times as risky as investing in the S&P 500. Surely, this means greater returns than the market in the good times and worse returns during the bad. The noticeably higher beta than its competitors makes me tread with caution for the foreseeable future.

YCharts

I see CARK as a hold right now, but an intriguing opportunity in the future. Investors should appreciate the ETF’s balanced approach to sector exposure, which mitigates some of the volatility typically associated with high-growth investing. However, it’s important to remain cognizant of the inherent risks, including sector-specific challenges and broader market fluctuations.