Roughly 18 months after making its first appearance in the UK and Europe, Cathie Wood’s Ark Invest has launched a new exchange traded fund (ETF), dedicated to the space and defence sector.

Ark Invest bought thematic fund provider Rize ETF in 2023. In April 2024, it listed three active ETFs on UK and European markets, all managed by Wood: her flagship Ark Innovation ETF (ARCK), the Ark Artificial Intelligence & Robotics ETF (ARCI) and the Ark Genomic Revolution ETF (ARCG). The Ark Space & Defence Innovation ETF (ARCX) has now been added to the mix. All four are similar to their US equivalents, which have been around for longer.

Between its European launch in April 2024 and 10 November 2025, the Ark Innovation ETF returned 83 per cent in sterling terms. In June last year, Wood told Investors’ Chronicle that the fund was in deep-value territory. Big returns since then could be seen to have justified her bold claim – except that, at the time of writing, the three biggest holdings in the fund (Tesla (US:TSLA) at 9.4 per cent, trading platform Robinhood (US:HOOD) at 6.2 per cent and crypto platform Coinbase (US:COIN) at 5.9 per cent) were trading on forward price/earnings (PE) ratios of 188, 57 and 45 times, respectively. It’s not that these stocks were cheap ‘value’ opportunities before; it’s more that they have sort of lost the plot now.

Read more from Investors’ Chronicle

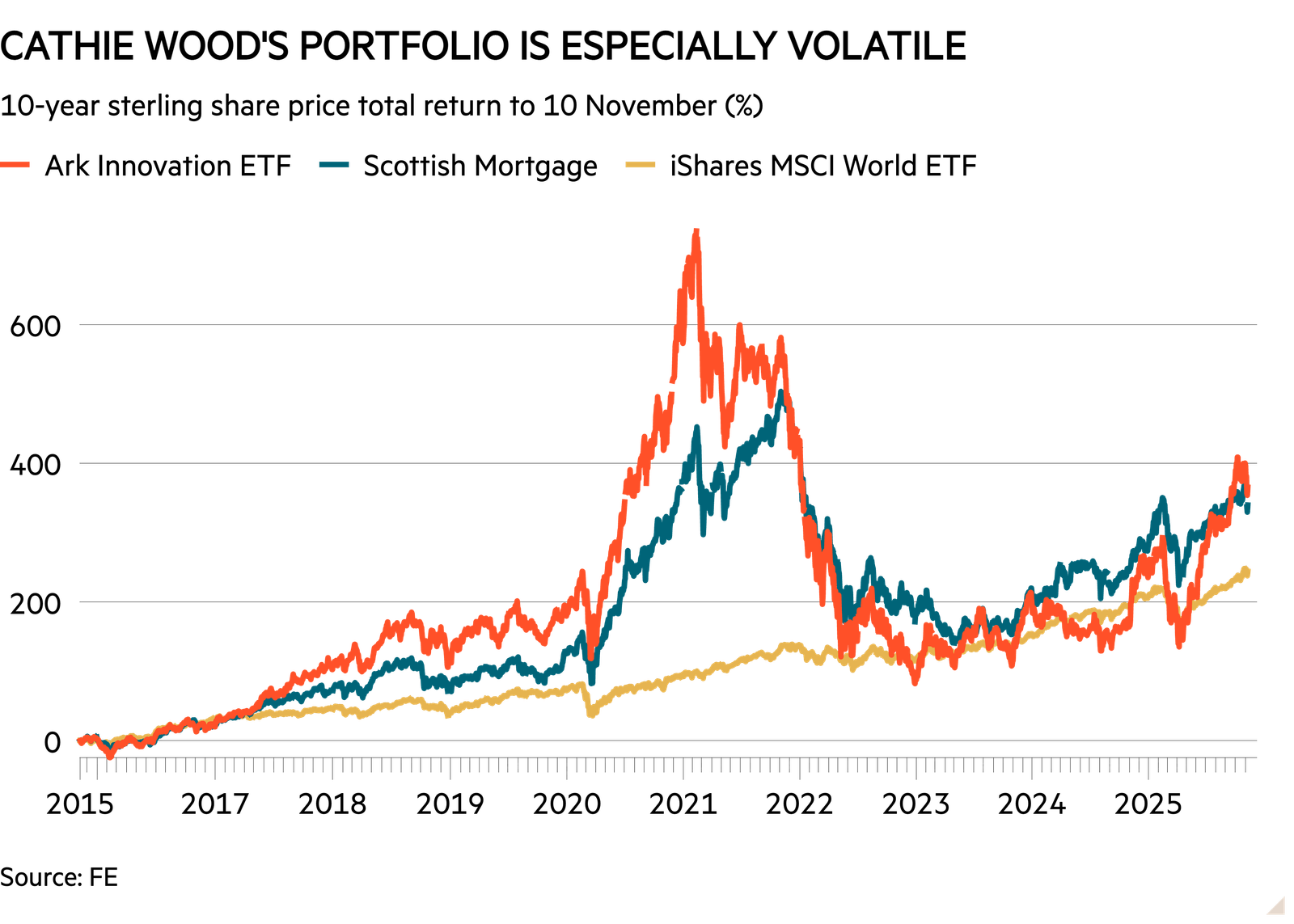

The big question is whether the fund’s returns justify its volatility, and the answer depends on your entry point. In the decade to 10 November, the US-listed Ark Innovation ETF returned 365 per cent in sterling terms, against 293 per cent for the MSCI World index. Baillie Gifford’s Scottish Mortgage (SMT), whose racy growth strategy feels more diversified and better thought out, made 340 per cent. At one point in early 2021, Wood’s fund was up 700 per cent; if you bought around then, who knows how long it will take you to ever get back to that point.

Thematic ETFs are tricky at the best of times – they can be very concentrated and volatile, and sometimes it’s hard to see how a certain company in the portfolio even fits the bill.

Wood’s space and defence ETF seeks to invest in “agile innovators across space and defence, not just legacy primes” and has “intentionally low” overlap with competing funds.

In other words, don’t expect much exposure to your standard defence plays – especially not European ones. The ETF does not hold BAE Systems (BA.) or Leonardo (IT:LDO), for example, and has an 84 per cent exposure to the US – compared with 52 per cent for the VanEck Defense ETF (DFNG) and 60 per cent for the HANetf Future of Defence ETF (NATO).

Instead, the portfolio is more focused on certain areas of tech: the biggest holding, Teradyne (US:TER) (7.8 per cent of the portfolio), is a robotics company that Wood also holds in her Innovation ETF (3 per cent of the portfolio). The same goes for data company Palantir (US:PLTR), whose share price has grown in a way that appears completely disconnected from its fundamentals; it is currently trading at 188 times forward earnings and the IC companies team rates it as a ‘sell’. Unusually, the ETF also holds Amazon (US:AMZN) at 4.5 per cent of the portfolio, Nvidia (US:NVDA) at 3.4 per cent and Alphabet (US:GOOGL) at 2.8 per cent.

In a nutshell, Wood’s ETFs are very racy, and very US- and tech-focused. Do not invest any money you can’t afford to lose. If you want a bold growth strategy with a long track record but sensible management, you are probably better off with Scottish Mortgage. If you really want to give Cathie Wood a go with some fun money, it might be worth at least waiting for the next price drop.